All Related Articles

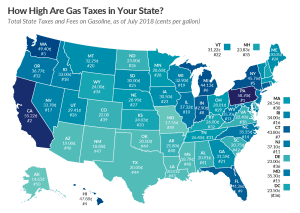

Gas Tax Rates by State, 2018

2 min read

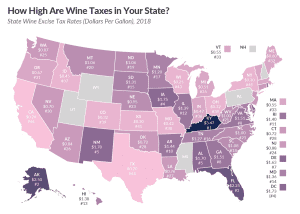

How High Are Wine Taxes in Your State?

1 min read

Sales Taxes on Soda, Candy, and Other Groceries, 2018

When policymakers get in the habit of handpicking goods for which the sales tax does or does not apply, the tax base simultaneously erodes and becomes more complex.

25 min read

Taxation, Representation, and the American Revolution

James Otis’s rallying cry of “taxation without representation is tyranny!” became the watchwords of the American Revolution and remain familiar to our ears. American independence, which we celebrate each year, was born of a tax revolt.

6 min read

Are Sugar-Sweetened Beverage Taxes Regressive? Evidence from Household Retail Purchases

Soda taxes are proposed with the promise to improve public health outcomes, but they come with equity concerns because of their regressive nature.

23 min read

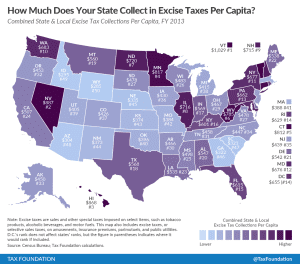

How Much Does Your State Collect in Excise Taxes?

Excise taxes make up a relatively small portion of state and local tax collections—about 11 percent—but per capita collections vary widely from state to state.

3 min read