All Related Articles

Facts and Figures 2020: How Does Your State Compare?

Our updated 2020 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

Kansas Tax Modernization: A Framework for Stable, Fair, Pro-Growth Reform

Our new report outlines various policy recommendations for Kansas to consider in order to begin a robust and bipartisan conversation about modernizing the state’s tax code to suit a 21st century economy.

15 min read

Welcome to the Index, Lithuania!

5 min read

Results of 2019 State and Local Tax Ballot Initiatives

Election Day 2019 will feature notable tax-related ballot measures in California, Colorado, New Mexico, Pennsylvania, Texas, and Washington. Once the polls close tonight, beginning with Pennsylvania and Texas at 8 PM EST, we will begin tracking the results as they come in.

4 min read

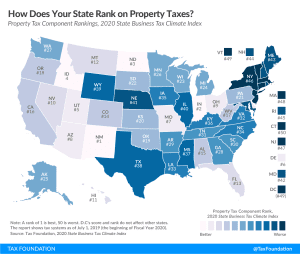

2020 State Business Tax Climate Index

Connecticut, California, New York, and New Jersey rank lowest in our 2020 State Business Tax Climate Index, which compares states on more than 120 tax policy variables to show how well they structure their tax systems and to provide a road map for improvement.

20 min read

UK Taxes: Potential for Growth

3 min read

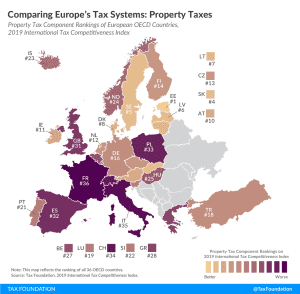

International Tax Competitiveness Index 2019

Our International Index compares OECD countries on over 40 variables that measure how well each country’s tax system promotes sustainable economic growth and investment.

11 min read