The incidence of increased vaping among teens as well as a recent uptick in lung disease has captured the attention of everyone from President Trump, who Wednesday called for a ban on flavored nicotine liquids used for vapor products, to Senate Finance Committee Ranking Member Ron Wyden (D-OR), who followed by proposing legislation to levy an excise tax on vapor products. Wyden’s proposal suggests excise levels similar to that for traditional combustible tobacco products. Many states also are discussing whether and how to tax these vaping products.

With all good intentions to reduce the underage use of a product designed for adults, the question remains: Is increasing excise taxes to punitive levels the best way to achieve this honorable target? Punitive excise levels not only impact minors but also limit the availability of vapor products to adults, who are trying to quit smoking.

It is a principle of good taxation policy that taxes remain as neutral as possible. That means taxes should neither encourage nor discourage personal or business decisions. Legislators should pass regulations rather than adopt taxes to achieve regulatory goals. Furthermore, they should make sure that current regulations are enforced. This is currently not the case for most states. For instance, 19.2 percent of high school students use vaping products in Minnesota, where minors are prohibited from purchasing them.

There is some debate over the societal health benefits of vaping, but generally it is believed beneficial for society every time a smoker becomes a vaper. Public Health England, an agency of the English Ministry for Health, recommends smokers switch to vaping, and the American Cancer Society concludes that, based on current available information, vaping is less harmful than smoking. In other words, vapor products could be a key tool in the fight against tobacco-related morbidity and mortality.

