Elke Asen was a Policy Analyst with the Tax Foundation’s Center for Global Tax Policy, focusing on international tax issues and tax policy in Europe. Prior to joining the Tax Foundation, Elke interned with the EU Delegation in Washington, D.C., the German Development Agency, and a social startup in Munich, Germany. She holds a BS in Economics from Ludwig Maximilian University of Munich.

Elke was born and raised in a small town of 500 people outside of Salzburg, Austria, and loves to travel. Road tripping and backpacking are her favorites.

Latest Work

Digital Taxation Around the World

The digitalization of the economy has been a key focus of tax debates in recent years. Our new report reviews digital tax policies around the world with a focus on OECD countries, explores the various flaws and benefits associated with the wide set of proposals, and provides recommendations for lawmakers to consider.

12 min read

Tax Relief for Families in Europe

Most countries provide tax relief to families with children—typically through targeted tax breaks that lower income taxes. While all European OECD countries provide tax relief for families, its extent varies substantially across countries.

2 min read

Reducing the Bias Against Long-term Investments

Other countries have shown that providing deductions in line with invested capital costs can have positive impacts both on investment and on debt bias.

7 min read

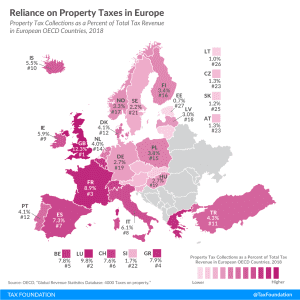

Reliance on Property Taxes in Europe

1 min read

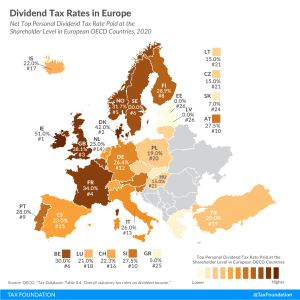

Dividend Tax Rates in Europe, 2020

2 min read

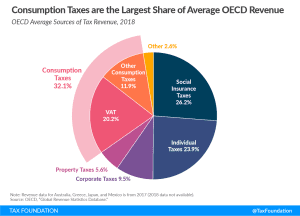

New OECD Study: Consumption Tax Revenues during Economic Downturns

Compared to other tax revenue sources, consumption tax revenue as a share of GDP tends to be relatively stable over time, even during economic downturns.

2 min read

Capital Cost Recovery across the OECD, 2020

Although sometimes overlooked in discussions about corporate taxation, capital cost recovery plays an important role in defining a business’s tax base and can impact investment decisions—with far-reaching economic consequences.

27 min read

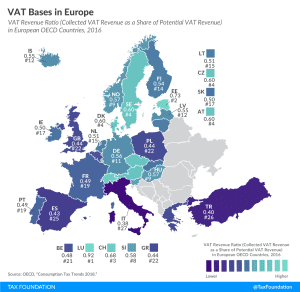

VAT Bases in Europe

The extent to which businesses and consumers will benefit from coronavirus relief measures like temporary VAT changes will depend on the VAT base.

2 min read

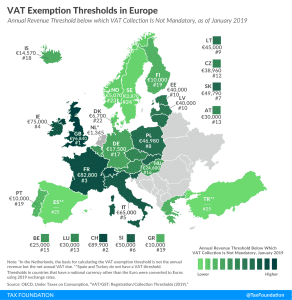

VAT Exemption Thresholds in Europe

Due to certain VAT exemption thresholds, many small businesses will not be able to benefit from the VAT changes being introduced throughout Europe to provide relief during the COVID-19 crisis.

2 min read

A German Export for Times of Crises: The Short-Time Work Scheme

One of the most talked about government economic responses to the COVID-19 crisis is Germany’s Kurzarbeit: the German short-work subsidy scheme.

3 min read

Tracking Economic Relief Plans Around the World during the Coronavirus Outbreak

Countries around the world are implementing emergency tax measures to support their economies under the coronavirus (COVID-19) threat.

51 min read

Economic Relief Plans Around the World During the Coronavirus Outbreak

Countries around the world are implementing emergency tax measures to support their debilitated economies under the coronavirus (COVID-19) threat.

7 min read

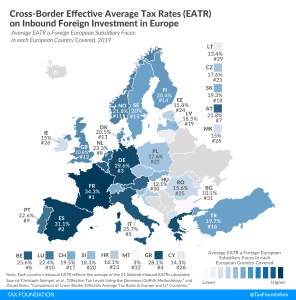

Summary of the OECD’s Impact Assessment on Pillar 1 and Pillar 2

The OECD presented its preliminary impact assessment on the Pillar 1 and Pillar 2 proposals. The impact assessment includes estimated revenue and investment effects presented at a country group level (low-, middle- and high-income countries and investment hubs). The OECD estimates global corporate income tax revenues to increase by 4 percent if both pillars get implemented, equaling $100 billion annually.

4 min read

Reliance on Consumption Taxes in Europe

2 min read