Policymakers have recently proposed various ways of raising taxes on the richest Americans and making the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code more progressive, including wealth taxes, estate taxes, and a higher marginal income tax rate. Changing the tax system, however, requires first understanding how it currently operates, and what kinds of transfers are already in place.

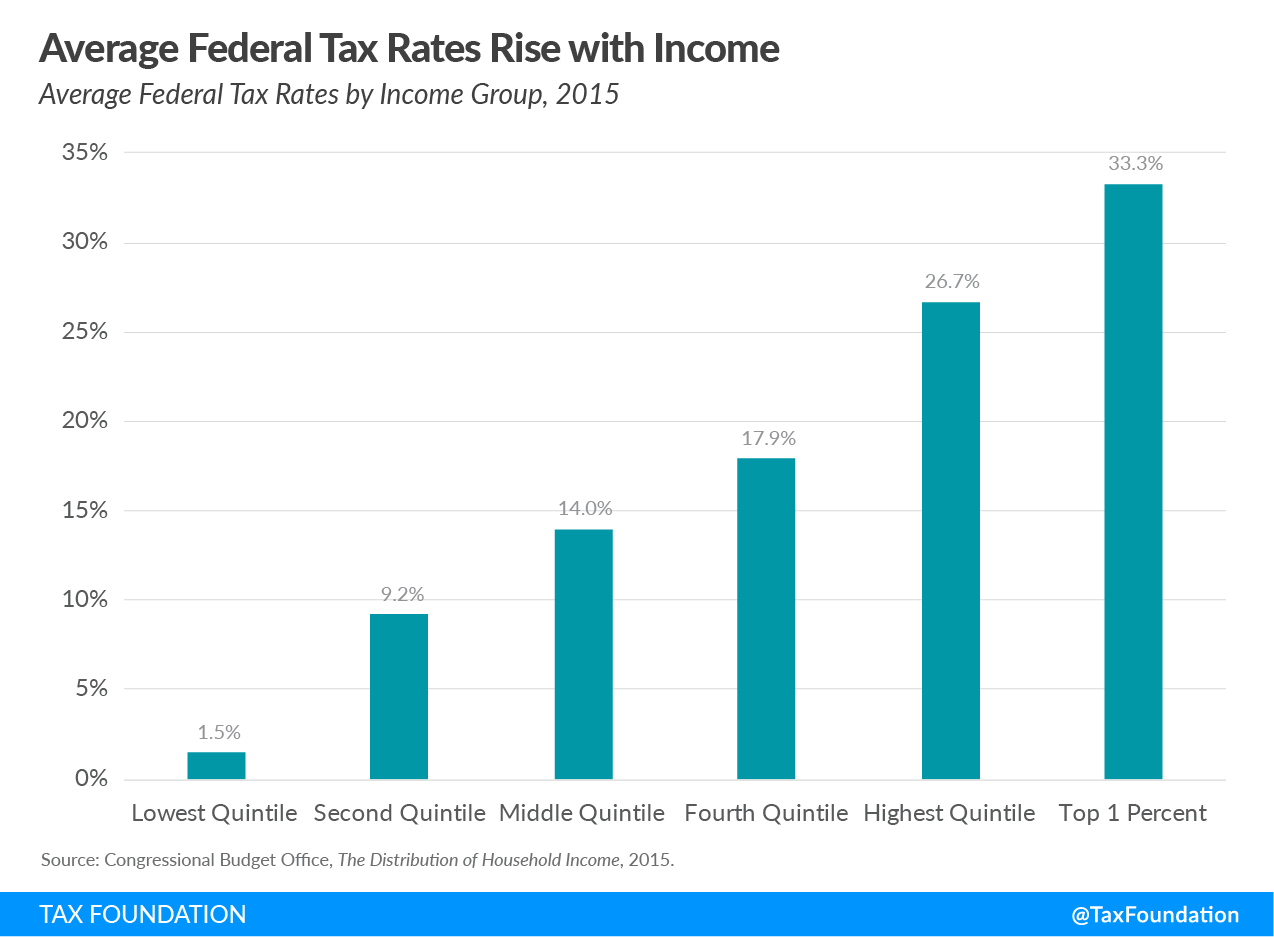

Data from the Congressional Budget Office (CBO) illustrates the progressivity of the federal tax code and the impact of transfers from high-income to low-income Americans. The following figure shows average federal tax rates—total federal taxes divided by total income before transfers and taxes—by income group in 2015.

Taxpayers face higher average federal tax rates as income increases. For example, those in the lowest quintile paid an average federal tax rate of 1.5 percent in 2015, while those in the highest quintile paid an average rate of 26.7 percent. The top 1 percent of Americans had an even higher rate of 33.3 percent.

