Trump Tariffs: Tracking the Economic Impact of the Trump Trade War

The tariffs amount to an average tax increase of nearly $1,200 per US household in 2025.

37 min readResearch & Analysis

Historical evidence and recent studies show that tariffs are taxes that raise prices and reduce available quantities of goods and services for US businesses and consumers, which results in lower income, reduced employment, and lower economic output. For example, the effects of higher steel prices, largely a result of the Bush administration’s 2002 US steel tariffs, led to a loss of nearly 200,000 jobs in the steel-consuming sector, a loss larger than the total employment in the steel-producing sector at the time. It’s also worth noting that measures of trade flows, such as the trade balance, are accounting identities and should not be misunderstood to be indicators of economic health.

We estimate Trump’s proposed tariffs and partial retaliation from all trading partners would together offset more than two-thirds of the long-run economic benefit of his proposed tax cuts. Explore Trump’s latest trade actions with our Tariff Tracker

The tariffs amount to an average tax increase of nearly $1,200 per US household in 2025.

37 min read

Do tariffs really level the playing field, or are they just bad economics? In this emergency episode, we fact-check the Trump administration’s claims that retaliatory tariffs make trade fairer.

Despite characterizing the tariffs as “reciprocal,” the White House didn’t actually measure tariffs, currency manipulation, or trade barrier policies employed by other countries. Instead, it drew its estimates from something else entirely: bilateral trade deficits in goods.

7 min read

Rather than hurting foreign exporters, the economic evidence shows American firms and consumers were hardest hit by tariffs imposed during President Trump’s first-term.

5 min read

Contrary to the president’s promises, the tariffs will cause short-term pain and long-term pain, no matter the ways people and businesses change their behavior.

5 min read

President Trump has announced that new tariffs will go into effect on April 2, following several weeks of threats. These new tariffs are likely to be broader in scope than the limited ones implemented thus far. So who is likely to pay for them?

7 min read

While tariffs are often presented as tools to enhance US competitiveness, a long history of evidence and recent experience shows they lead to increased costs for consumers and unprotected producers and harmful retaliation, which outweighs the benefits afforded to protected industries.

As we learned in the first trade war, retaliation will exact harm on US exporters by lowering their export sales—and the US-imposed tariffs will directly harm exporters too. US-imposed tariffs can burden exporters by increasing input costs, which acts like a tax on exports.

4 min read

President-elect Trump may want to impose tariffs to encourage investment and work, but his strategy will backfire. Tariffs will certainly create benefits for protected industries, but those benefits come at the expense of consumers and other industries throughout the economy.

5 min read

The Trump administration appears to be moving in a “reciprocal” policy direction despite the significant negative economic consequences for American consumers of across-the-board tariffs on goods coming into the US. However, the EU’s VAT system should not be used as a justification for retaliatory tariffs.

6 min read

We estimate Trump’s proposed tariffs and partial retaliation from all trading partners would together offset more than two-thirds of the long-run economic benefit of his proposed tax cuts.

12 min read

Using tariff policy to reallocate investment and jobs is a costly mistake—that’s a history lesson we should not forget.

6 min read

Lawmakers will need to pursue fiscal responsibility as they address the tax law expirations, but fiscal responsibility requires finding sound ways to pay for spending priorities. Tariffs don’t make the cut.

4 min read

Estimating the economic effects of different types of taxes informs policymakers about the trade-offs of raising revenue in a given way.

5 min read

Can tariffs truly replace income taxes in today’s economy? In this episode, we examine the bold and controversial proposal from former President Trump to replace income taxes with tariffs. What would this dramatic shift mean for everyday Americans, particularly those with lower incomes? And would it actually work?

When the government imposes a tariff, it may be trading jobs and production in one part of the economy for jobs in another part of the economy by increasing production costs for downstream industries.

6 min read

If Vice President Kamala Harris is elected the 47th U.S. president, she would inherit a trade war started by former President Donald Trump and continued by President Joe Biden. But she’d also have the chance to end it.

While both President Biden and Vice President Harris aim their proposed tax hikes on businesses and high earners, key differences between their tax ideas in the past reveal where Harris may take her tax policy platform in the 2024 campaign.

6 min read

From President Biden calling the Tax Cuts and Jobs Act the “largest tax cut in American history,” to former President Trump claiming that Biden “wants to raise your taxes by four times,” the campaign rhetoric on taxes may be sparking some confusion.

5 min read

As members of Congress prepare to address the expiration of the TCJA, they should appreciate how revenues have evolved since 2017.

4 min read

Taxing wealth has become a hot-button issue in today’s political discourse, promising to reshape economic equality. But what are the real-world implications of such policies?

Tariffs are a hot topic this election cycle for both President Biden and former President Trump. But why are tariffs so popular despite their economic downsides?

The Section 232 tariffs on imports of steel and aluminum raised the cost of production for manufacturers, reducing employment in those industries, raising prices for consumers, and hurting exports.

18 min read

Varying local trade tax rates impact business investment and local government revenue across Germany’s municipalities.

4 min read

Calling the latest round of tariffs “strategic” does not change the underlying reality: these policies are just another form of protectionism, and therefore, subject to all the same economic problems.

4 min read

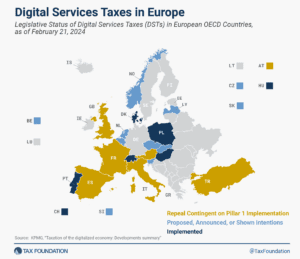

About half of all European OECD countries have either announced, proposed, or implemented a DST. Because these taxes mainly impact U.S. companies and are thus perceived as discriminatory, the United States responded to the policies with retaliatory tariff threats, urging countries to abandon unilateral measures.

4 min read

Trump’s protectionist measures and the continuation of most of them under the Biden administration already form the matrix of American trade policy after the 2024 elections.

All taxes tell a story, and today we’ll explore how taxes influenced Bob Dylan’s decision to sell his music catalog, how the “chicken tax” reshaped the auto industry, and how the historic “tax on air and light” had profound effects on architecture and living conditions.

If reelected, President Trump would drastically escalate the trade war he started during his first term. But what often goes unnoticed is President Biden’s role in continuing Trump’s first trade war. In fact, more tax revenue from the trade war tariffs has been collected under Biden than under Trump.

5 min read

If a multilateral solution to remove digital services taxes (DSTs) is not agreed to, then DSTs will continue to spread and mutate with negative impacts on some of the most innovative companies in the world.

What does it mean to be an American company?

4 min read

Historical evidence and recent studies have shown that retaliatory tax and trade proposals raise prices and reduce the quantity of goods and services available to U.S. businesses and consumers, resulting in lower incomes, reduced employment, and lower economic output.

5 min read

The Trump campaign is mulling a massive tax increase on American purchases from China. If reelected, he might quintuple the tax, imposing tariffs of 60 percent on imports from China. The economic ramifications would be significant and unwelcome.

5 min read

A national-level carbon price—a tax or cap-and-trade scheme placed on CO2 or other greenhouse gases—may seem distant in the U.S., especially since the Inflation Reduction Act, which included major climate policy, omitted one. However, policymakers on both sides of the aisle have been nibbling around the edges of carbon taxes.

5 min read

A multilateral agreement that eliminates digital services taxes would be valuable, but not if it introduces more complexity and leaves unanswered many questions about the impacts on the U.S. tax base.