Details and Analysis of the American Families and Jobs Act

Details and analysis of the latest House GOP tax plan, the American Families and Jobs Act. Learn more about the House Republican tax plan.

7 min readGarrett Watson is Director of Policy Analysis at the Tax Foundation, where he conducts research on federal and state tax policy. His work has been featured in The Washington Post, The Atlantic, Politico, the Associated Press and other major outlets.

Previously, Garrett was a program manager at a nearby think tank and conducted policy research on economic opportunity and labor markets, including non-compete clause reform.

Garrett earned a bachelor’s degree from St. Lawrence University in upstate New York, where he studied economics and philosophy. Garrett lives in northwest Arkansas and is an avid hockey fan and snowboarder.

Details and analysis of the latest House GOP tax plan, the American Families and Jobs Act. Learn more about the House Republican tax plan.

7 min read

This tax reform plan would boost long-run GDP by 2.5%, grow wages by 1.4%, and add 1.3M jobs, all while collecting a similar amount of tax revenue as the current code and reducing the long-run debt burden.

38 min read

According to our analysis, President Biden’s budget would reduce long-run economic output by about 1.3 percent and eliminate 335,000 FTE jobs. See what tax policies the president is proposing.

17 min read

President Biden’s new budget proposal outlines several major tax increases targeted at businesses and high-income individuals that would bring U.S. income tax rates far out of step with international norms.

7 min read

Adopting a distributed profits tax would greatly simplify U.S. business taxes, reduce marginal tax rates on investment, and renew our country’s commitment to pro-growth tax policy.

6 min read

While hoping for inflation’s continued decline, policymakers should finish the job and index the tax code to prepare for future bouts of high inflation and as a contingency in case it takes longer to defeat elevated inflation than expected.

4 min read

The FairTax is a proposal to replace all major sources of the federal government’s revenue—the individual income tax, corporate income tax, estate and gift taxes, and payroll tax—with a national sales tax and rebate, abolishing the IRS in the process.

7 min read

A combination of long-standing IRS operational deficiencies, the agency’s temporary closure due to the pandemic, and the now-expired pandemic relief produced a perfect recipe for a paper backlog.

4 min read

Lawmakers should use the most comprehensive analytical tools available to them—like dynamic scoring—to make informed decisions about policy changes.

5 min read

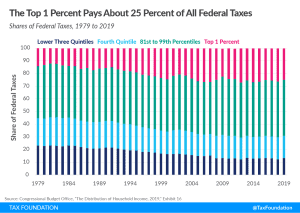

Newly published data from the CBO indicates in 2019, before the onset of the pandemic, American incomes continued to rise as part of a broad economic expansion. It also shows that, contrary to common perceptions, the federal tax system is progressive.

4 min read

The year-end omnibus federal spending package makes a number of reforms to retirement savings accounts.

3 min read

Lawmakers should recognize both the growing importance of business R&D and the need to support it through a commonsense tax policy, namely a return to full and immediate expensing for R&D.

6 min read

While there is disagreement about the amount of interest that should be deductible, it’s clear that the limit based on EBIT makes the U.S. an outlier compared to other countries across the OECD while raising the cost of new investment.

7 min read

Two weeks after the 2022 midterm elections, it’s becoming clearer where tax policy may be headed for the rest of the year and into 2023. In the short term, Congress must deal with tax extenders and expiring business tax provisions that may undermine the economy.

5 min read

Policymakers face a difficult balancing act this year in what is likely to be an unusual tax extenders season.

6 min read

As we near this year’s “lame duck” session of Congress, there has been renewed interest in reforming the child tax credit as part of a tax deal. Our new analysis highlights the trade-offs that policymakers will face

5 min read

The business tax changes originally introduced in the TCJA are scheduled to increase tax burdens on businesses at a time when economic headwinds and broader uncertainty are higher than they have been in decades.

12 min read

We find that the dynamic cost of permanent bonus depreciation rises by about 7 percent under 4 percent inflation, but the economic benefit, measured by the size of the economy, rises by about 25 percent.

4 min read

The Social Security Administration (SSA) announced the cost-of-living adjustment for Social Security payments based on inflation over the previous year. This has brought renewed attention to how the tax code treats Social Security benefits, which can be a confusing subject for taxpayers.

4 min read

President Biden proposed a 7-point hike in the corporate tax rate to 28 percent, a new minimum book tax on corporate profits, and higher taxes on international activity. We estimated these proposals would reduce the size of the economy (GDP) by 1.6 percent over the long run and eliminate 542,000 jobs.

6 min read