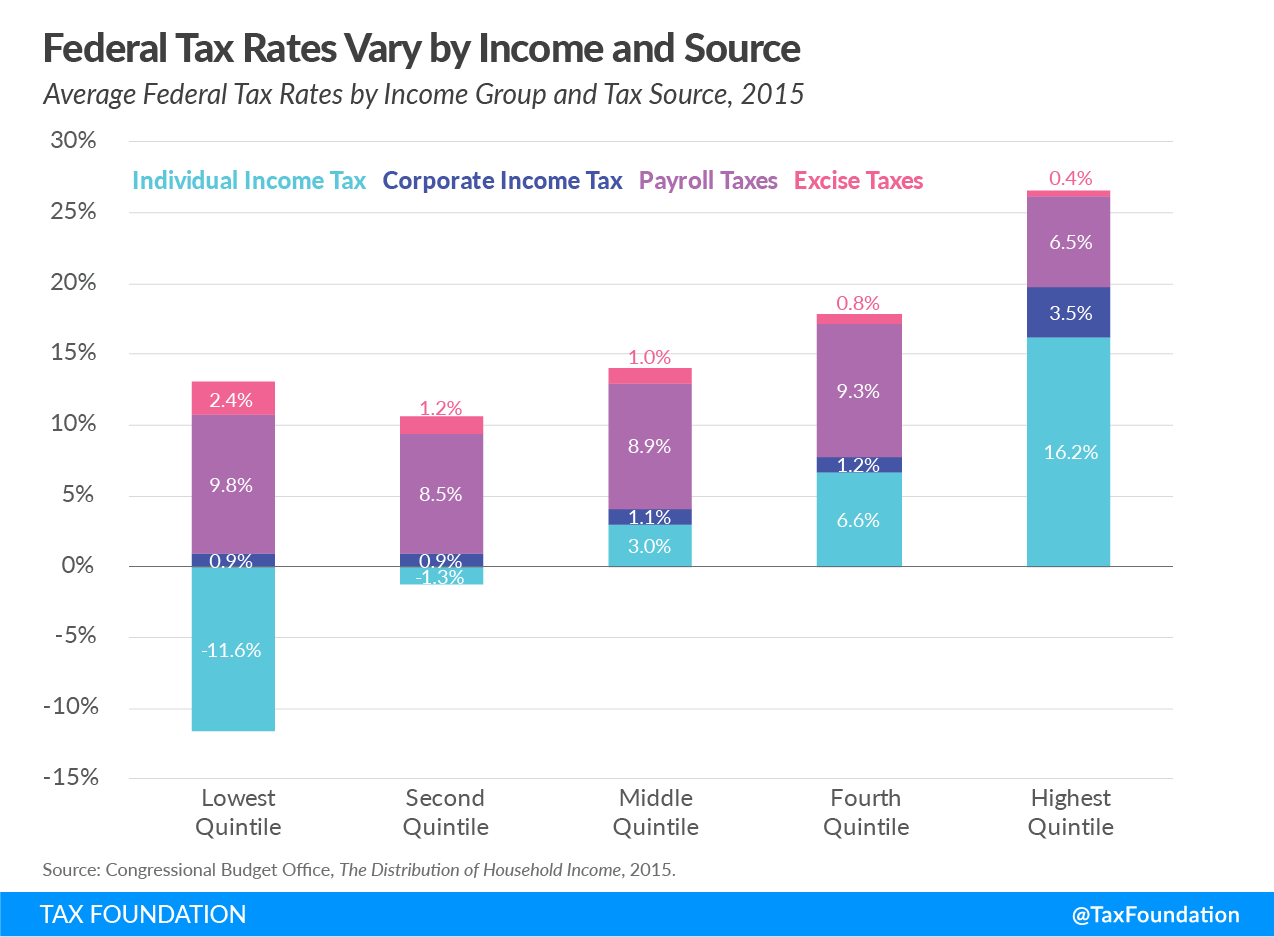

Federal taxes can be further broken down into individual income taxes, payroll taxes, corporate income taxes, and excise taxes. The following chart shows average federal tax rates for each type, illustrating how the progressivity of the federal tax code varies by tax source.[1]

While the overall federal tax system is progressive, not every tax that comprises it is. The individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. is most progressive, falling most heavily on the highest quintile. The bottom two quintiles experience a negative income tax—in other words, their income increases—as a result of refundable tax credits such as the Earned Income Tax CreditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. and the Child Tax Credit. In contrast to the income tax, the payroll tax is regressive, with lower-income individuals facing higher average tax rates. In 2015, the lowest quintile’s average payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. rate was 9.8 percent, compared to the highest quintile’s rate of 6.5 percent. Similarly, the lowest quintile’s average excise tax rate was 2.4 percent, compared to the highest quintile’s rate of 0.4 percent.

