All Related Articles

Facts and Figures 2018: How Does Your State Compare?

Facts and Figures is a one-stop data resource comparing the 50 states on over 40 measures of individual and corporate income taxes, sales taxes, excise taxes, property taxes, business tax climates, and more.

1 min read

Property Taxes in Arkansas

As Arkansas considers tax reform, expanding or increasing the state’s property tax, if used to finance other tax changes, would be worth exploring.

7 min read

Important Differences Between the House and Senate Tax Reform Bills Heading into Conference

The House and Senate have both passed legislation that would overhaul the federal tax code. Learn about the key differences between the two bills.

7 min read

2018 State Business Tax Climate Index

For 15 years, our State Business Tax Climate Index has been the standard for legislators and taxpayers to understand how their state’s tax code compares and how it can be improved. Now, for the first time ever, you can explore our Index’s 100+ variables in an easy to use, interactive format.

16 min read

Unpacking the State and Local Tax Toolkit: Sources of State and Local Tax Collections

There are a number of sources of state and local tax collections each with important implications for revenue stability and economic growth. Which taxes does your state and/or locality rely on most?

22 min read

Ohio Illustrated: A Visual Guide to Taxes & The Economy

This new chart book cuts through the complexity and gives you a broad perspective of Ohio’s overall economy and tax system. The result is a powerful diagnostic tool you can use to identify your state’s unique strengths and weaknesses.

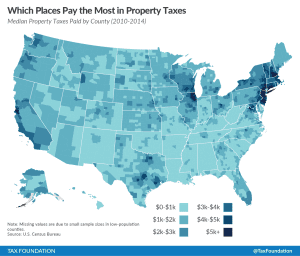

Property Taxes by County, 2017

2 min read

Tax Freedom Day 2017 is April 23rd

Tax Freedom Day® is the day when the nation as a whole has earned enough money to pay its total tax bill for the year. This year, Tax Freedom Day falls on April 23rd, 113 days into the year.

4 min read

2017 State Business Tax Climate Index

16 min read