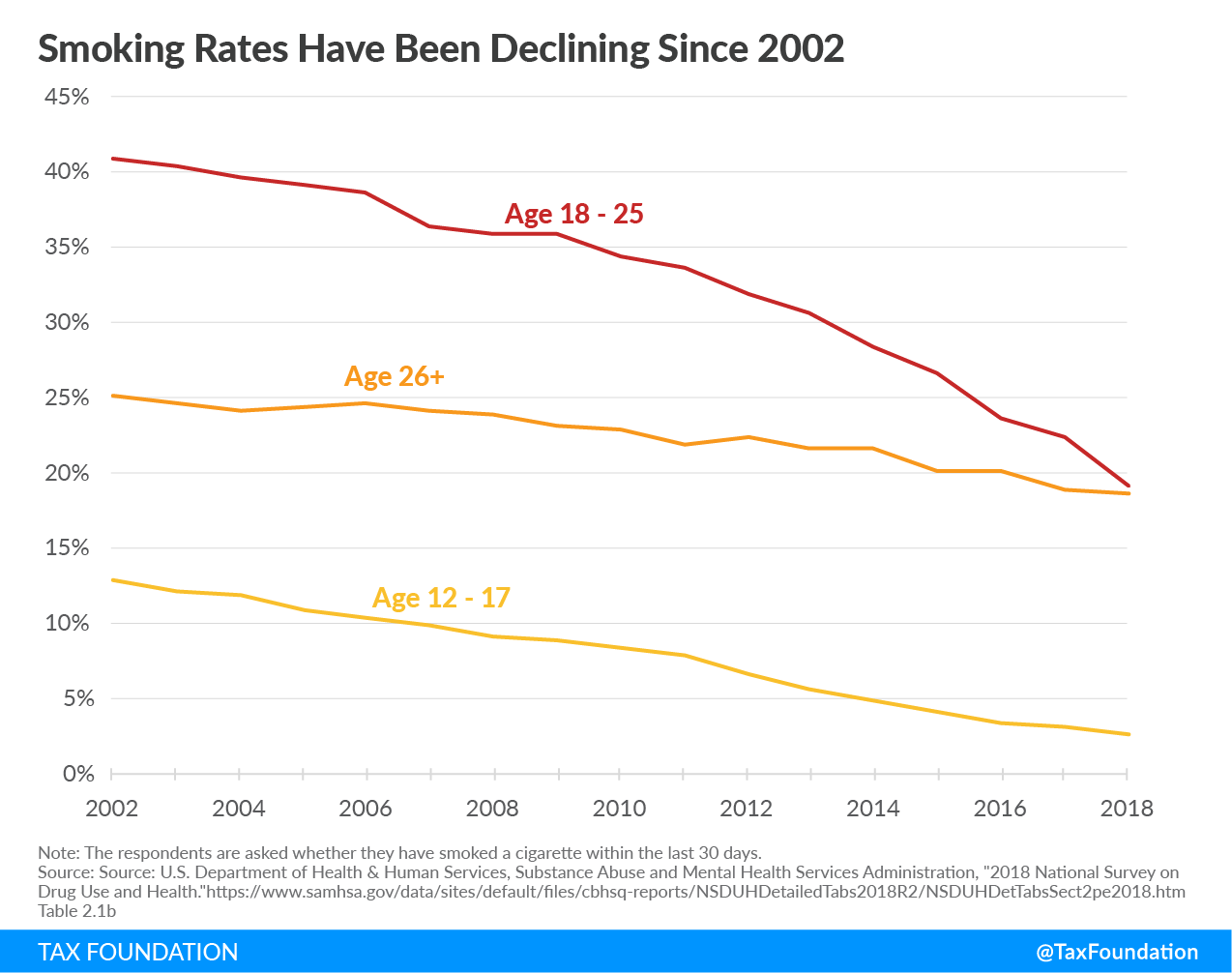

There seems to be some correlation among growth in the vapor market and a declining cigarette market. While vaping has been growing in many states, the decline in smoking has accelerated—among teens and adults.

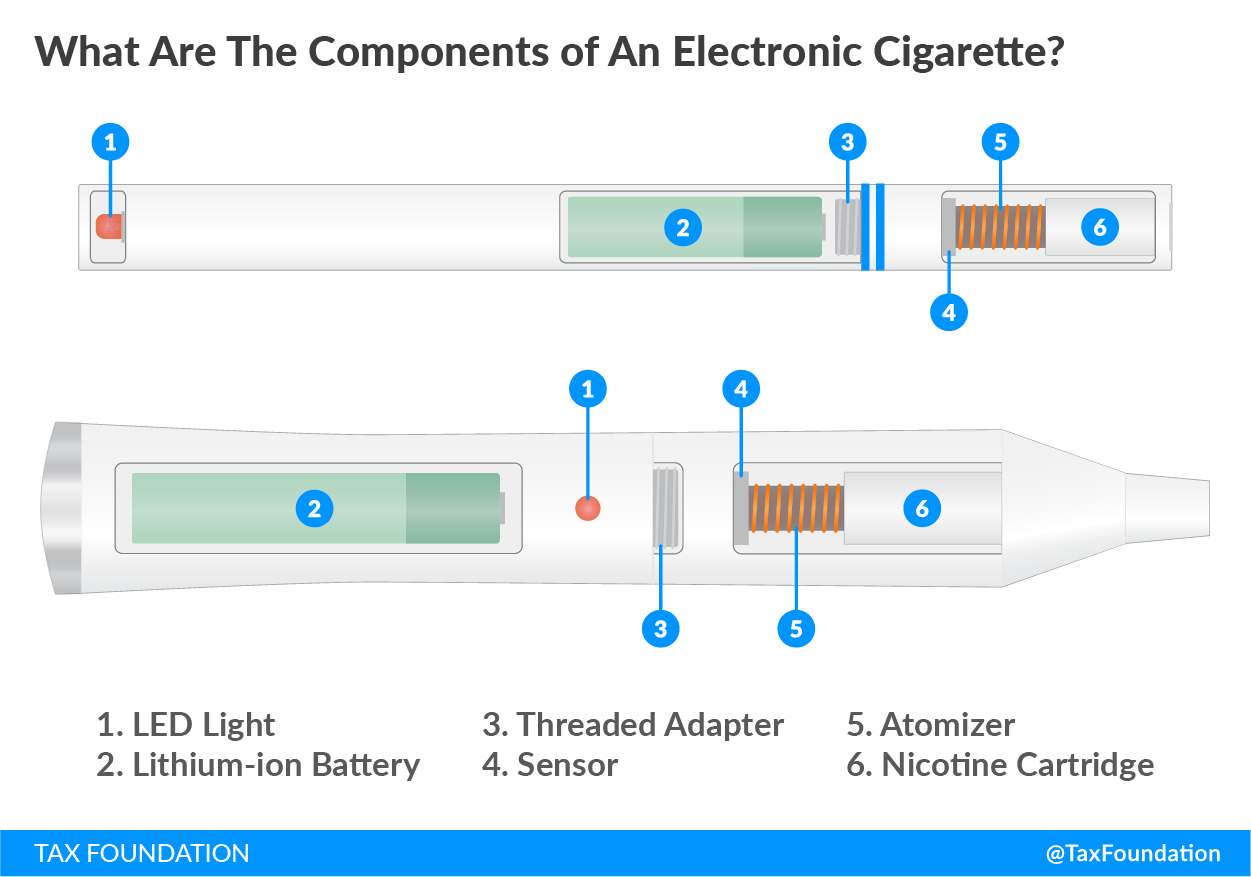

What Comprises an E-Cigarette?