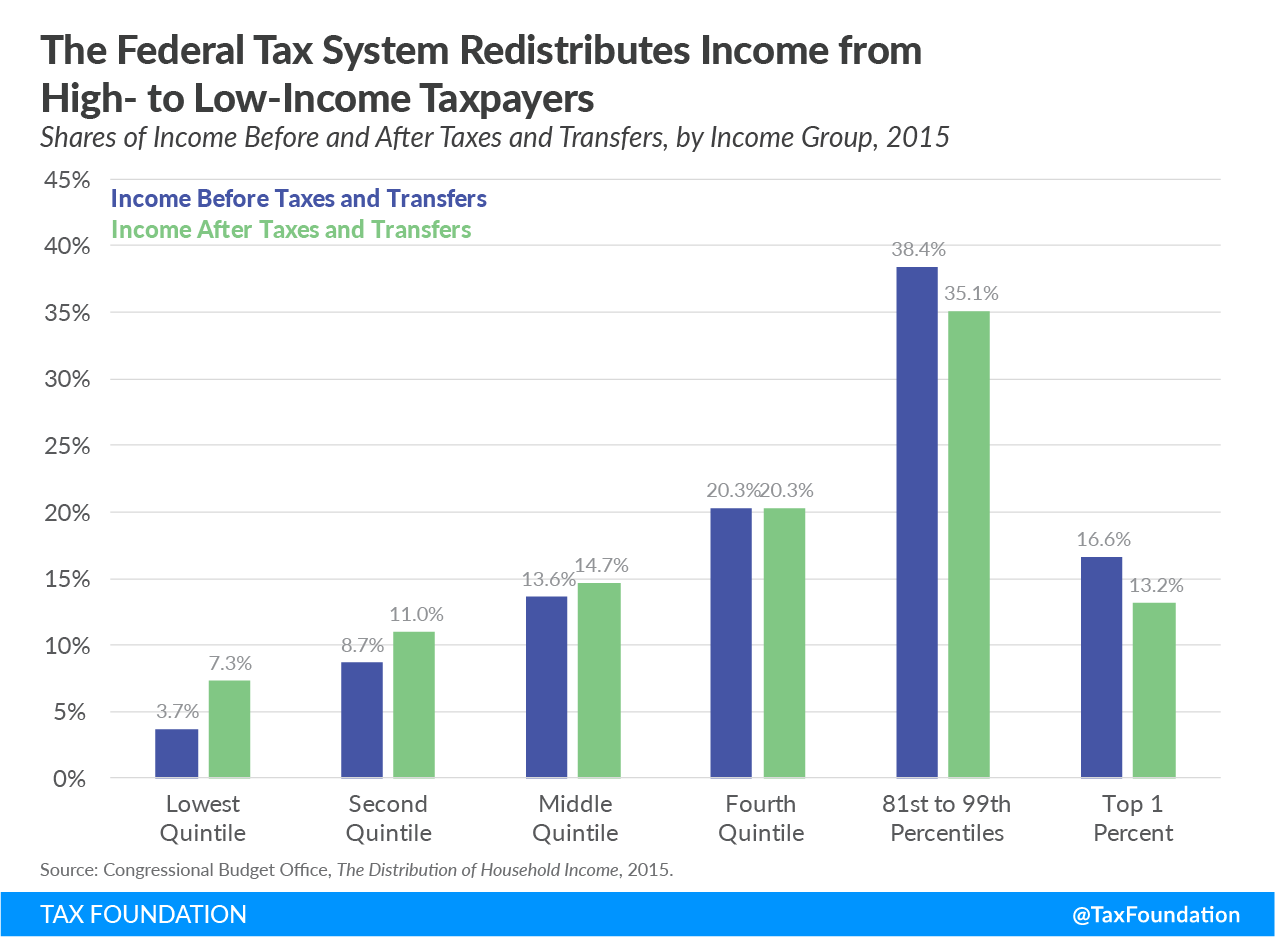

Although some taxes fall more heavily on lower quintiles, the net result of federal taxes and transfers is lower incomes for high-income Americans and higher incomes for low-income Americans. The following chart shows the shares of income by income group before and after taxes and transfers.

The lowest quintile’s income nearly doubles, while the second and middle quintiles experience relatively smaller increases in income. The fourth quintile’s income share remains constant, and only the highest quintile has a lower share of income after taxes and transfers. The top 1 percent’s share of income, for example, falls from 16.6 percent to 13.2 percent.

The result of all federal taxes and transfers is a redistribution of income from high- to low-income households. According to the CBO, “In 2015, average household income before accounting for means-tested transfers and federal taxes was $20,000 for the lowest quintile and $292,000 for the highest quintile. After transfers and taxes, those averages were $33,000 and $215,000.”[2] In other words, the lowest quintile’s average household income rose by $11,000, while the highest quintile’s average household income fell by $77,000.

As policymakers debate ways to raise taxes on the rich, they should keep in mind the extent to which the federal government already transfers income between income groups and remember that America already has a progressive tax system. This context is essential for productive conversations on how to improve the tax code, rather than weaken it.

Note: This is part of our “Putting a Face on America’s Tax Returns” blog series

- America Already Has a Progressive Tax System

- The Composition of Federal Revenue Has Changed Over Time

- The Top 1 Percent’s Tax Rates Over Time

- Who Benefits from Itemized Deductions?

- Income Taxes on the Top 0.1 Percent Weren’t Much Higher in the 1950s

- A Growing Percentage of Americans Have Zero Income Tax Liability

[1] The corporate income tax portion is the CBO’s estimate of the incidence of the tax.

[2] CBO’s measure of means-tested transfers includes cash payments and in-kind transfers from federal, state, and local governments.

Share this article