Recent discussions of a proposed wealth tax for the United States have included little information about trends in wealth taxation among other developed nations. However, those trends and the current state of wealth taxes in OECD countries can provide context for U.S. proposals.

The OECD maintains detailed tax revenue statistics for its 38 member countries. The data includes revenues from taxes on the net wealth of individuals.

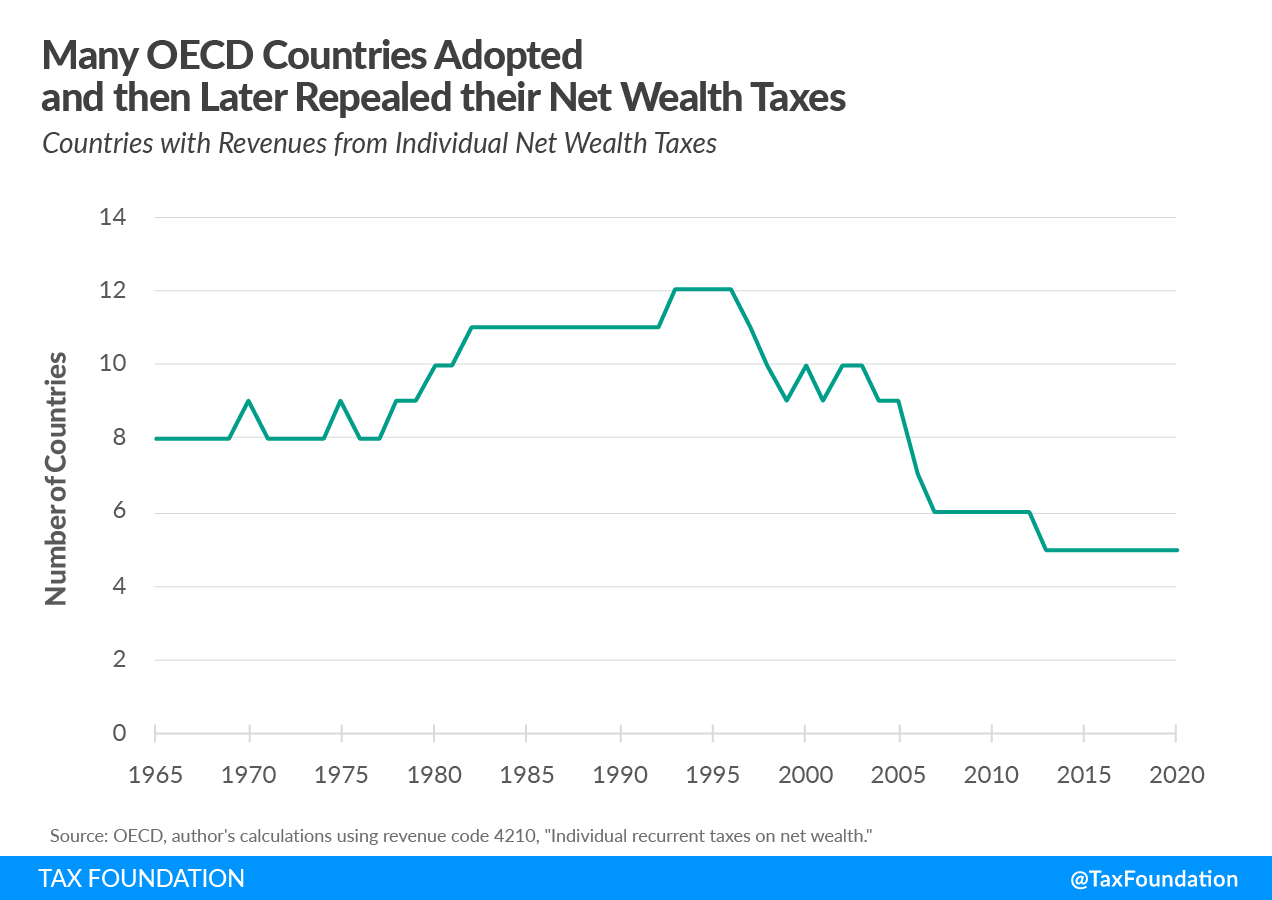

According to these data, the number of current OECD members that have collected revenue from net wealth taxes has grown from eight in 1965 to a peak of 12 in 1996 to just five in 2020.

