New Jersey and Utah Are Latest States to Consider Reforming Economic Nexus

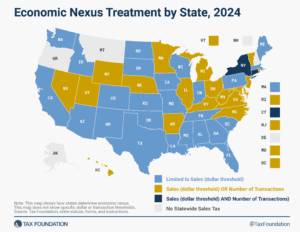

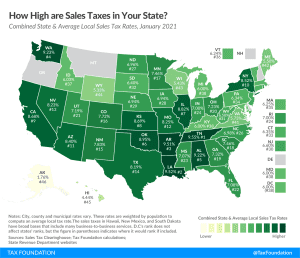

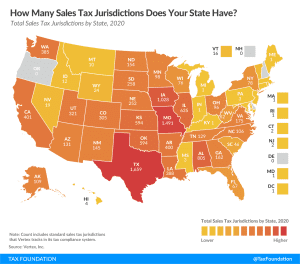

Despite stark competitiveness differences, both New Jersey and Utah share a common goal this legislative session: reforming economic nexus rules that require out-of-state sellers and marketplace facilitators to collect and remit state sales taxes.

4 min read