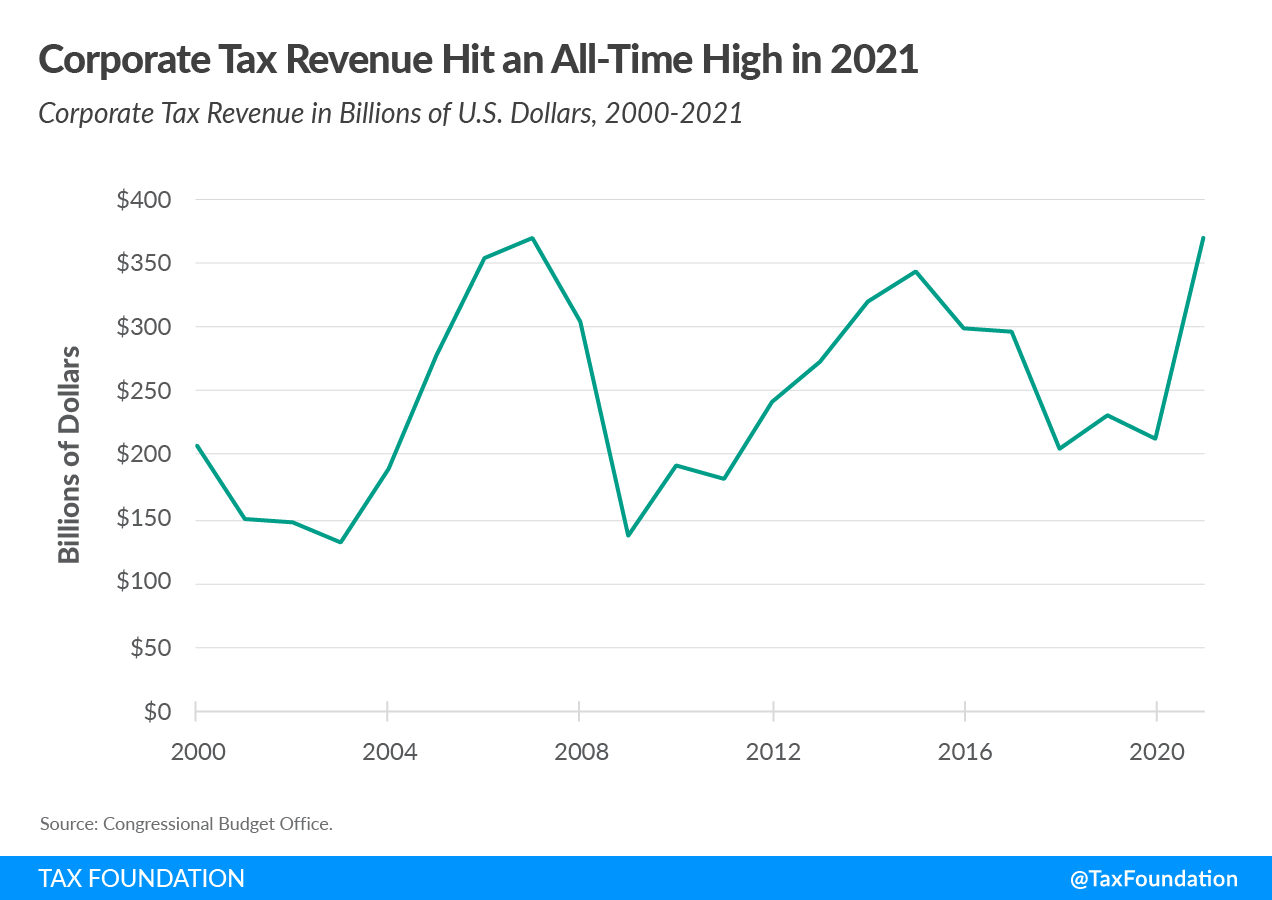

The Congressional Budget Office (CBO) now estimates that the federal government received $370 billion in corporate taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. revenue over the past year (fiscal year 2021), matching the record high level from 2007. This is a 75 percent increase over the previous year’s total, reflecting a rebound in corporate profits and the broader economy.

This year’s robust corporate tax collections calls into question efforts by the administration and congressional Democrats to increase the corporate tax rate and raise other corporate taxes based on claims of relatively low tax collections following the Tax Cuts and Jobs Act (TCJA) in 2017. In fact, corporate tax collections this year are about 25 percent higher than the $297 billion collected in 2017, prior to passage of TCJA. Likewise, as a share of GDP, corporate tax collections are higher this year (1.63 percent) than in 2017 (1.52 percent).

In addition, the rebounding economy has boosted individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. collections to an all-time high of $2.052 trillion for the fiscal year. Payroll tax revenue came in at $1.308 trillion, close to last year’s total, and other receipts came in at $317 billion. In total, federal tax collections reached $4.047 trillion in fiscal year 2021, an all-time high in nominal terms.

As a share of GDP, total federal tax collections hit 17.8 percent this year, which is higher than almost any year (2015 is the exception) since the Bush tax cuts in 2001, and substantially higher than the 16.3 percent of GDP that was collected on average between the passage of the Bush tax cuts in 2001 and the TCJA in 2017.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe