All Related Articles

Maryland Legislature Seeks Revenue with Risky Proposals

One notable consequence of high state tobacco excise tax rates is increased smuggling as people procure discounted products from low-tax states and sell them in high-tax states. Smugglers wouldn’t have to look far to find cheaper smokes. All of Maryland’s neighboring states have rates lower than $4 per pack, including Virginia ($1.20) and West Virginia ($0.30). Such an increase would impact the many small business owners operating vape shops around the state and convenience stores relying heavily on vapers as well as tobacco sales.

7 min read

Sources of Government Revenue in the OECD, 2020

OECD countries have on average become more reliant on consumption taxes and less reliant on individual income taxes. These policy changes matter, considering that consumption-based taxes raise revenue with less economic damage and distortionary effects than taxes on income.

13 min read

Facts and Figures 2020: How Does Your State Compare?

Our updated 2020 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

Banning Flavored Tobacco Could Have Unintended Consequences

The prospect of a ban on flavored tobacco and nicotine products highlights the complications of contradictory tax and regulatory policy, the instability of excise taxes that go beyond pricing in the cost of externalities, and the public risks of driving consumers into the black market through excessive taxation or regulation.

6 min read

Navigating Alaska’s Fiscal Crisis

4 min read

Taxing Nicotine Products: A Primer

New nicotine products, along with a greater consciousness about the dangers of smoking, have prompted millions to give up smoking. This has contributed to federal and state excise tax collections on tobacco products declining since 2010. Our new report outlines the best way to tax nicotine products based on health outcomes and revenue stability.

49 min read

Proposal to Increase New York Beer Tax

3 min read

Tax Trends at the Dawn of 2020

From remote sales tax collection to taxes on marijuana and vaping products, we recap the top state tax trends from 2019 and break down which ones you should watch for in 2020.

38 min read

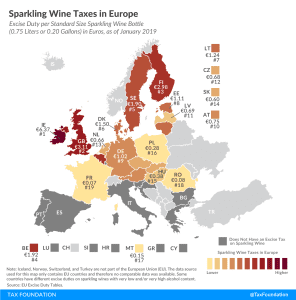

Sparkling Wine Taxes in Europe

1 min read

Virginia Governor Looks to Excise Taxes

The proposed budget reflects a growing trend as policymakers across the country look to excise taxes as long-term solutions to budget woes. While excise taxes can be a part of the revenue picture, they are not a sustainable revenue source due to their narrow base, which is easily affected by changes in consumer behavior or market conditions.

2 min read

State Tax Changes as of January 1, 2020

This year was a significant one for state tax policy, and the wide range of changes taking effect January 1, 2020, reflects the scope and intensity of that activity. With states continuing to grapple with issues like the taxation of international income and collections obligations for remote sellers and marketplace facilitators, the coming year is unlikely to be any quieter.

23 min read

Kansas Tax Modernization: A Framework for Stable, Fair, Pro-Growth Reform

Our new report outlines various policy recommendations for Kansas to consider in order to begin a robust and bipartisan conversation about modernizing the state’s tax code to suit a 21st century economy.

15 min read