All Related Articles

Reliance on Consumption Taxes in Europe

2 min read

How High are Other Nations’ Gas Taxes?

3 min read

Sources of Government Revenue in the OECD, 2019

OECD countries have on average become more reliant on consumption taxes and less reliant on individual income taxes. These policy changes matter, considering that consumption-based taxes raise revenue with less economic damage and distortionary effects than taxes on income.

10 min read

An Analysis of Senator Warren’s ‘Real Corporate Profits Tax’

Sen. Elizabeth Warren introduced a 7 percent surtax on corporate profits called the “Real Corporate Profits Tax.” We estimate that this tax would reduce the incentive to invest in the United States, and result in a 1.9 percent smaller economy, a 3.3 percent smaller capital stock, and 1.5 percent lower wages. The surtax would raise $872 billion between 2020 and 2029 on a conventional basis and $476 billion on a dynamic basis. The tax would make the tax code more progressive, but it would fall on taxpayers in every income group.

9 min read

Recapping the 2019 Arkansas Tax Reform

3 min read

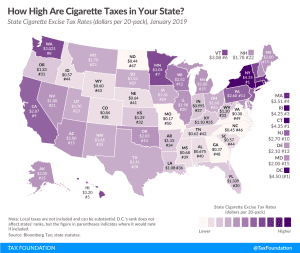

How High Are Cigarette Taxes in Your State?

Cigarette taxes around the country are levied on top of the federal rate of $1.0066 per 20-pack of cigarettes. As of 2016, taxes accounted for almost half of the retail cost of a pack of cigarettes.

2 min read