All Related Articles

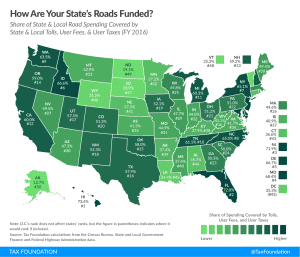

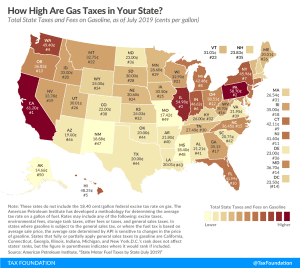

Road Taxes and Funding by State, 2019

4 min read

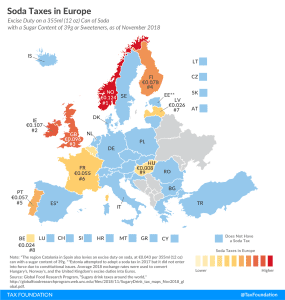

Soda Taxes in Europe

2 min read

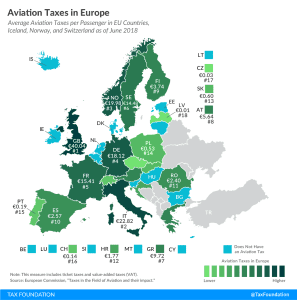

Aviation Taxes in Europe

1 min read

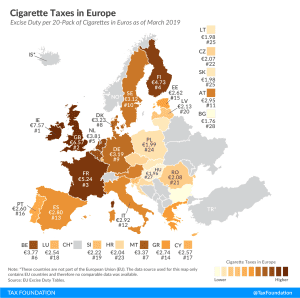

Cigarette Taxes in Europe, 2019

Today, Ireland and the United Kingdom levy the highest excise duties on cigarettes in the European Union (EU), at €7.57 (US $8.93) and €6.57 ($7.75) per 20-cigarette pack, respectively. This compares to an EU average of €3.09 ($3.64). In contrast, Bulgaria (€1.76 or $2.07) and Hungary (€1.96 or $2.31) levy the lowest excise duties.

3 min read

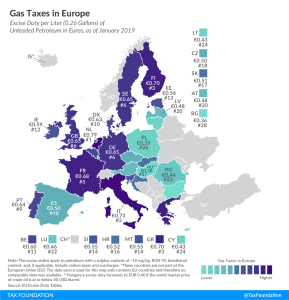

Gas Taxes in Europe, 2019

4 min read

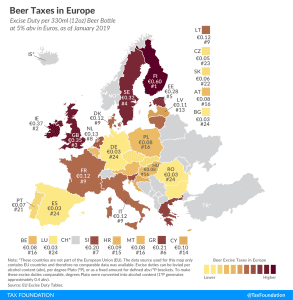

Beer Taxes in Europe, 2019

2 min read

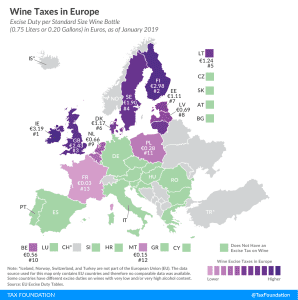

Wine Taxes in Europe

1 min read

The Proper Role of Excise Taxes

3 min read

Gas Tax Rates by State, 2019

3 min read

Tax Reforms in Georgia 2004-2012

9 min read

State Tax Changes as of July 1, 2019

15 min read

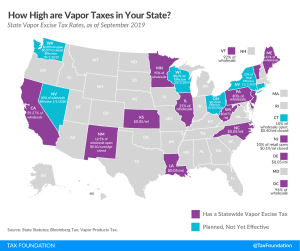

Vaping Taxes by State, 2019

3 min read

Distilled Spirits Taxes by State, 2019

3 min read