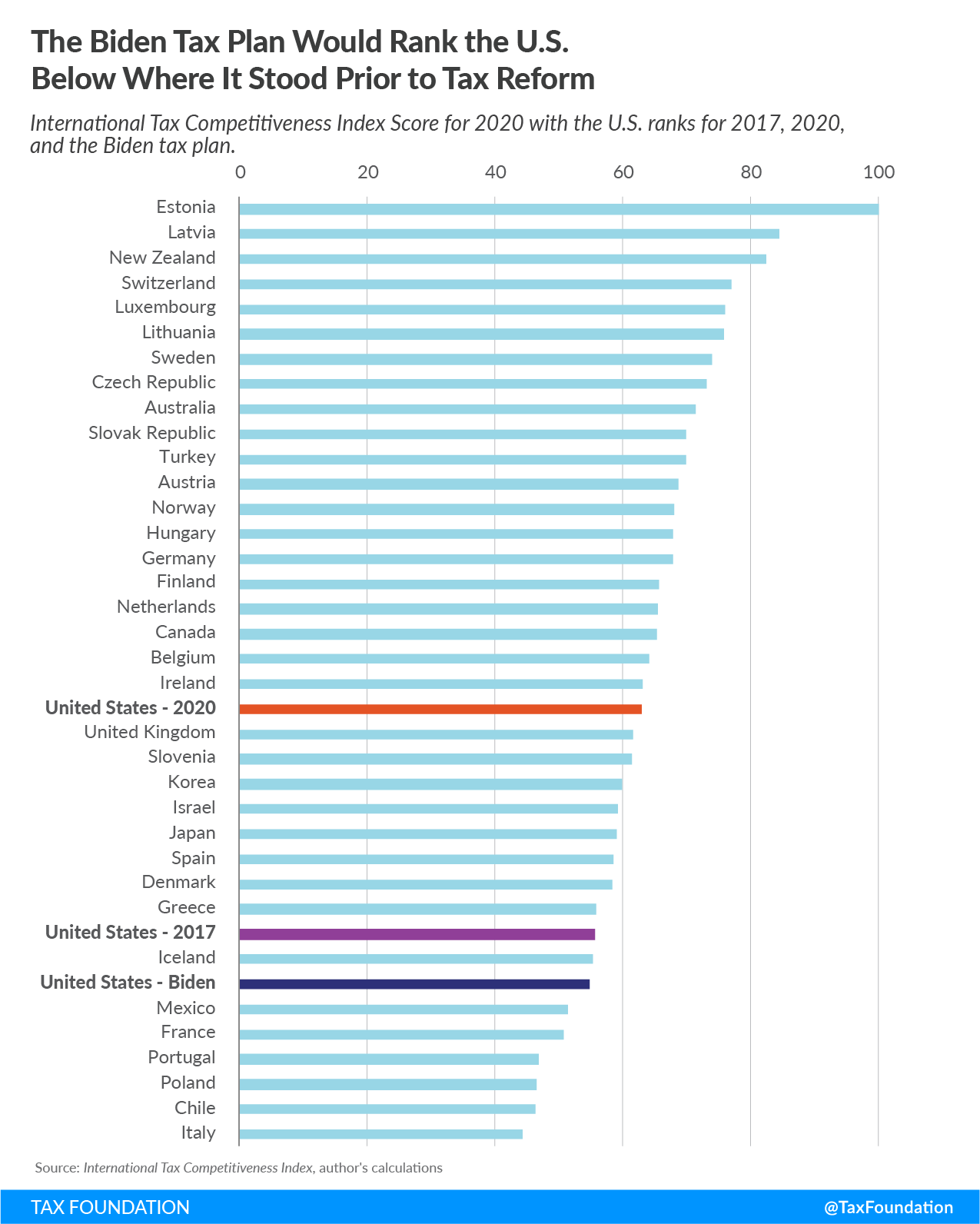

Our International Tax Competitiveness Index has been used to compare the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. systems of OECD countries since 2014. At the beginning of that period, the United States ranked 28th out of 36 countries in the Index. Following the 2017 U.S. tax reform, the rank improved dramatically to 20th, and the U.S. now ranks 21st.

The improvement in the U.S. ranking was driven by changes in corporate taxes and personal income taxes. The Tax Cuts and Jobs Act of 2017 reduced the federal corporate tax rate from 35 percent to 21 percent, and tax rates for individuals were reduced across the board. Tax reform also resulted in a new international tax system that allows foreign earnings to be brought back to the U.S. without facing the full corporate tax rate. The U.S. also adopted separate rules to tax foreign earnings in some circumstances.

In response to the tax cuts in the U.S., other countries also saw pressure to reform their tax systems or experienced spillover effects. Canada followed the U.S. in adopting full expensing for short-lived assets, removing barriers to investment. A significant corporate tax rate reduction has occurred in France since the U.S. reform. By the end of 2022, the combined French corporate tax rate will have fallen from the 2016 level of 34.43 percent to 25.8 percent. Early evidence on German firms identified tax reform benefits for foreign businesses with substantial operations in the U.S.

Tax changes proposed by Democratic presidential nominee Joe Biden would work against current trends, particularly by increasing the corporate tax rate. The Biden campaign has proposed increasing the federal corporate tax rate to 28 percent and returning the top individual federal personal income tax rate to 39.6 percent while applying payroll taxes to earnings above $400,000. Top tax rates on capital gains and dividends would rise significantly.

These policies and others that the Biden campaign has released would impact U.S. competitiveness on the international stage. Taxes play a role in both business decisions about where to invest and expand and individual decisions about where to work and live. Higher taxes on businesses can both impact investment by U.S. businesses and whether foreign businesses will choose to invest in U.S. operations. Higher taxes on U.S. workers, especially those with higher incomes, can influence migration decisions.

From the standpoint of the International Tax Competitiveness Index, the corporate and individual tax hikes envisioned by the Biden campaign would push the U.S. down the rankings to 30th place, even below where the U.S. stood prior to tax reform. On corporate taxes, the U.S. rank would fall from 19th to 33rd. On individual taxes, the U.S. rank would fall from 23rd to 36th, last for individual taxation.

| ITCI Rank Category | Final Rank | Corporate Rank | Income Rank | Consumption Rank | Property Rank | International Rank |

|---|---|---|---|---|---|---|

|

2017 Rank |

28 | 35 | 26 | 5 | 28 | 33 |

|

2020 Rank |

21 | 19 | 23 | 5 | 28 | 32 |

|

Biden Plan Rank |

30 | 33 | 36 | 5 | 28 | 32 |

|

Source: Author’s analysis of the Biden tax plan using the International Tax Competitiveness Index. |

||||||

While the Biden campaign is certainly focused on increasing taxes on U.S. businesses and high-income earners, it is important that policymakers also understand what that reversal might do to U.S. competitiveness, and the competitive global environment in which U.S. companies and U.S. workers operate.

From the standpoint of the International Tax Competitiveness Index, the answer is clear that the Biden campaign’s approach would make the U.S. tax system less competitive.

Share this article