All Related Articles

Business Tax Collections Within Historical Norm After Accounting for Pass-through Business Taxes

When looking at the tax burden on businesses over time, it is important to provide a complete picture by accounting for the different types of businesses in the U.S. and the timing effects of the 2017 tax law. Doing so provides important context on existing tax burdens and for considering the impact of raising taxes on corporations and pass-through firms.

3 min read

2022 Tax Brackets

The IRS recently released the new inflation adjusted 2022 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

5 min read

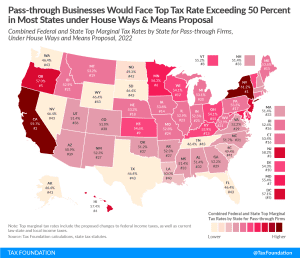

Top Tax Rate on Pass-through Business Income Would Exceed 50 Percent in Most States Under House Dems’ Plan

Under the House Democrats’ reconciliation plan, the top tax rate on pass-through business income would exceed 50 percent in most states. Pass-through businesses, such as sole proprietorships, S corporations, and partnerships, make up a majority of businesses and majority of private sector employment in the United States.

3 min read

Claiming 97 Percent of Small Businesses Exempt from Biden Taxes Is Misleading

The Biden administration recently cited an analysis from Treasury claiming that “the President’s agenda will protect 97 percent of small business owners from income tax rate increases.” However, the figure is misleading. To assess the economic effect of higher marginal tax rates, it matters how much income or investment will be affected—not how many taxpayers.

3 min read

Analysis of Sen. Wyden’s Pass-through Deduction Proposal

Sen. Wyden recently introduced the Small Business Tax Fairness Act—the impact of which we modeled—to reform the Section 199A pass-through business deduction created in the Tax Cuts and Jobs Act (TCJA) of 2017. The provision currently allows taxpayers to deduct up to 20 percent of their qualified business income from their taxable income, subject to certain limitations.

2 min read

D.C.’s Income Tax Hike Helps Maryland and Virginia, Not D.C.

Even as lawmakers in eleven states have cut income taxes this year, the D.C. Council has responded to surpluses and growth by voting to include substantial income tax increases in the budget.

7 min read

Biden Plan’s Higher Taxation of Businesses Would Boost Collections to Highest in 40-Plus Years

President Biden’s tax proposals released as part of his fiscal year 2022 budget would collect about $2 trillion in new tax revenue from businesses over 10 years. This new revenue would bring income tax collections on businesses as a portion of GDP to its highest level on a sustained basis in over 40 years.

2 min read

Biden’s Tax Proposals Could Impact Small Businesses Over Time

The Biden administration has primarily focused on increasing taxes on top earners to generate revenue to fund its spending priorities. However, these proposals would hit many pass-through businesses and much of pass-through business income, including small businesses, family-owned businesses, and farms.

3 min read

The Impact of the Biden Administration’s Tax Proposals by State and Congressional District

The redistribution of income from the Biden administration’s tax proposals would involve many winners and losers, not only across different types of taxpayers but also geographically across the country. Launch our new interactive map to see average tax changes by state and congressional district over the budget window from 2022 to 2031.

8 min read

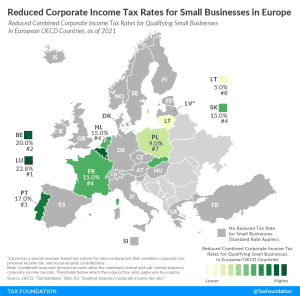

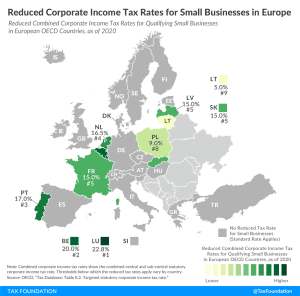

Reduced Corporate Income Tax Rates for Small Businesses in Europe

Corporate income taxes are commonly levied as a flat rate on business profits. However, some countries provide reduced corporate income tax rates for small businesses. Out of 27 European OECD countries covered in today’s map, eight levy a reduced corporate tax rate on businesses that have revenues or profits below a certain threshold.

3 min read

Many Small Businesses Could Be Impacted by Biden Corporate Tax Proposals

Policymakers should recognize that corporate tax hikes will not only impact large firms, but many smaller and younger firms as well. Considering that many of these smaller firms are significant contributors to net job growth, raising corporate taxes at this time would not be conducive for a speedy economic recovery.

2 min read

New Research Finds Limited Effects on Taxpayer Behavior from Pass-through Deduction

While proponents of the Section 199A pass-through deduction claimed it would boost investment and critics claimed it would encourage tax avoidance and income shifting, new research casts doubt on both claims.

3 min read

Facts and Figures 2021: How Does Your State Compare?

Our updated 2021 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

A $6 Billion Tax Increase Proposal in Pennsylvania Would Yield the Nation’s Highest Combined Flat-Rate Income Taxes

Under the budget introduced by Gov. Tom Wolf, Pennsylvania’s flat personal income tax rate would increase by 46 percent, partially offset by an outsized increase in the poverty credit, which would see a family of four eligible for partial relief due to poverty until they reached $100,000 in taxable income—four times the poverty line.

6 min read

Wisconsin’s PPP Loan Recipients Face Hundreds of Millions in Surprise Taxes

Unless the legislature acts, businesses that have received PPP loans and related federal assistance will face $457 million in state taxes through 2024—with more than half of those taxes coming due this spring—despite Wisconsin being on track to see continued general fund revenue growth even amid the pandemic.

4 min read

Pandemic Highlights the Need for Better Tax Policy for Entrepreneurs and Small Businesses

As Congress works to provide another round of emergency economic relief, it is a good time to step back and consider how tax policy affects entrepreneurs and small businesses.

3 min read

Details and Analysis of State and Local Aid Under the Bipartisan State and Local Support and Small Business Protection Act of 2020

On Monday, members of the bipartisan Gang of Eight negotiating an end-of-year pandemic relief package announced that they had settled on language and had divided the package into two bills: a pandemic aid package and a $160 billion state and local support package.

6 min read

Reduced Corporate Income Tax Rates for Small Businesses in Europe

Corporate income taxes are commonly levied as a flat rate on business profits. However, some countries provide reduced corporate income tax rates for small businesses

2 min read