All Related Articles

States Should Continue to Reform Taxes on Tangible Personal Property

Tangible personal property taxes increase the complexity of state and local tax codes, discriminate against taxpayers based on their capital structure, and change economic behavior by incentivizing taxpayers to modify their property ownership to avoid the tax.

32 min read

Tax Reforms in Georgia 2004-2012

9 min read

State Tax Changes as of July 1, 2019

15 min read

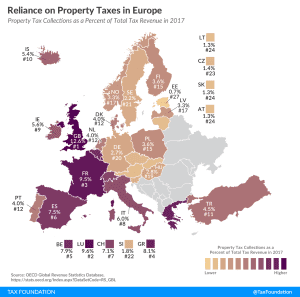

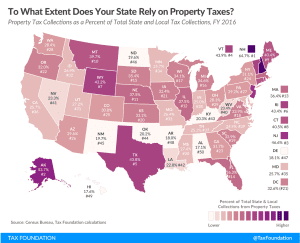

Reliance on Property Taxes in Europe

1 min read

A Property Tax is a Wealth Tax, but…

Warren’s comparison between the property tax and her proposed wealth tax makes a good sales pitch. However, there are important differences between the taxes. By no means is the property tax in many jurisdictions perfect, but it is generally better structured than a wealth tax.

4 min read

Iowa Adopts a “Soft” Property Tax Cap

3 min read

A Tradition Unlike Any Other: The Masters Tax Exemption

Augusta National Golf Club is famous for more than green jackets and pimento cheese sandwiches—legend has it that it’s the impetus for one of the tax code’s many exemptions.

3 min read

Facts and Figures 2019: How Does Your State Compare?

Our updated 2019 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read