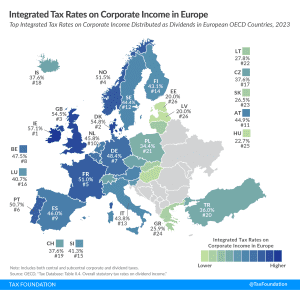

Integrated Tax Rates on Corporate Income in Europe, 2023

In most European OECD countries, corporate income is taxed twice, once at the entity level and once at the shareholder level.

4 min readCristina Enache writes on the economics of tax policy and is the author of the Spanish Regional Tax Competitiveness Index. She was formerly the Director of Research at Civismo, an economic research organization based in Spain. She also served as head of research at Institución Futuro, a regional think tank based in Navarra in northern Spain. She is also currently Secretary-General at the World Taxpayers Associations and General Manager of the Spanish Taxpayers Union, which she joined in 2016.

Cristina has a degree in economics from the Academy of Economic Studies in Bucharest and a master’s degree in Economics and Finance from the University of Navarra.

In most European OECD countries, corporate income is taxed twice, once at the entity level and once at the shareholder level.

4 min read

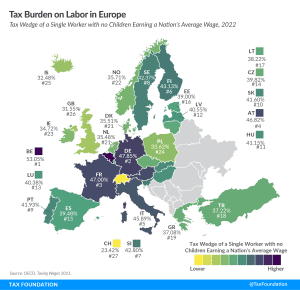

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services.

4 min read

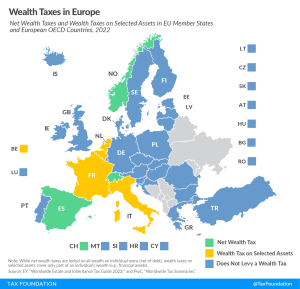

Instead of reforming and hiking the wealth tax, perhaps policymakers should consider whether the tax is serving its intended objectives, and, if not, consider repealing the tax altogether.

4 min read

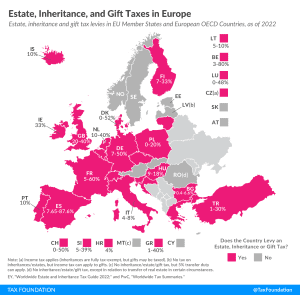

As tempting as inheritance, estate, and gift taxes might look—especially when the OECD notes them as a way to reduce wealth inequality—their limited capacity to collect revenue and their negative impact on entrepreneurial activity, saving, and work should make policymakers consider their repeal instead of boosting them.

3 min read

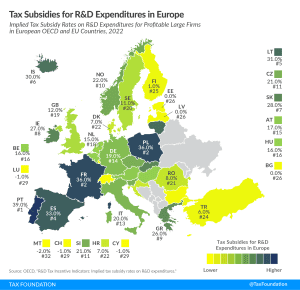

Many countries incentivize business investment in research and development (R&D), intending to foster innovation. A common approach is to provide direct government funding for R&D activity. However, a significant number of jurisdictions also offers R&D tax incentives.

4 min read

Spain should follow the examples of Italy and the UK and enact tax reforms that have the potential to stimulate economic activity by supporting private investment while increasing its international tax competitiveness.

7 min read

To recover from the pandemic and put the global economy on a trajectory for growth, policymakers need to aim for more generous and permanent capital allowances. This will spur real investment and can also contribute to more environmentally friendly production across the globe.

33 min read

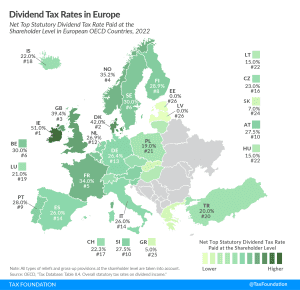

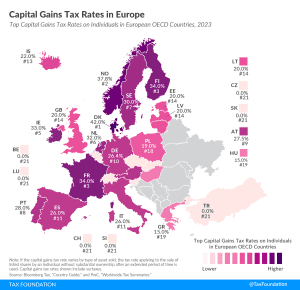

In many countries, corporate profits are subject to two layers of taxation: the corporate income tax at the entity level when the corporation earns income, and the dividend tax or capital gains tax at the individual level when that income is passed to its shareholders as either dividends or capital gains.

