The primary objective of taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. reform should be economic growth. The Tax Cuts and Jobs Act (TCJA) was a pro-growth bill; however, many of its provisions are scheduled to phase out or expire over the next decade. Permanence for some provisions is more cost-effective than others, which is important to keep in mind as lawmakers consider which provisions to make permanent.

As our new paper explains, the TCJA made significant progress in improving the cost recoveryCost recovery is the ability of businesses to recover (deduct) the costs of their investments. It plays an important role in defining a business’ tax base and can impact investment decisions. When businesses cannot fully deduct capital expenditures, they spend less on capital, which reduces worker’s productivity and wages. treatment of business investment by enacting 100 percent bonus depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. , allowing the immediate write-off of certain short-lived investments, but the provision will only be in effect for five years before it begins phasing out.

On the individual income tax side, the TCJA cut rates and curbed or eliminated several deductions and expanded some tax credits. Some of the most prominent changes in the TCJA include: the top income tax bracketA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. rate went from 39.6 percent to 37 percent; the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing their federal income taxes. was doubled; both the state and local tax deductionA tax deduction is a provision that reduces taxable income. A standard deduction is a single deduction at a fixed amount. Itemized deductions are popular among higher-income taxpayers who often have significant deductible expenses, such as state and local taxes paid, mortgage interest, and charitable contributions. and the mortgage interest deductionThe mortgage interest deduction is an itemized deduction for interest paid on home mortgages. It reduces households’ taxable incomes and, consequently, their total taxes paid. The Tax Cuts and Jobs Act (TCJA) reduced the amount of principal and limited the types of loans that qualify for the deduction. were capped; the personal exemption was eliminated; the child tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly. was doubled. However, these changes are scheduled to expire after December 31, 2025.

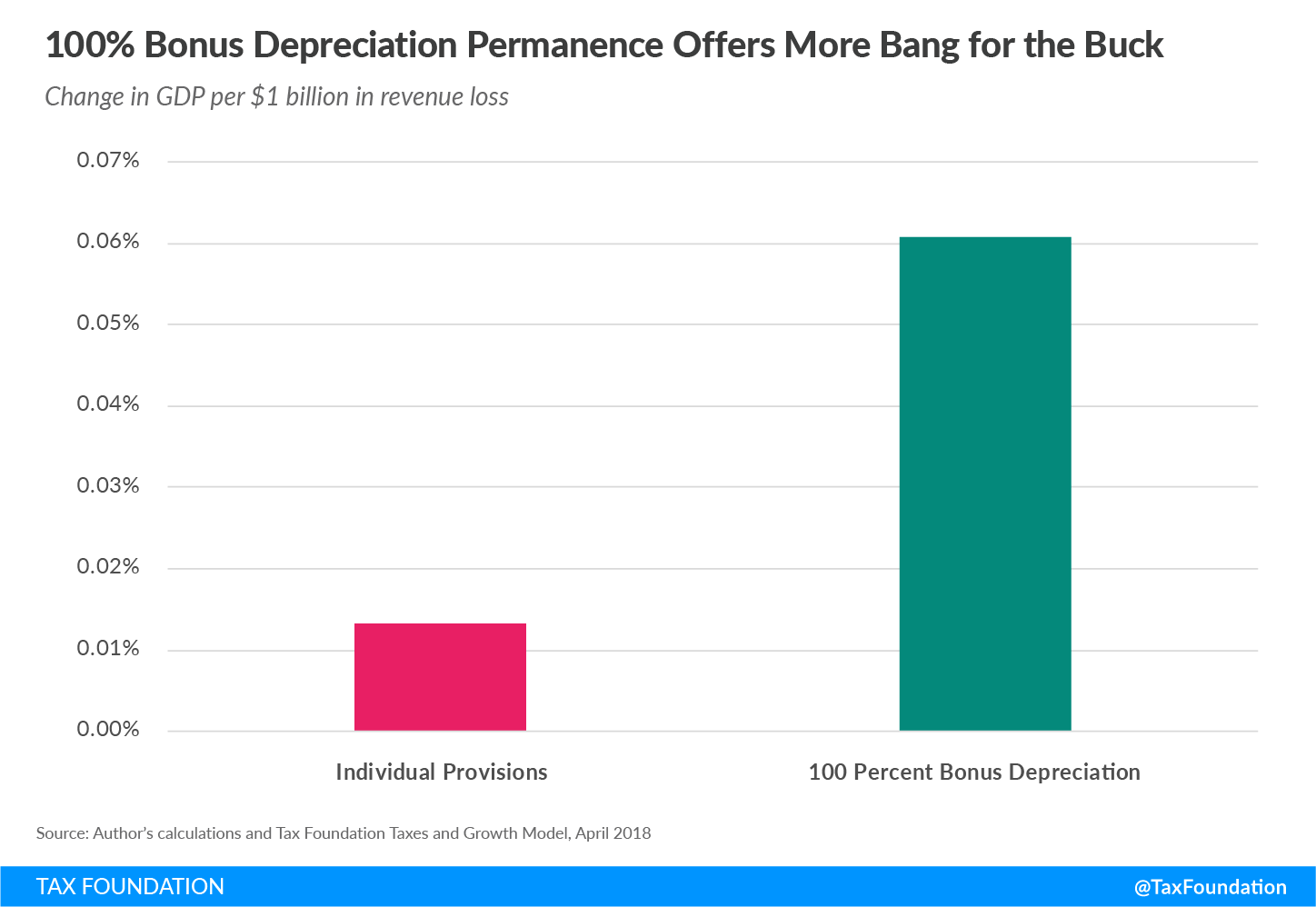

Permanence for 100 percent bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. as well as the individual provisions would grow the economy, boost wages, and increase jobs. While both of these policies grow the U.S. economy in the long run, making bonus depreciation permanent does so at a lower cost, providing more bang for the buck. In the long run, permanent 100 percent bonus depreciation produces about 4.5 times more GDP growth per dollar of revenue than making individual TCJA provisions permanent.

Going forward, lawmakers will face the challenge of weighing trade-offs between permanence and revenue. When in doubt, permanence for provisions that provide the most growth for the least cost, such as full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. , should be a guiding principle.

Share