Important Differences Between House and Senate Versions of the Tax Cuts and Jobs Act

This list, though not exhaustive, catalogues the major differences between the House and Senate version of the Tax Cuts and Jobs Act.

4 min readJared Walczak is Vice President of State Projects at the Tax Foundation. He is the lead researcher on the annual State Business Tax Climate Index and Location Matters, and has authored or coauthored tax reform guides on Alaska, Iowa, Kansas, Louisiana, Nevada, New York, Pennsylvania, South Carolina, West Virginia, and Wisconsin.

Jared’s work is regularly cited in The New York Times, The Wall Street Journal, The Washington Post, Los Angeles Times, Politico, AP, and many other prominent national and state outlets.

He previously served as legislative director to a member of the Senate of Virginia and as policy director for a statewide campaign, and consulted on research and policy development for a number of candidates and elected officials. In his free time, Jared enjoys hiking and has a goal of visiting all 63 national parks.

This list, though not exhaustive, catalogues the major differences between the House and Senate version of the Tax Cuts and Jobs Act.

4 min read

The Senate Tax Cuts and Jobs Act shares many things with its House counterpart, but also differs on several particulars. This guide consolidates all of the details of the Senate plan in one convenient location.

3 min read

According to the Taxes and Growth model, the House Tax Cuts and Jobs Act should increase after-tax income by 4.5 percent for those in the second-lowest quintile, and by 4.6 percent for those in the middle quintile.

3 min read

The way the state and local tax deduction, alternative minimum tax, and Pease limitation interact is complex. This primer makes things easier to understand.

5 min read

Considered as a whole, this plan would make the U.S. substantially more competitive, not only due to lower rates but also due to a better tax structure.

2 min read

The widely anticipated House Tax Cuts and Jobs Act includes hundreds of structural changes to the tax code. Here are the eight most important provisions in no particular order.

6 min read

The House Tax Cuts and Jobs act would fundamentally reform the U.S. tax code for the first time in over 30 years. Here are all the important details.

4 min read

Hampered by high marginal tax rates and complex business tax rules, the United States again ranks towards the bottom of the pack on our 2017 International Tax Competitiveness Index, placing 30 out of 35 OECD countries.

11 min read

To achieve meaningful tax reform, Congress will require significant base-broadeners. Saving the property tax deduction makes the math more difficult, but still leaves clear paths forward.

6 min read

The state and local tax deduction isn’t just a costly federal subsidy. It also skews state and local tax policy decisions.

2 min read

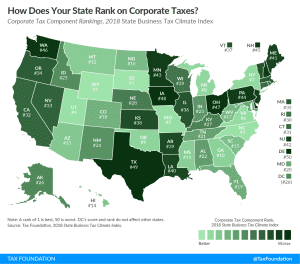

For 15 years, our State Business Tax Climate Index has been the standard for legislators and taxpayers to understand how their state’s tax code compares and how it can be improved. Now, for the first time ever, you can explore our Index’s 100+ variables in an easy to use, interactive format.

16 min read

The Ohio Commercial Activity Tax, a 0.26 percent tax on business gross receipts above $1 million, is a throwback to an earlier era of taxation, bringing back a tax type that had been in steady retreat for nearly a century.

34 min read

Estate and inheritance taxes reduce investment, discourage business expansion, and sometimes drive wealthy taxpayers out of state. It’s little wonder that states are under pressure to reduce or eliminate them.

44 min read