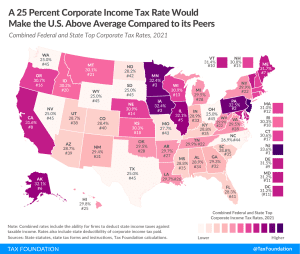

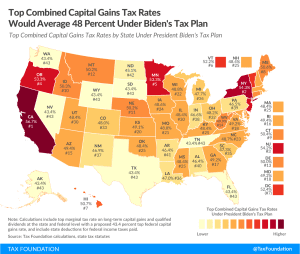

Biden Plan’s Higher Taxation of Businesses Would Boost Collections to Highest in 40-Plus Years

President Biden’s tax proposals released as part of his fiscal year 2022 budget would collect about $2 trillion in new tax revenue from businesses over 10 years. This new revenue would bring income tax collections on businesses as a portion of GDP to its highest level on a sustained basis in over 40 years.

2 min read