In the OECD data, the countries that collected revenues from net wealth taxes on individuals in 2020 are Colombia, France, Norway, Spain, and Switzerland. Revenues from net wealth taxes made up 5.12 percent of revenues in Switzerland in 2020 but just 0.19 percent of revenues in France. Among those five OECD countries collecting revenues from net wealth taxes, revenues made up just 1.5 percent of total revenues on average in 2020.

France’s net wealth taxA wealth tax is imposed on an individual’s net wealth, or the market value of their total owned assets minus liabilities. A wealth tax can be narrowly or widely defined, and depending on the definition of wealth, the base for a wealth tax can vary. was mostly repealed in 2018 and now only applies to real property. At its peak in 2014, revenue from the French net wealth taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. made up 0.55 percent of total French revenue. Colombia is currently operating a temporary 1 percent tax on net wealth for tax years 2019 through 2021.

An OECD report about wealth taxes argues that these taxes can harm risk-taking and entrepreneurship, harming innovation and impacting long-term growth. The report also suggests that a net wealth tax could spur investment and risk-taking. Essentially, the argument is that because a wealth tax would erode the after-tax return for an entrepreneur, that entrepreneur might engage in even riskier ventures to maximize a potential return. However, a wealth tax would be a particularly poor way to encourage risk-taking.

The revenue data from the OECD does not perfectly match the policy changes made by countries. For instance, Austria effectively repealed its net wealth tax in 1994, but revenues from the tax continued to trickle in until 2000. The OECD also conducted a survey of countries regarding their net wealth taxes and the trend for collecting revenues from net wealth taxes is similar to the survey responses.

| Country | Rate | Base |

|---|---|---|

| Colombia | 1% | Net wealth in excess of COP 5 billion ($1.3 million). |

| France | Rates range from 0.5% to 1.5% | Personal net real estate assets exceeding EUR 1.3 million. |

| Norway | 0.7%at the municipality level and 0.25%at the national level | Fair market value of assets minus debt. Tax applies to value of wealth above NOK1.5 million ($180,000) for single/not married taxpayers and NOK 3 million ($360,000 for married couples. |

| Spain | Rates range from 0.2%to 3.5% | May differ depending on the region, but generally value of assets minus value of liabilities. Regions have autonomy in setting the exemption amount. Extremadura has a top rate of 3.75%. Madrid provides a full exemption. |

| Switzerland | Rates range from 0.05% to 0.45% depending on the canton and city. | Gross assets (at fair market value) minus debts. |

|

Source: PWC, Worldwide Tax Summaries |

||

Some countries have unique exclusions to their wealth taxes. In Spain, the net wealth tax effectively only applies to taxpayers who do not reside in Madrid, because the city provides 100 percent relief from the tax. In 2020, as part of tax relief during the pandemic, Norway temporarily postponed payments of the wealth tax for individuals whose net wealth included businesses that were running losses.

Over the years, countries have repealed their net wealth taxes for various reasons, but economic impact is included in those reasons. French Finance Minister Bruno LeMaire has made it clear that the partial repeal of the wealth tax in France was part of a reform package designed to “attract more foreign investment.” The French reform package also included a planned reduction in the corporate tax rate which has been implemented over a number of years.

The lessons from other countries’ experiences with wealth taxes should inform policymakers in the U.S. as they consider such a proposal. With so many countries having adopted and then abandon a wealth tax, perhaps the U.S. should avoid adopting one in the first place.

Note: This blog, originally published in 2019, has been updated to reflect more recent data on the revenues from wealth taxes.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe