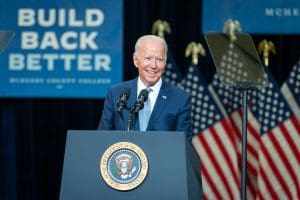

Comparing Tax Provisions in Different Versions of the House Build Back Better Act

The most recent versions of President Biden’s Build Back Better plan are improvements on the original proposal, but would still reduce economic growth and average after-tax incomes for the top 80 percent of earners in the long run.

7 min read