Utah lawmakers are reportedly targeting a December 12th special session as a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. reform task force makes the final adjustments to a plan which broadens the sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. base, reduces income tax rates, and adjusts revenue earmarking. The proposal is intended to help rebalance a tax code that has swung too far toward reliance on income taxes as the growth trajectories of income and sales taxes have diverged over the past decade, and to reverse some of the erosion of the sales tax base attributable to a changing economy.

The draft legislation, which has undergone several revisions, scales back some of the sales tax base broadening proposed by legislators earlier in the process, but would still include a broader range of transactions in the tax, eliminating exemptions for:

- Unprepared foods (currently taxed at a lower rate);

- Motor fuel and special fuels (with a new 10 cent per gallon excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. on diesel fuel);

- Installation of tangible personal property when part of a taxable sale;

- Pet boarding and pet daycare services;

- Most non-governmental transportation services, including ridesharing

- Parking and towing;

- Certain primarily digital services, like streaming media, identity theft protection, and dating services;

- Electronic security monitoring (of real property);

- Shipping and handling when part of a taxable sale;

- Certain entertainment activities, like admissions to college athletic events or playing arcade games;

- Certain entertainment-adjacent purchases (electricity for ski resort lifts, vehicles used at temporary sporting events);

- Certain cleaning services (car washes and “unassisted” cleaning services); and

- Newspapers and textbooks.

The revenue from base broadeningBase broadening is the expansion of the amount of economic activity subject to tax, usually by eliminating exemptions, exclusions, deductions, credits, and other preferences. Narrow tax bases are non-neutral, favoring one product or industry over another, and can undermine revenue stability. , along with an increase in the car rental tax (from 2.5 to 4 percent), would support:

- An income tax rate reduction, bringing individual and corporate rates from 4.95 to 4.64 percent;

- An increase in the Utah dependent exemption from $565 to $2,500;

- A new grocery tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. of $125 per household member for lower- and middle-income households;

- A new Social Security Income tax credit; and

- A new state earned income tax credit worth 10 percent of the federal credit.

Funding for several programs would be shifted within the budget, with sales tax earmarks for transportation reduced (replaced by the higher diesel tax) and higher education funding shifted from the income to sales tax.

All told, the sales tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. broadening provisions are expected to raise $501 million, while the income tax provisions—including the earned income tax credit and grocery credit—will cost $581 million, for a net tax cut of about $80 million, paid for out of recent surpluses. Earlier versions expanded to additional services, while the most recent draft adds one new exemption, for feminine hygiene products.