E-cigarettes generally come in two varieties: an open system, where the nicotine liquid is filled manually, and closed systems, which are prefilled with nicotine liquid in cartridges. The systems offer different user experiences as they are designed to be consumed in different ways. Closed tank systems normally have higher nicotine levels per milliliter to allow for consuming the desired amount of nicotine in shorter sessions. Due to these design differences lawmakers might look into differentiated excise levels for open and closed systems to achieve a product-neutral outcome.

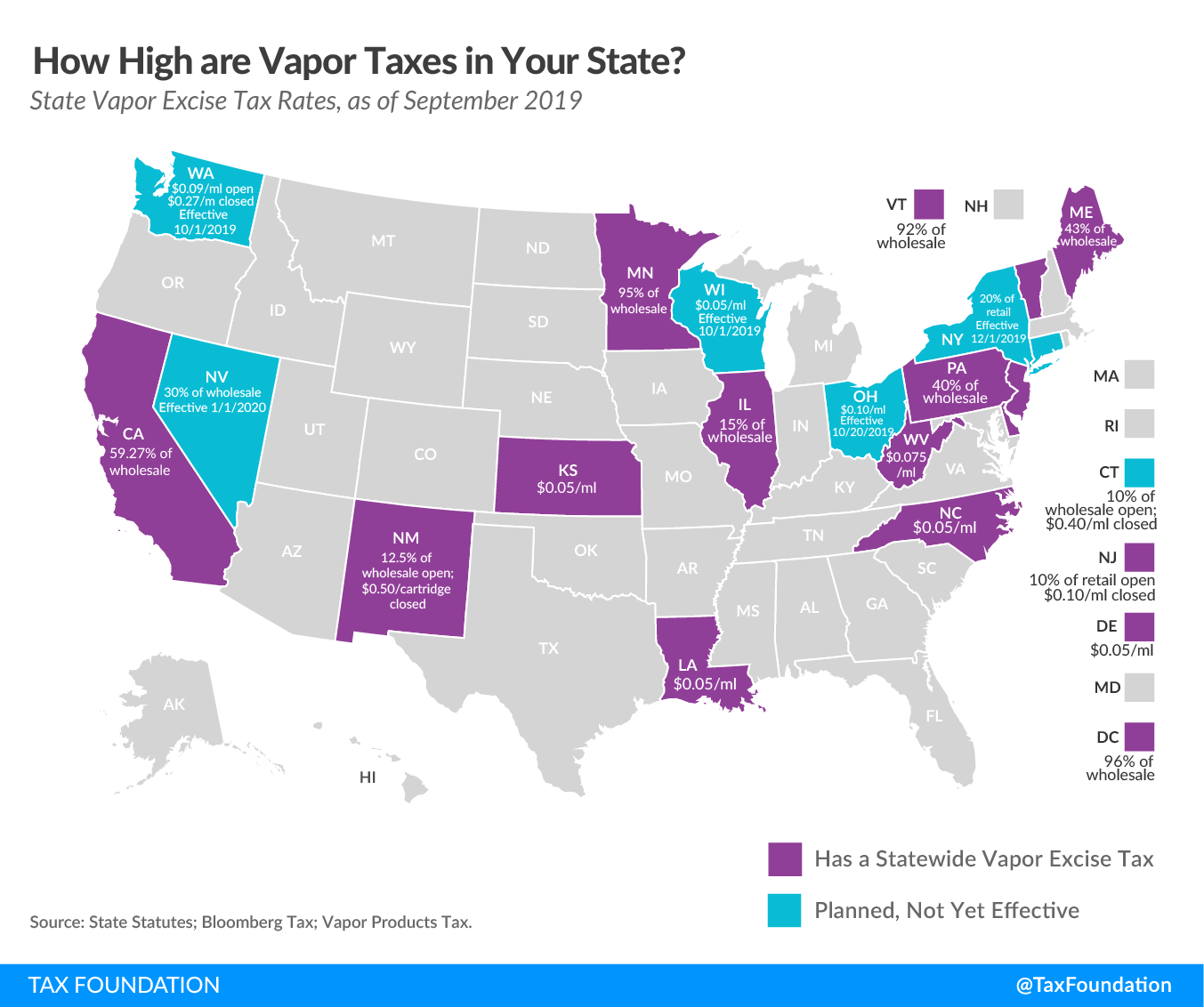

How Are They Currently Taxed?