3 min read

As Chile looks to the future, policymakers might want to follow the UK’s example. Policymakers should focus on growth-oriented tax policies that encourage private and foreign direct investment, savings, and entrepreneurial activity, increasing Chile’s international tax competitiveness.

2 min read

In many countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income. Denmark levies the highest top capital gains tax of all countries covered, at a rate of 42 percent. Norway levies the second-highest top capital gains tax at 37.8 percent. Finland and France follow, at 34 percent each.

4 min read

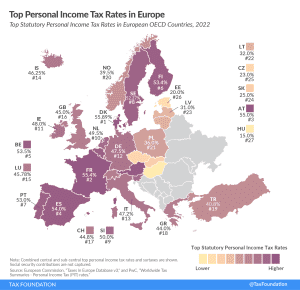

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

2 min read

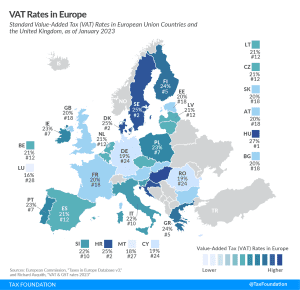

The EU countries with the highest standard VAT rates are Hungary (27 percent), Croatia, Denmark, and Sweden (all at 25 percent). Luxembourg levies the lowest standard VAT rate at 16 percent, followed by Malta (18 percent), Cyprus, Germany, and Romania (all at 19 percent).

4 min read

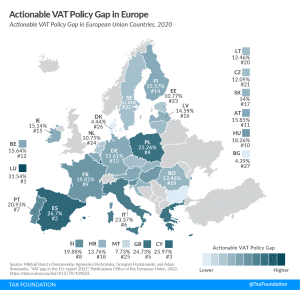

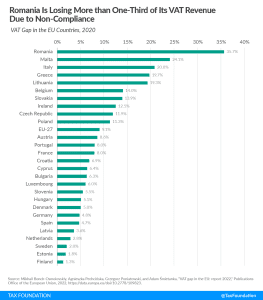

Value-added taxes (VAT) make up approximately one-fifth of total tax revenues in Europe. However, European countries differ significantly in how efficiently they raise VAT revenues. One way to measure a country’s VAT efficiency is the VAT Gap.

4 min read

Since VAT revenues are such a significant and stable contributor to overall government revenues, EU policymakers should pay particular attention to how efficiently those revenues are raised.

22 min read

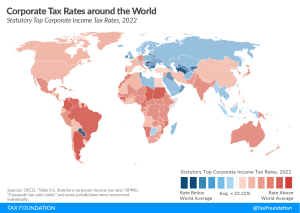

A new report shows that corporate tax rates around the world continue to level off. “We aren’t seeing a race to the bottom, we’re seeing a race toward the middle,” said Sean Bray, EU policy analyst at the Tax Foundation.

25 min read

As Chile looks to the future, the accelerated deductions for capital investment costs should be extended and made permanent while unnecessary tax hikes on individuals and capital should be avoided. Policymakers should focus on growth-oriented tax policy that encourages investment, savings, and entrepreneurial activity, increasing Chile’s international tax competitiveness.

4 min read

Since 2020, Spain has dropped from 26th to 34th on the International Tax Competitiveness due to multiple tax hikes, new taxes, and weak performances in all five index components.

7 min read

Colombia should consider shifting its planned tax reforms from harmful corporate and individual taxes to less harmful consumption taxes.

5 min read

The 2022 Spanish Regional Tax Competitiveness Index allows policymakers and taxpayers to evaluate and measure how their regions’ tax systems compare.

8 min read

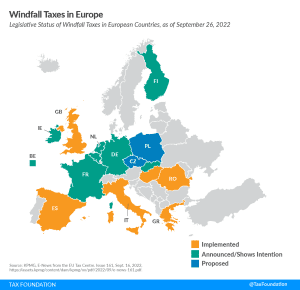

It’s unlikely these implemented and proposed windfall taxes will achieve their goals of addressing high gas and energy prices and raising additional revenues. They would more likely raise prices, penalize domestic production, and punitively target certain industries without a sound tax base.

9 min read