Kansas Lawmakers to Consider Veto Override on Tax Reform Bill

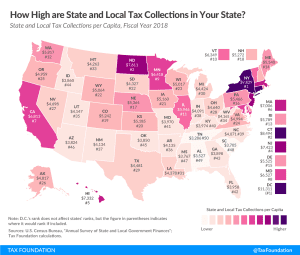

Kansas has the revenue cushion it needs to provide tax relief to individuals and businesses and improve the structure of its tax code in the process. These pro-growth reforms would not only help taxpayers amid the pandemic but would also promote economic recovery and growth in a state that is lagging behind its competitors.

7 min read