FAQ: The One Big Beautiful Bill Act Tax Changes

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

24 min read

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

24 min read

However states choose to respond to other tax provisions of the One Big Beautiful Bill Act, they should conform to the pro-growth provisions, which represent a marked improvement in the corporate tax code.

12 min read

The One Big Beautiful Bill is now law—but what does it actually do? In this episode, we break down the new tax law’s key provisions, including who benefits, who doesn’t, and what it means for the economy, tax certainty, and the federal deficit.

The One Big Beautiful Bill Act makes many of the individual tax cuts and reforms of the TCJA permanent. It improves upon the TCJA by making expensing for R&D and equipment permanent. However, for the most part, it does not include further structural reforms, and instead introduces many new, narrow tax breaks to the code, adding complexity and raising revenue costs.

7 min read

We estimate the One Big Beautiful Bill Act would increase long-run GDP by 1.2 percent and reduce federal tax revenue by $5 trillion over the next decade on a conventional basis.

11 min read

President Trump signed the One Big Beautiful Bill Act into law on July 4, 2025.

16 min read

Congress is racing to pass the One Big Beautiful Tax Bill before the July 4 deadline. In this episode, Kyle Hulehan and Erica York break down what just happened over the weekend, what’s actually in the bill, and what comes next as the House and Senate try to reconcile their differences.

Summer has arrived, and states are beginning to implement policy changes that were enacted during this year’s legislative session (or that have delayed effective dates or are being phased in over time).

28 min read

The Senate’s version of the OBBB restores the benefit of avoiding the SALT deduction cap with PTETs for all pass-through businesses, while placing new limits on the extent of the workarounds.

6 min read

Rather than permanently expanding a complicated, nonneutral tax break, Congress should prioritize permanence for the most neutral and pro-growth policies like bonus depreciation and R&D expensing.

6 min read

Our preliminary analysis finds the tax provisions increase long-run GDP by 0.8 percent and reduce federal tax revenue by $4.0 trillion from 2025 through 2034 on a conventional basis before added interest costs.

9 min read

From generous tax breaks to costly trade-offs, the House GOP’s One, Big, Beautiful Bill has a little of everything. It’s a sweeping attempt to extend key provisions of the 2017 Tax Cuts and Jobs Act before they expire in 2026—but what’s actually in it?

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

Developed countries raise tax revenue through individual income taxes, corporate income taxes, social insurance taxes, taxes on goods and services, and property taxes—the combination of which determines how distortionary or neutral a tax system is.

4 min read

For owners of pass-through businesses, the reconciliation package (1) raises the state and local tax (SALT) deduction cap, (2) denies the benefit of pass-through entity-level taxes that had previously worked around the SALT cap for such pass-through businesses, and (3) increases the Section 199A deduction for qualifying pass-through entities.

4 min read

Letting the SALT cap slip further upwards would undercut the TCJA’s long-term legacy, worsening the fiscal outlook of the tax package and providing an unneeded benefit to higher earners.

4 min read

We break down the House GOP’s One, Big, Beautiful Bill—a sweeping tax package designed to extend key parts of the 2017 Tax Cuts and Jobs Act before they expire in 2026.

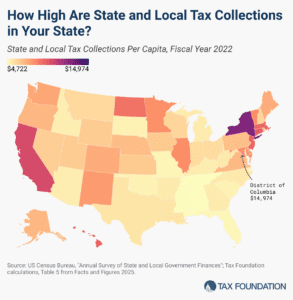

According to the latest economic data from the US Census Bureau, the average per capita state and local tax burden is $7,109. However, collections vary widely by state, reflecting differences in tax rates and bases, natural resource endowments, the scale and scope of taxable economic activity in each state, and residents’ political preferences.

5 min read

Pairing permanent TCJA individual tax cuts with new limits on business SALT deductions would shrink the economy, reduce American incomes, and increase the federal budget deficit, undermining the policy goals of TCJA permanence.

3 min read

The economic literature overwhelmingly suggests that an income tax increase of this magnitude would negatively affect economic growth and opportunity in Rhode Island.