Yesterday, Governor Hutchinson and legislative leaders in Arkansas announced their final plan for restructuring Arkansas’s individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. brackets. After more than 18 months of study, the Arkansas General Assembly will consider the plan starting next week. The plan would lower taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. liabilities for a number of filers in Arkansas and implements the third phase of tax cuts in the Natural State.

The plan introduced yesterday differs from previous versions discussed in the Tax Reform and Relief Legislative Task Force. Several weeks ago, it was reported that the previous version of the “2/4/5.9% plan,” as it was known, contained a miscalculation, which would have increased taxes for approximately 200,000 Arkansans.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeThis new plan targets the tax relief onto higher-income Arkansans, defined as those with taxable incomes above $79,300. Arkansas currently uses three rate schedules for individuals, based on their income. This plan would simplify the third rate schedule, reducing state revenues by $97 million over the next several years.

Starting on January 1, 2020, the plan would simplify the brackets for those above $79,300 in income from six to three, with the top rate falling from 6.9 percent to 6.6 percent. Then, on January 1, 2021, the top rate would be cut again from 6.6 percent to 5.9 percent. At the same time, the top rate on the middle rate schedule, for those between $22,200 and $79,300 in income, would drop from 6 percent to 5.9 percent, to match the top table.

| Total Income Under $22,000 | Total Income Between $22,200 and $79,300 | Total Income Above $79,300 | |||||

|---|---|---|---|---|---|---|---|

| $0-$4,499 | 0% | $0-$4,499 | 0.75% | $0-$4,499 | 0.90% | ||

| $4,500-$8,899 | 2% | $4,500-$8,899 | 2.50% | $4,500-$8,899 | 2.50% | ||

| $8,900-$13,399 | 3% | $8,900-$13,399 | 3.50% | $8,900-$13,399 | 3.50% | ||

| $13,400-$22,199 | 3.40% | $13,400-$22,199 | 4.50% | $13,400-$22,199 | 4.50% | ||

| $22,200-$37,199 | 5% | $22,200-$37,199 | 6.00% | ||||

| $37,200-$79,300 | 6% | $37,200+ | 6.90% | ||||

|

Note: the exact brackets will change slightly due to Arkansas’s policy of inflation-adjusting its brackets annually. |

|||||||

| Total Income Under $22,200 | Total Income Between $22,201 and $79,300 | Total Income Above $79,300 | |||||

