All Related Articles

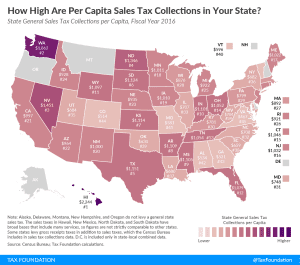

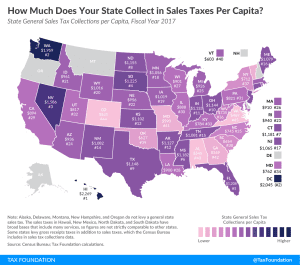

Facts and Figures 2019: How Does Your State Compare?

Our updated 2019 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

New Mexico Tax Increase Package Advances

7 min read

Wisconsin Tax Options: A Guide to Fair, Simple, Pro-Growth Reform

Despite tax cuts in recent years, Wisconsin’s overall tax structure lags behind competitor states in simplicity, tax rates, and business climate for residents and investment. Explore our new comprehensive guide to see how the Badger State can achieve meaningful tax reform.

11 min read

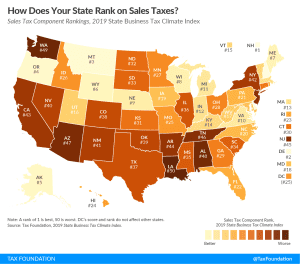

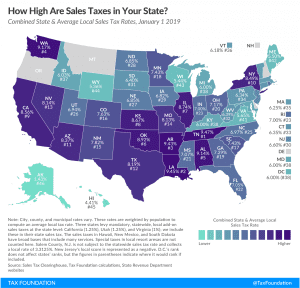

State and Local Sales Tax Rates, 2019

11 min read

Tax Trends Heading Into 2019

In 2019, key trends in state tax policy include reductions in corporate tax rates, updating sales tax systems to include remote online sales, taxes on marijuana and sports betting, gross receipts taxes, and more. Explore our new 2019 guide!

32 min read

South Carolina: A Road Map For Tax Reform

South Carolina is by no means a high tax state, though it can feel that way for certain taxpayers. The problems with South Carolina’s tax code come down to poor tax structure. Explore our new comprehensive guide to see how South Carolina can achieve meaningful tax reform.

16 min read

Cyber Monday, Post-Wayfair Edition

2 min read

Top State Tax Ballot Initiatives to Watch in 2018

Explore our list of the top state tax ballot measures to watch for throughout the country.

11 min read