All Related Articles

Facts and Figures 2018: How Does Your State Compare?

Facts and Figures is a one-stop data resource comparing the 50 states on over 40 measures of individual and corporate income taxes, sales taxes, excise taxes, property taxes, business tax climates, and more.

1 min read

Should Congress Act Before SCOTUS On Online Sales Taxes?

The U.S. Supreme Court is hearing a case on the constitutionality of a South Dakota law requiring internet vendors collect online sales tax, but should Congress fix the problem first?

13 min read

Tax Foundation Brief in Wayfair Online Sales Tax Case: SCOTUS Should Set Meaningful Limits on State Taxing Power

In the South Dakota v. Wayfair online sales tax case, the U.S. Supreme Court should ensure that state sales tax laws don’t burden interstate commerce.

3 min read

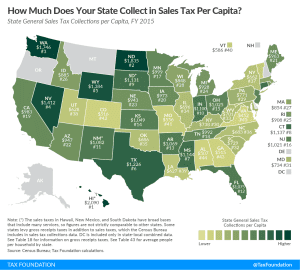

State and Local Sales Tax Rates, 2018

In addition to state-level sales taxes, consumers also face local sales taxes in 38 states. These rates can be substantial, so a state with a moderate statewide sales tax rate could actually have a very high combined state and local rate.

11 min read

Supreme Court Agrees to take South Dakota v. Wayfair Online Sales Tax Case

The U.S. Supreme Court has agreed to take South Dakota v. Wayfair Inc., which could result in a ruling that settles the years-long debate over how to apply sales taxes to online retail activity.

1 min read

Trends in State Tax Policy, 2018

In 2018, trends to watch in state tax policy will include reductions in corporate tax rates, the spread of gross receipts taxes, new and lower taxes on marijuana, estate tax repeal, a wait-and-see approach on federal tax reform, and more.

16 min read

Sales Tax Base Broadening: Right-Sizing a State Sales Tax

Due in part to historical accident and also to the proliferation of exemptions, the effectiveness of the state sales tax continues to erode. The median state sales tax, which should apply to all personal consumption, is nonly applied to 23 percent of personal consumption.

25 min read

How the State and Local Tax Deduction Influences State Tax Policy

The state and local tax deduction isn’t just a costly federal subsidy. It also skews state and local tax policy decisions.

2 min read

Sales Tax Holidays by State, 2017

Sales tax holidays have enjoyed political success, but rather than providing a valuable tax cut or a boost to the economy, they impose serious costs on consumers and businesses without providing offsetting benefits.

43 min read