|---|---|---|---|---|---|---|---|

| $0-$4,499 | 0% | $0-$4,499 | 0.75% | $0-$4,000 | 2.00% | ||

| $4,500-$8,899 | 2% | $4,500-$8,899 | 2.50% | $4,000-$8,000 | 4.00% | ||

| $8,900-$13,399 | 3% | $8,900-$13,399 | 3.50% | $8,000+ | 5.90% | ||

| $13,400-$22,199 | 3.40% | $13,400-$22,199 | 4.50% | ||||

| $22,200-$37,199 | 5% | ||||||

| $37,200-$79,300 | 5.90% | ||||||

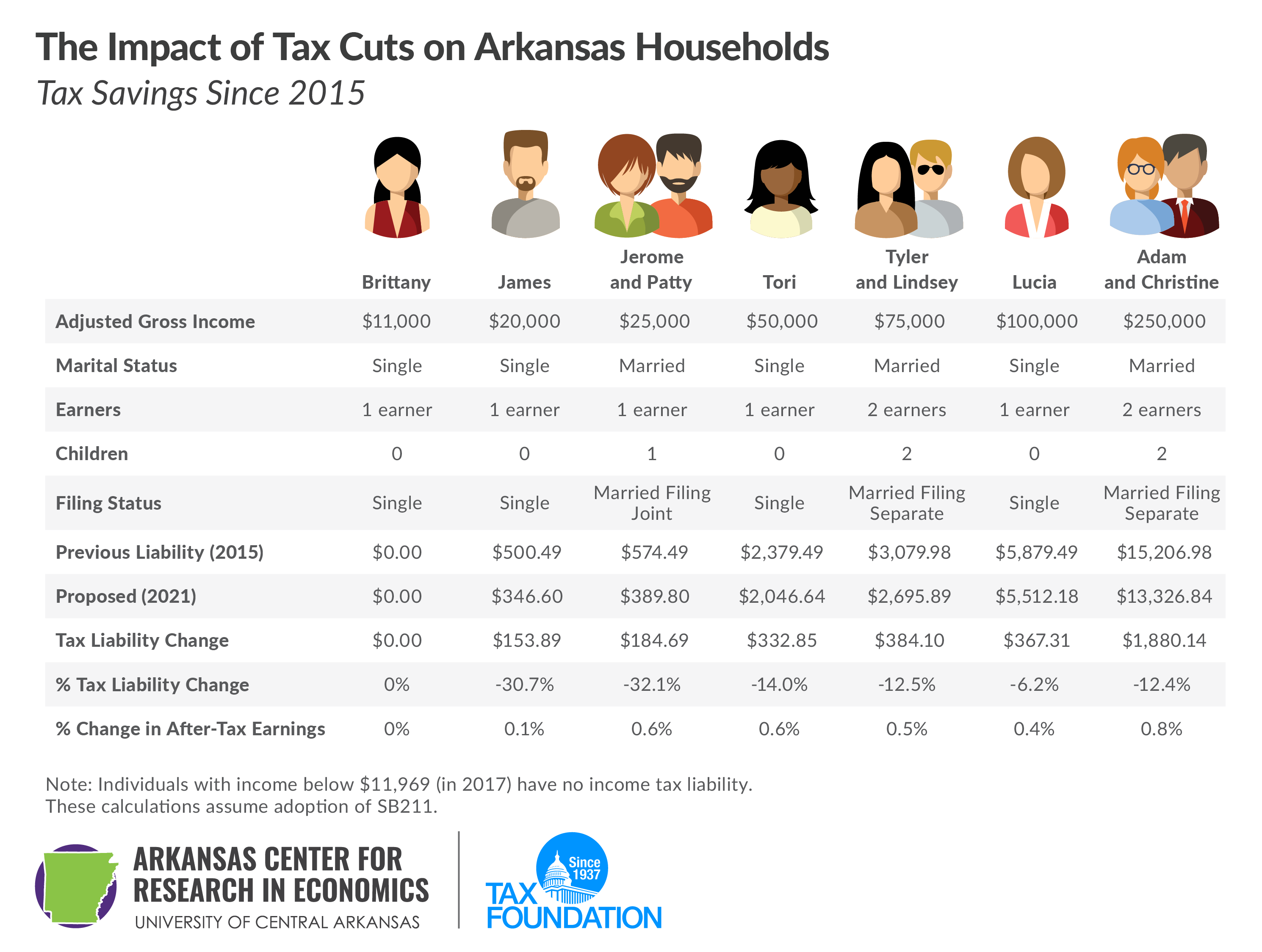

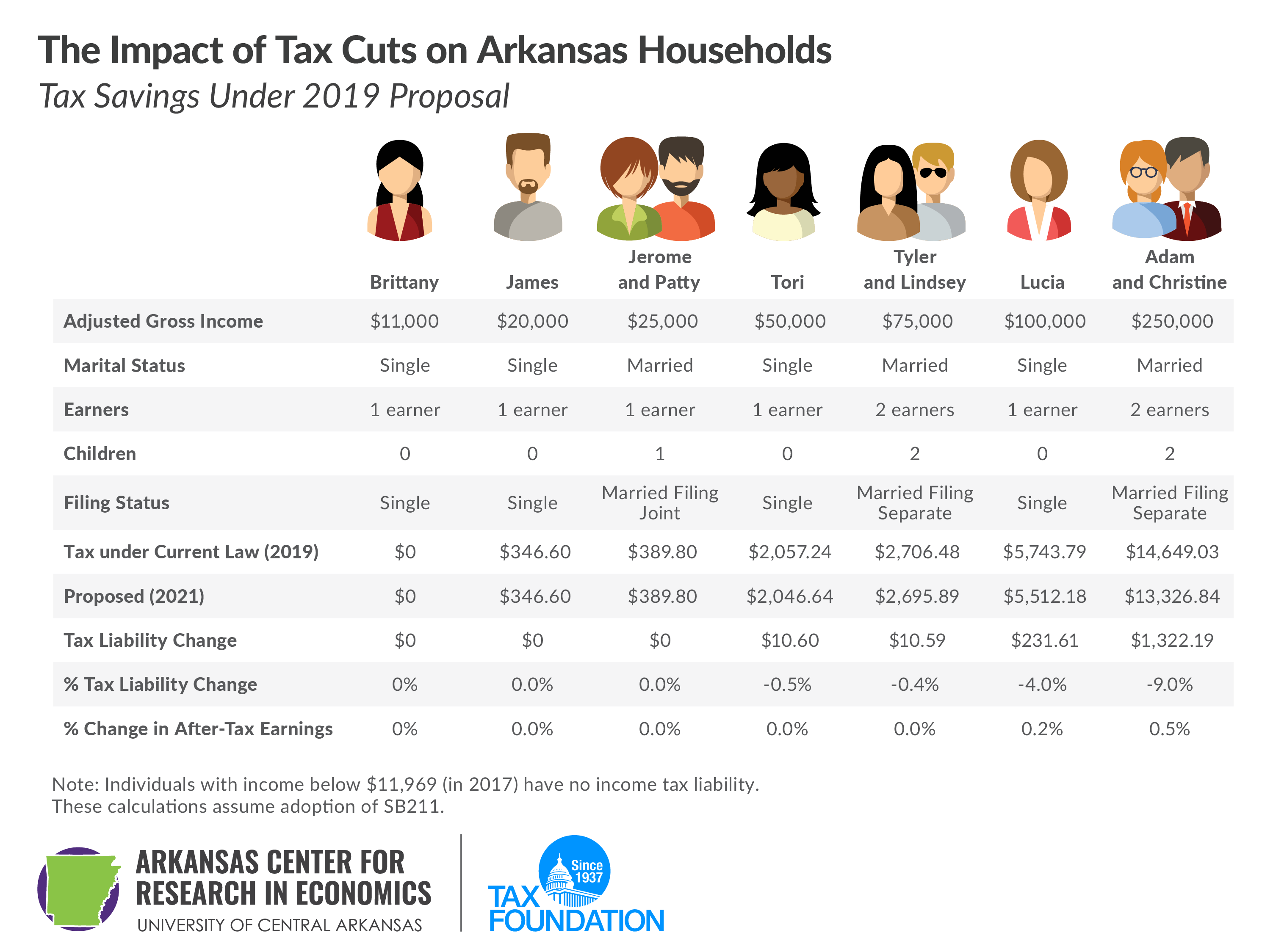

We have estimated the impact of these tax cuts on seven sample taxpayers in Arkansas. As shown below, taxes would be lowered for those with income above $37,200. Those below that income level do not see any tax cuts under this plan.

However, these cuts are the third phase of the individual income tax cuts in Arkansas. Looking only at the 2019 proposal misses much of the work done by the General Assembly in previous sessions. First, in 2015, it passed tax cuts for individuals with incomes between $21,000 and $75,000. Second, in 2017, it passed tax cuts for individuals with incomes below $21,000. (Single individuals with income below $11,969 have no income tax liability due to Arkansas’s low-income tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. first adopted in 1991 and expanded in 2007.) So, this final plan brings those with incomes above $75,000 closer to the cuts already passed in 2015 and 2017. (These numbers vary slightly due to Arkansas’s policy of inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. -adjusting their tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. annually.)

Here, we see that the income tax cuts are spread throughout the income spectrum. James has seen his income tax cut by 30.7 percent since 2015, compared to a 14 percent reduction for Tori and a 6.2 percent reduction for Lucia. Adam and Christine receive the largest nominal tax cut, $1,880.14, but as a percent of their income, their cut is among the smallest.

The $97 million revenue cost is also similar to that of the 2015 tax cut targeted at middle-income taxpayers.

