Elke Asen was a Policy Analyst with the Tax Foundation’s Center for Global Tax Policy, focusing on international tax issues and tax policy in Europe. Prior to joining the Tax Foundation, Elke interned with the EU Delegation in Washington, D.C., the German Development Agency, and a social startup in Munich, Germany. She holds a BS in Economics from Ludwig Maximilian University of Munich.

Elke was born and raised in a small town of 500 people outside of Salzburg, Austria, and loves to travel. Road tripping and backpacking are her favorites.

Latest Work

UK Taxes: Potential for Growth

3 min read

International Tax Competitiveness Index 2019

Our International Index compares OECD countries on over 40 variables that measure how well each country’s tax system promotes sustainable economic growth and investment.

11 min read

OECD Tackling Harmful Tax Practices

Countries around the world often design their tax policies to become attractive targets for foreign investment. These policies can be anything from a system with special preferences for certain industries to a well-designed tax system based on principles of sound tax policy. Systems that are rife with special preferences and complexities can create distortions in local jurisdictions and across the global economy.

3 min read

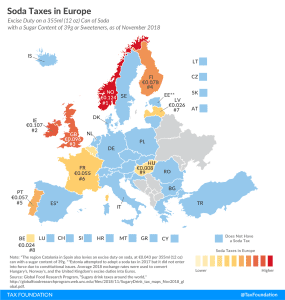

Soda Taxes in Europe

2 min read

Standard VAT Rate on German Meat?

2 min read

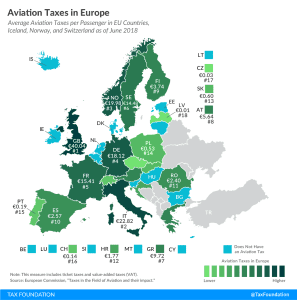

Aviation Taxes in Europe

1 min read

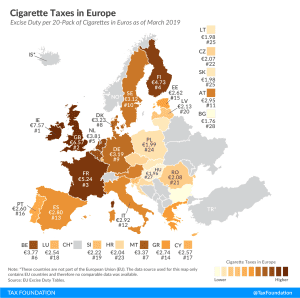

Cigarette Taxes in Europe, 2019

Today, Ireland and the United Kingdom levy the highest excise duties on cigarettes in the European Union (EU), at €7.57 (US $8.93) and €6.57 ($7.75) per 20-cigarette pack, respectively. This compares to an EU average of €3.09 ($3.64). In contrast, Bulgaria (€1.76 or $2.07) and Hungary (€1.96 or $2.31) levy the lowest excise duties.

3 min read

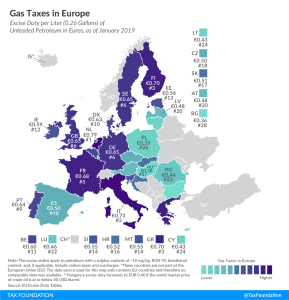

Gas Taxes in Europe, 2019

4 min read

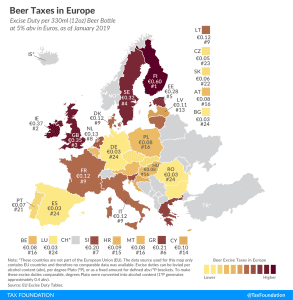

Beer Taxes in Europe, 2019

2 min read

Amazon Passes France’s Digital Services Tax on to Vendors

France’s new 3 percent digital tax may be targeted at Amazon and other large digital firms, but Amazon’s French vendors will bear the burden of the tax.

3 min read

The Good and Bad about Tax Havens

3 min read