The Economics of Stock Buybacks

Stock buybacks are readily visible, and unfortunately some have misunderstood stock buybacks to be taking place at the expense of long-term investments.

17 min readErica York is Vice President of Federal Tax Policy with Tax Foundation’s Center for Federal Tax Policy. She previously worked as an auditor at a large community bank in Kansas and interned at Tax Foundation’s Center for State Tax Policy.

Her analysis has been featured in The Wall Street Journal, The Washington Post, Politico, and other national and international media outlets. She holds a master’s degree in Economics from Wichita State University and an undergraduate degree in Business Administration and Economics from Sterling (KS) College, where she is currently an adjunct professor. Erica lives in Kansas with her husband and their two children.

Stock buybacks are readily visible, and unfortunately some have misunderstood stock buybacks to be taking place at the expense of long-term investments.

17 min read

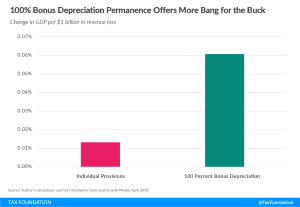

Full expensing is a key driver of future economic growth, and can have a larger pro-growth effect per dollar of revenue forgone than cutting tax rates.

3 min read

In the long run, permanent full expensing produces about 4.5 times more GDP growth per dollar of revenue than making individual TCJA provisions permanent.

2 min read

The Tax Cuts and Jobs Act made significant progress in improving businesses’ ability to recover the cost of making investments in the United States by enacting 100 percent bonus depreciation.

11 min read

Raising the corporate tax rate would reduce economic growth and lead to a smaller capital stock, lower wage growth, and reduced employment.

2 min read

Tax compliance creates real costs, which can be calculated. Each method provides unique illustrations of the cost of complying with U.S. tax code.

11 min read

Cutting the corporate tax rate improves the United States’ international tax competitiveness, incentives new investment and benefits both old & new capital.

3 min read

The Tax Cuts and Jobs Act reduced the corporate income tax rate from the highest statutory rate in the developed world to a more globally competitive 21 percent.

13 min read

The newly expanded standard deduction will reduce the time taxpayers spend working on Form 1040 by 4 to 7 percent, translating into $3.1 to $5.4 billion saved annually.

15 min read

Stock buybacks are a clearly visible phenomenon, but most critics point out the initial action, the buyback, and ignore the greater context.

3 min read