All Related Articles

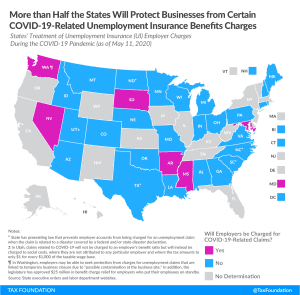

More Than Half the States Will Protect Businesses from Certain COVID-19-Related Unemployment Insurance Tax Hikes

Lawmakers can help expedite their state’s economic recovery by protecting employers from facing higher unemployment insurance tax rates at a time when they can least afford to pay them.

8 min read

Tax Policy After Coronavirus: Clearing a Path to Economic Recovery

Governments at all levels must work to remove the tax policy barriers that stand in the way of economic recovery and long-term prosperity following the COVID-19 crisis. Our new guide outlines several comprehensive options that policymakers can take at the federal and state levels.

26 min read

States’ Unemployment Compensation Trust Funds Could Run Out in Mere Weeks

Six states, which collectively account for over one-third of the U.S. population, are currently in a position to pay out fewer than 10 weeks of the unemployment compensation claims that have already come in since the start of the COVID-19 pandemic.

3 min read

A Visual Guide to Unemployment Benefit Claims

Another 1.4 million Americans filed initial regular unemployment benefit claims, the eleventh week of a decline in the rate of new claims, but still among the highest levels in U.S. history. The total number of new and continued claims now stands at 19.3 million, a marked decline from the peak of 24.9 million a month ago.

7 min read

Congress Approves Economic Relief Plan for Individuals and Businesses

The CARES Act, now signed into law, is intended to be a third round of federal government support in the wake of the coronavirus public health crisis and associated economic fallout, following the $8.3 billion in public health support passed two weeks ago and the Families First Coronavirus Response Act.

10 min read

Spain’s COVID-19 Economic Response

Spain’s policy response needs to be broad and in keeping with long-term objectives. It is paramount that the short-term harm caused by this outbreak does not turn into a long-term economic downturn.

5 min read

Evaluating the Trade-offs of Unemployment Compensation Changes in the CARES Act

Policymakers must weigh the trade-offs of subsidizing unemployment with mitigating community spread of coronavirus.

6 min read

Are States Prepared for Skyrocketing Unemployment Insurance Claims?

Unemployment claims are going to tax state unemployment compensation trust funds beyond their limits. We need to start thinking about what to do about it.

5 min read

How the Federal Government and the States Could Help Save Small Businesses Through Temporary UI Tax Adjustments

Governmental responses to the coronavirus outbreak will require creativity and flexibility—and one aspect of that may involve temporarily rethinking how we structure not only unemployment insurance (UI) benefits but also the taxes that pay for them.

5 min read

Tax Options for Economic Relief During the Coronavirus Crisis

Instead of simply reaching for fiscal stimulus with the goal of increasing economic activity, tax policy changes can give vulnerable individuals and businesses additional liquidity and space to survive the reduction in economic activity needed in light of the coronavirus outbreak.

5 min read

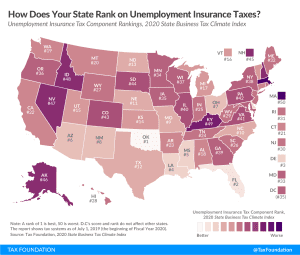

2020 State Business Tax Climate Index

Connecticut, California, New York, and New Jersey rank lowest in our 2020 State Business Tax Climate Index, which compares states on more than 120 tax policy variables to show how well they structure their tax systems and to provide a road map for improvement.

20 min read

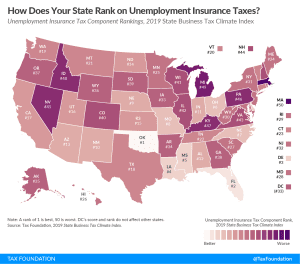

2019 State Business Tax Climate Index

Our 2019 State Business Tax Climate Index compares each state on over 100 variables including corporate, individual, property, and sales taxes. How does your state rank?

17 min read

2018 State Business Tax Climate Index

For 15 years, our State Business Tax Climate Index has been the standard for legislators and taxpayers to understand how their state’s tax code compares and how it can be improved. Now, for the first time ever, you can explore our Index’s 100+ variables in an easy to use, interactive format.

16 min read