Property Taxes by State and County, 2023

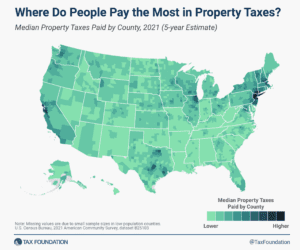

Property taxes are the primary tool for financing local governments and generate a significant share of state and local revenues.

6 min read

Property taxes are the primary tool for financing local governments and generate a significant share of state and local revenues.

6 min read

Discover why there are better and worse ways for governments to raise a dollar of revenue. That’s because no two taxes impact the economy the same.

Montana Policymakers should pursue principled property tax reform that benefits all property owners without creating market distortions or unfairly shifting the tax burden.

5 min read

In Greta Gerwig’s new Barbie movie, Barbie’s venture outside of Barbieland introduces her to new experiences. But what about Barbie and taxes?

3 min read

At least 32 notable tax policy changes recently took effect across 18 states, including alterations to income taxes, payroll taxes, sales and use taxes, property taxes, and excise taxes. See if your state tax code changed.

16 min read

Texas’s robust surpluses create an opportunity to use state funds to lower local property taxes. However, it remains important for legislators to pursue a principled approach to rate compression, rather than enacting a plan that will simply shift the tax burden in nonneutral ways.

3 min read

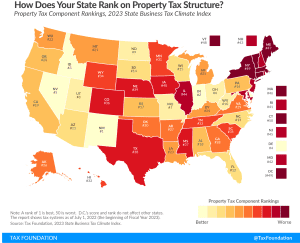

States are in a better position to attract business investment when they maintain competitive real property tax rates and avoid harmful taxes on tangible personal property, intangible property, wealth, and asset transfers.

5 min read

A better-designed tax system should be a goal of any fiscal consolidation package. That said, our simulations suggest that even substantially higher tax increases are insufficient to curtail long-run debt-to-GDP growth.

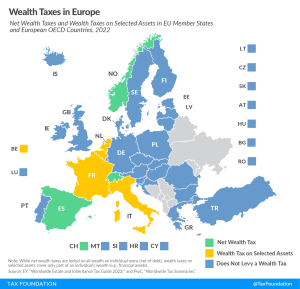

Instead of reforming and hiking the wealth tax, perhaps policymakers should consider whether the tax is serving its intended objectives, and, if not, consider repealing the tax altogether.

4 min read

If Wisconsin policymakers return some of the projected continued revenue growth to taxpayers in a structurally sound and pro-growth manner, those tax cuts will benefit businesses and individuals throughout the state, leading to more innovation, more job and wage growth, more economic opportunities, and more vibrant communities.

The overall U.S. tax and transfer system is overwhelmingly progressive, and understanding the extent—and source—of that progressivity is essential for lawmakers considering the trade-offs associated with each tax policy decision.

23 min read

As housing prices are rapidly increasing, and property tax bills along with them, the property tax has come into the spotlight in many states. The design of a state’s property tax system can affect how attractive that state is to businesses and residents.

9 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

In a day and age when businesses and individuals alike are increasingly mobile, West Virginians can be relieved that their state is getting off the sideline and into the action.

4 min read

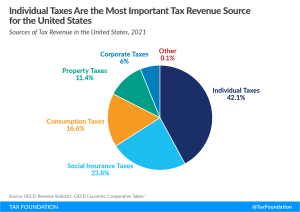

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

5 min read

At the end of 2022, prices were 14.6 percent higher than they were two years prior. That’s the fastest inflation rate over any two calendar years since the stagflation era of the late 1970s. State policymakers are understandably interested in bringing any tools at their disposal to bear on the problem. And many of them are reaching for tax policy solutions.

7 min read

West Virginia is one of only seven states that hasn’t offered any significant tax relief since 2021—and five of the other six forgo an individual income tax.

6 min read

On the heels of adopting one of the most comprehensive state tax reform packages in years, Iowa lawmakers are back in Des Moines with property tax relief in their sights. But while the issue is worthy of their attention, House File 1 (HF 1) as currently drafted misses the mark.

4 min read

Since 2020, Spain has dropped from 26th to 34th on the International Tax Competitiveness due to multiple tax hikes, new taxes, and weak performances in all five index components.

7 min read