And the reduction of the top rate from 6.9 percent to 5.9 percent makes Arkansas more competitive among its neighbors and in the South generally. Currently, the 6.9 percent rate is the highest among Arkansas’s neighboring states, and the second highest in the South (just below South Carolina’s 7.0 percent). This reduction brings Arkansas roughly in line with neighboring Missouri (5.9 percent) and Louisiana (6.0 percent), as well as Georgia and Kentucky (both at 6.0 percent). Neighboring Oklahoma and Mississippi are still slightly lower at 5.0 percent, and Texas and Tennessee have no income tax on wages and salaries, so there is still work to be done in the future. Ideally, future legislatures will work to further simplify the rate schedules, but this is a big step in the right direction.

Finally, these examples do not include other expected tax changes in Arkansas this legislative session. This bill is the first in a series of reforms planned by the General Assembly. The legislature is expected to consider reforms to its corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate and tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. and changes to the state’s sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. following the U.S. Supreme Court’s Wayfair decision, among other changes.

Calculation Assumptions

For our calculations, we used the Arkansas tax system as it exists on both January 1, 2015 and January 1, 2019. For the 2019 calculations, these are after the scheduled phase-in of the low-income tax changes effective on January 1. We assumed all filers used the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. Taxpayers who take the standard deduction cannot also itemize their deductions; it serves as an alternative. , for simplicity and comparisons (those though with itemized deductions will not see an increase, unlike previous versions of the plan). These calculations assume the rate structure under the “2/4/5.9% plan” when it’s fully phased in in 2021.

These calculations do not include any other tax changes, such as taxing online transactions under a sales tax, other sales tax base changes, or any business-side changes.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe