14.8% Individual Income Tax and 16.1% Corporate Income Tax Coming To New York City?

Raising rates on those with the most flexibility to leave—or never to return—risks turning those fears into a self-fulfilling prophesy.

3 min read

Raising rates on those with the most flexibility to leave—or never to return—risks turning those fears into a self-fulfilling prophesy.

3 min read

States which forgo income taxes have seen population and economic growth vastly outstripping their peers, and a post-pandemic culture that is friendlier to remote work will greatly enhance tax competition.

71 min read

Policymakers should be very cautious about relying too heavily on excise tax increases to pay down tax reductions elsewhere. Ideally, revenue offsets would come from more stable, broader-based revenue sources.

4 min read

Some tax hikes are more damaging than others, according to Congressional Budget Office (CBO) and new Tax Foundation economic modeling.

5 min read

The increase in expenditures associated with COVID-19 relief is another illustration of using the tax code to administer social spending.

3 min read

Since 1987, unemployment compensation benefits have been subject to federal income tax and, in most states, to state income tax. According to the Congressional Research Service, such treatment—including unemployment compensation benefits in taxable income—is common across industrial nations.

4 min read

The IRS recently announced the extension of tax filing and payment deadlines from April 15th to May 17th to help taxpayers navigating the many tax changes amid the pandemic and give the IRS opportunity to clear its backlog of tax returns and correspondence.

7 min read

Our updated 2021 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

As the Senate debates the relief package and makes progress in the budget reconciliation process, policymakers should keep in mind the trade-off between targeted economic relief and increasing marginal tax rates in the tax code, which can distort incentives to earn income and induce taxpayers to creatively adjust their AGI to receive a payment in the next tax season.

4 min read

A year ago, it seemed possible that New Hampshire was headed toward a triggered tax increase. Instead, lawmakers may trim business tax rates and begin the phaseout of the state’s tax on interest and dividend income, which would take away the asterisk and make New Hampshire the ninth state to forgo an individual income tax altogether.

4 min read

Policy changes to attract foreigners are not without benefits, but governments should carefully weigh the costs of the tax incentives against opportunities to implement broader tax reforms. A more efficient income tax system is a better objective than just focusing on incentives for foreigners to change their tax residence.

4 min read

The international experience with wealth taxes should serve as a warning to the U.S. A wealth tax would reduce the size of the economy, shrink national income, and significantly distort international capital flows.

4 min read

Mississippi has an opportunity to become the 10th state without an individual income tax and to do so with sales tax rates which, while certainly high, are in line with regional competitors. For such a momentous undertaking, however, policymakers should be equipped with reliable revenue projections and a detailed accounting of how much revenue is projected to come from each offsetting change. A change worth doing is worth doing right.

15 min read

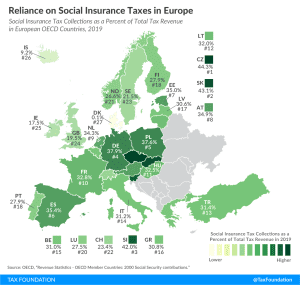

Social insurance taxes are the second largest tax revenue source in European OECD countries, at an average of 29.5 percent of total tax revenue.

2 min read

A new study illustrates how overlooking an important element of the tax system—the structure of the tax base—can lead to an incomplete understanding of how tax reform impacts the economy.

4 min read

Under the budget introduced by Gov. Tom Wolf, Pennsylvania’s flat personal income tax rate would increase by 46 percent, partially offset by an outsized increase in the poverty credit, which would see a family of four eligible for partial relief due to poverty until they reached $100,000 in taxable income—four times the poverty line.

6 min read

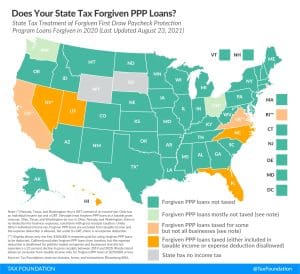

Congress chose to exempt forgiven Paycheck Protection Program (PPP) loans from federal income taxation. Many states, however, remain on track to tax them by either treating forgiven loans as taxable income, denying the deduction for expenses paid for using forgiven loans, or both.

11 min read

Learn more about the recent Alabama tax reform measures (House Bill 170), which combines pandemic-era tax policy responses with broader tax policy reforms.

4 min read

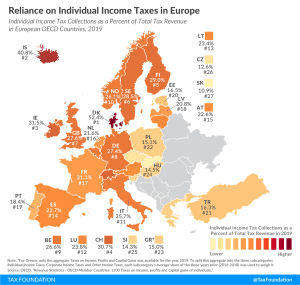

Denmark relies the most on revenue from individual income taxes, at 52.4 percent of total tax revenue, followed by Iceland and Ireland at 40.8 percent and 31.5 percent, respectively.

1 min read

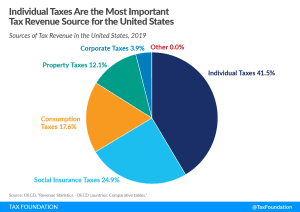

In the United States, individual income taxes (federal, state, and local) are the primary source of tax revenue, at 41.5 percent of total tax revenue. Social insurance taxes make up the second-largest share, at 24.9 percent, followed by consumption taxes, at 17.6 percent, and property taxes, at 12.1 percent.

4 min read