All Related Articles

Pro-Growth Tax Reform for Oklahoma

Our new study identifies a number of deficiencies in Oklahoma’s tax code and outlines possible solutions for reform that would create a more neutral tax code and encourage long-term growth in the state.

6 min read

International Tax Competitiveness Index 2021

A well-structured tax code (that’s both competitive and neutral) is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

40 min read

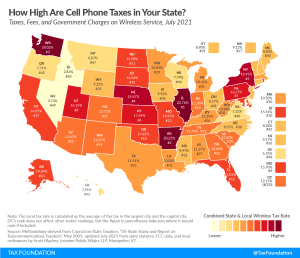

Excise Taxes and Fees on Wireless Services Increase Again in 2021

Taxes and fees on the typical American wireless consumer increased again this year, to a record 24.96 percent.

32 min read

Reviewing Business Tax Expenditures: Credit Union Tax Exemption

Policymakers should carefully analyze tax expenditures before categorizing one as a loophole—some tax expenditures are important structural elements of the tax code while others are unsound.

14 min read

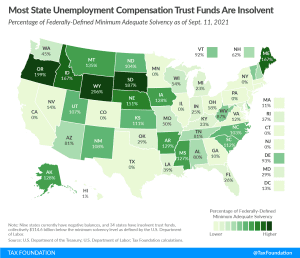

States Have $95 Billion to Restore their Unemployment Trust Funds—Why Aren’t They Using It?

Given the restrictions on the use of federal relief funding, and the significantly higher tax burdens on employment that will result if trust funds are not replenished, applying federal aid to these trust funds should be an urgent priority.

11 min read

Options for Reforming the Taxation of U.S. Multinationals

The Biden administration’s international tax proposals would impose a 7.7 percent surtax on the foreign profits of U.S. multinationals, resulting in a net increase in profit shifting out of the U.S.

60 min read

Simplifying the Tax Code and Reducing the Tax Gap: What Can Be Achieved?

Reducing the tax gap is, on the margin, a good way to raise revenue, but is not without costs. Policymakers should consider compliance costs for law-abiding taxpayers as well as administrative costs for the IRS when evaluating measures to reduce the tax gap.

33 min read

Sales Tax Holidays by State, 2021

Although state budgets may be in unusual places this year, sales tax holidays remain the same as they always have been—ineffective and inefficient.

4 min read

States Respond to Strong Fiscal Health with Income Tax Reforms

As states close their books for fiscal year 2021, many have much more revenue on hand than they anticipated last year. Eleven states have responded by reducing income tax rates and making related structural reforms as they strive to solidify a competitive advantage in an increasingly competitive national landscape.

29 min read

Anti-Base Erosion Provisions and Territorial Tax Systems in OECD Countries

From a policy perspective it is appropriate to combat base erosion and profit shifting, but policymakers need to keep in mind the need for simplicity to avoid increasing the compliance burden on taxpayers and administrative burdens on tax authorities.

68 min read

State Tax Changes Taking Effect July 1, 2021

Thirteen states have notable tax changes taking effect on July 1, 2021, which is the first day of fiscal year (FY) 2022 for every state except Alabama, Michigan, New York, and Texas. Individual and corporate income tax changes usually take effect at the beginning of the calendar year for the sake of maintaining policy consistency throughout the tax year, but sales and excise tax changes often correspond with the beginning of a fiscal year.

11 min read

Net Operating Loss Policies in the OECD

During the COVID-19 pandemic, several OECD countries temporarily expanded their NOL carrybacks and carryforwards to provide relief to illiquid but otherwise solvent businesses. These policies should be made permanent and, where necessary, expanded.

21 min read

Biden Administration Changes to GILTI and FDII Will Yield Automatic State Tax Increases

State taxation of GILTI is unconventional and economically uncompetitive and will become even more so if the federal government adopts a more aggressive approach to taxing GILTI, as outlined in the American Jobs Plan Act.

29 min read

A Comparison of the Tax Burden on Labor in the OECD, 2021

Governments often justify higher tax burdens with more extensive public services. However, the cost of these services can be more than half of an average worker’s salary.

21 min read

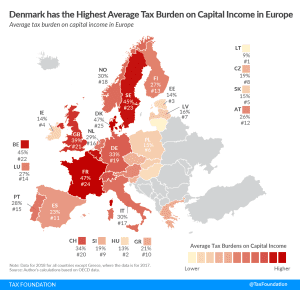

Taxing Capital – An International Comparison

The taxation of capital—at both the individual and the corporate level—is much debated and affects economic growth by lowering the incentives to save and invest.

6 min read

States Consider Digital Taxes Amidst Conflicting Rationales

Digital advertising, social media, and data tax proposals have been introduced in nine states following enactment of Maryland’s digital advertising tax, which has since been postponed a year due to administrative and legal challenges.

14 min read

Location Matters 2021: The State Tax Costs of Doing Business

A landmark comparison of corporate tax costs in all 50 states, Location Matters provides a comprehensive calculation of real-world tax burdens, going beyond headline rates to demonstrate how tax codes impact businesses and offering policymakers a road map to improvement.

8 min read