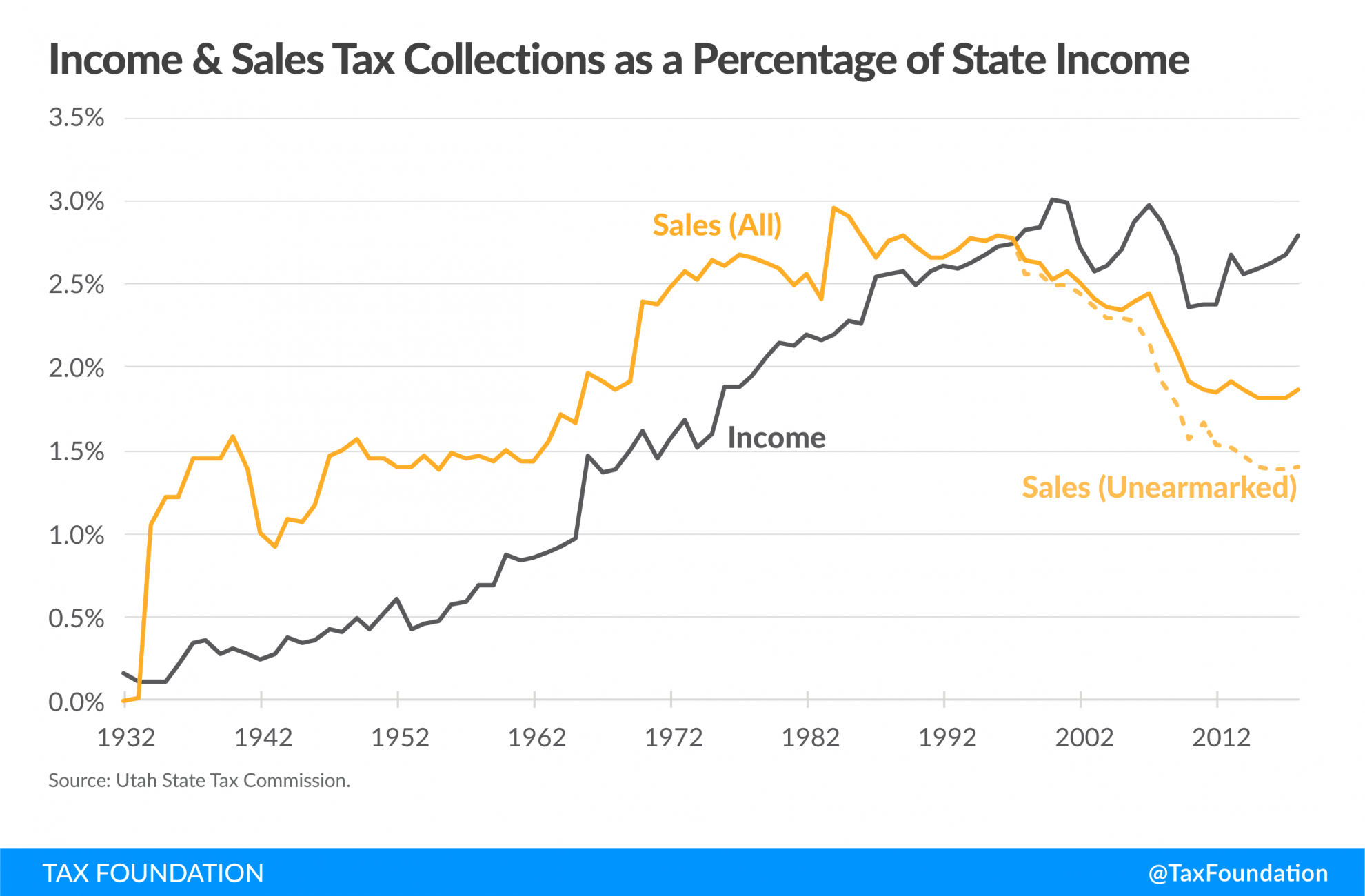

As we’ve written in the past, Utah’s tax code is the envy of is peers, with tax reforms adopted in 2007 giving the state one of the best-structured income taxes in the country. Utah’s economy, moreover, is booming. Unfortunately, some of the gains made in 2007 are being undone by the increasing divergence between sales and income tax revenues, resulting in a code that leans more heavily on income taxes than it should. The trend is one of long standing—over the past four decades, the sales tax has declined 31 percent as a share of state tax collections while the income tax is up 60 percent—but has been accelerating, driven by the shift in consumption patterns as we become a more service-oriented economy.

Reform today, therefore, would modernize the sales tax, giving it a tax base that reflects today’s economy and is flexible enough to capture tomorrow’s. It would use that revenue to reduce income tax rates, since income taxes have a greater adverse economic impact, as well as to rebalance revenue reliance. And it would maintain desired progressivity through targeted, efficient means.

The proposed tax restructuring revisions are not perfect, but they represent an important step in the right direction. Instead of relying on a reduced rate on groceries, which studies suggest does little to improve the progressivity of the sales tax, this plan would extend the sales tax to cover more high-end transactions while using revenues for more targeted relief: an earned income tax credit, a grocery tax credit for lower- and middle-income families, and a Social Security Income tax credit. These policies are not perfect—indeed, there are good arguments to be made against preferential treatment of Social Security income—but they are much better targeted than the current reduced rate on groceries.

As we observed previously, policymakers often exempt or lower rates on certain classes of consumption as an attempt at progressive reform, but it doesn’t always work out that way. Prepared foods are taxed at the standard rate and most of the progressivity of taxing unprepared foods is addressed by the exemption for SNAP (food stamps) and WIC purchases, while the exemption is enjoyed by high-income earners as well—who often spend considerably more on groceries.

In fact, while not enough work has been undertaken to establish a consensus, there is research finding that lower-income taxpayers would actually be better off if groceries were fully included in sales tax bases (while retaining the federally-indicated exemption of SNAP and WIC purchases) and revenue-neutral adjustments made to the tax rate. The lower grocery rate is designed to create progressivity but largely fails to do so. Base broadening to spread the tax burden to a wider range of consumption, combined with targeted relief, is a superior option.

Tax reform, like most major undertakings, is messy. There will always be complaints about what’s in, what’s out, and how and by whom those decisions are reached. But Utah has a real chance to build on a reform effort that began in 2007, when lawmakers overhauled corporate and individual income taxes but fell short of initial plans to bring the sales tax code into the 21st century.

Ideally, legislators should push for a more robust package of sales tax base broadening. That tax reform is hard is not a reason to pull back, but rather a reason to get it right the first time rather than having to return to the issue again down the road. The base expansions in the draft legislation are meaningful and necessary, and help rebalance the tax code, but they fall far short of the structural adjustments that would allow the sales tax base to grow with the economy in the future.

By moving forward with reforms—preferably bolder and more forward-looking, but even in the current configuration—policymakers can (1) enhance the neutrality and competitiveness of the state tax code, (2) improve revenue stability for the state with a tax code that grows with the economy, and (3) rebalance state revenues and allow income and sales tax collections to grow at similar rates. That would be a real win for Utahns.

Share this article