The Biden Administration’s Misguided Approach to Defining “American” Companies

What does it mean to be an American company?

4 min readDaniel Bunn is President and CEO of the Tax Foundation. Daniel has been with the organization since 2018 and, prior to becoming President, successfully built its Center for Global Tax Policy, expanding the Tax Foundation’s reach and impact around the world.

Prior to joining the Tax Foundation, Daniel worked in the United States Senate at the Joint Economic Committee as part of Senator Mike Lee’s (R-UT) Social Capital Project and on the policy staff for both Senator Lee and Senator Tim Scott (R-SC). In his time in the Senate, Daniel developed legislative initiatives on tax, trade, regulatory, and budget policy.

He has a master’s degree in Economic Policy from Central European University in Budapest, Hungary, and a bachelor’s degree in Business Administration from North Greenville University in South Carolina.

Daniel lives in Halethorpe, Maryland, with his wife and their three children.

What does it mean to be an American company?

4 min read

Historical evidence and recent studies have shown that retaliatory tax and trade proposals raise prices and reduce the quantity of goods and services available to U.S. businesses and consumers, resulting in lower incomes, reduced employment, and lower economic output.

5 min read

The rules of tax competition are changing with the recent agreement on a global minimum tax and other changes to tax rules around the world, but that does not mean the contest is over.

5 min read

The EU Tax Observatory has taken an extreme view in assessing the global minimum tax. The rules were not meant to immediately reduce the stock of shifted profits or align profitability levels more closely with employment costs. The rules do change incentives for multinationals, but profits may continue to remain in low-tax jurisdictions for many years.

6 min read

Policymakers on Capitol Hill should prioritize permanent pro-growth policy in the coming years as the economy struggles with inflation and the recovery from the pandemic.

4 min read

The OECD recently released a trove of new documents on a draft multilateral tax treaty. The U.S. Treasury has opened a 60-day consultation period for the proposal and is requesting public review and input.

7 min read

The global minimum tax agreement known as Pillar Two is intended to curb profit shifting. However, OECD countries already have a variety of mechanisms in place that seek to prevent base erosion and profit shifting by multinational corporations.

40 min read

Pillar Two implementation is underway in many jurisdictions, and many governments are aiming to get their proposals approved before the end of 2023. However, estimating Pillar Two’s impact on government revenue is proving difficult. As a result, only a few countries have publicly presented their findings.

7 min read

On 12 September, the European Commission released a proposal called “Business in Europe: Framework for Income Taxation” (BEFIT) and two associated proposals on transfer pricing and a Head of Office tax system.

6 min read

A major case pending before the U.S. Supreme Court (Moore v. United States) is calling into question provisions on large portions of the U.S. tax base which could quickly become legally uncertain, putting significant revenue at stake.

7 min read

The United Nations (UN) is preparing to flex its muscles on international tax policy. Several developing countries say the OECD’s approach favors richer countries at their expense, and the UN hopes to fix this.

5 min read

Simplifying international tax rules will not solve all the challenges that stand in the way of healthy cross-border investment, but eliminating unnecessary provisions would be a positive pivot relative to the trajectory of recent years. It’s high time that policymakers stopped pursuing ever more complex rules and started the hard work of simplification.

6 min read

The price tag of the Inflation Reduction Act’s green energy tax credits is much higher than originally thought. Among other things, the updated analysis indicates the Inflation Reduction Act does not reduce deficits after all.

6 min read

The legislation follows from the bipartisan concern regarding tax policies adopted by other countries specifically targeting U.S. businesses or the U.S. tax base.

6 min read

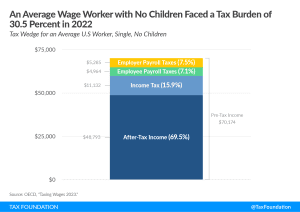

Although the U.S. has a progressive tax system and a relatively low tax burden compared to the OECD average, average-wage workers still pay more than 30 percent of their wages in taxes.

4 min read

Permanent full expensing is an efficient and neutral tax policy that will allow markets to allocate private investment effectively while moving the economy towards the climate goals of the EU.

33 min read

Scandinavian countries are well known for their broad social safety net and their public funding of services such as universal health care, higher education, parental leave, and child and elderly care. So how do Scandinavian countries raise their tax revenues?

7 min read

The UK’s adoption of full expensing is a welcome step that may generate short-run economic benefits. However, for the reform to have a meaningful effect on the UK’s international competitiveness and long-run economic performance, it must be made permanent—which the British government has said it hopes to do.

6 min read

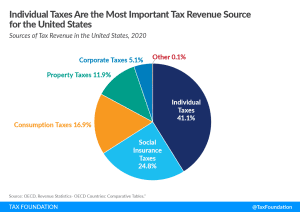

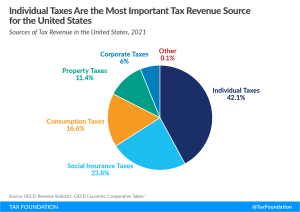

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

5 min read