Vapor products debuted in the United States in 2007, but states have generally been slow to act on taxation. Currently, 12 states and the District of Columbia taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. vaping products. Seven other states have passed legislation to begin taxing. The current focus on vaping gives states an opportune chance to modernize their excise taxes to reflect the actual nicotine market. Virginia has already done this and passed amendments to its definitions to reflect market developments. The new definitions include heated tobacco products, alternative nicotine products, nicotine vapor products, and liquid nicotine.

This exercise can help states design correct and simple ways to levy excise taxes on these novel products.

Minnesota is the state with the longest-running tax regime for e-cigarettes. It taxes the product at 95 percent of the wholesale value as it considers it a non-cigarette smoking tobacco product. In 2016 Minnesota raised $5.7 million from vapor products and expects to collect around $600 million in total tobacco excise taxes in 2019.

North Carolina, another state with a history of taxing vapor products, collected $4.5 million on vapor products and estimates $260 million in total tobacco tax revenue in 2018.

How to Tax Vapor Products

To the extent that legislators choose to tax vapor products, they should design a principled excise regime. Legislators should focus on raising revenue in a simple, neutral, transparent, and stable manner. Levying taxes based on these principles limits the adverse effects on the economy and the individual.

The tax should be specific, based on quantity. In terms of vapor products, the obvious choice is to tax the liquid based on volume (e.g., a certain amount per ml). It is the administratively simplest and most straightforward way for governments to tax a good as it doesn’t require valuation and as such doesn’t require expensive tax administration. Volume-based taxation also avoids discriminating between disposable and reusable products. In Minnesota for instance, the tax is levied differently when the nicotine solution is mixed in-state versus products imported in their final consumable form. During the 2017 legislative session, a bill was proposed that would have modified the tobacco tax statute to standardize how e-cigarette products are taxed in Minnesota. However, the proposal did not advance.

Taxing the value of a good (ad valorem) hurts consumer choice and product quality as it incentivizes manufacturers and retailers to reduce prices to limit tax liability. It also incentivizes downtrading, which is when consumers move from premium products to cheaper alternatives. Downtrading effects do not reduce harm and have no relation to any externality the tax is seeking to capture. Taxing based on quantity rather than value makes it easier for governments to forecast revenue as it is not affected by changes in consumer brand preference or retail prices.

The level (dollar amount) of the excise should reflect the harm of vapor products relative to traditional tobacco products and should be equal regardless of price, as potential harm caused by a vapor product is theoretically equal regardless of the price of the brand. More research relating to the potential harm-reduction qualities of vapor products is needed, but there is certainly consensus that vapor products are significantly less harmful than traditional combustible tobacco products. Public Health England reports vapor products are 95 percent less harmful than cigarettes.

When determining tax levels, it is important to keep in mind that excise taxes are regressive in nature. As smoking is more common among low-income Americans, lawmakers should take care to protect this group’s ability to switch from cigarettes to vapor products.

Revenue collected through excise taxes on vapor products should not be considered stable—excise revenues seldomly are—and the market is both young and volatile. Keep in mind that cigarette tax revenue is notoriously difficult to predict, and the cigarette market is, contrary to the vaping market, a mature market. Legislators and state revenue forecasters should be aware of this when calculating the revenue expectations and appropriating funds.

Given the regressivity of these taxes and their inherent instability, policymakers are well-advised to avoid relying on this revenue to fund broad-based government programs. The revenue should instead be used to cover the externalities associated with the excised good.

Finally, if a specific excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. is set at a relatively low rate reflecting the relative harm-reduction compared to traditional combustible tobacco products, it may make sense to inflation-adjust the rate to avoid needing to do so later. Resistance to inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. -adjusting tobacco excise taxes has often centered around the concern that rates are already quite high, promoting smuggling and heavily taxing lower-income consumers; the argument is the result may be counterproductive. If policymakers get the rate right in the first place, though, as they have an opportunity to do with vapor products, inflation adjustments could form a part of a well-structured tax regime.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe