Budget Reconciliation: Tracking the 2025 Trump Tax Cuts

Our experts are providing the latest details and analysis of proposed federal tax policy changes.

10 min readAcademic studies show that higher corporate tax rates depress worker wages and lead to fewer jobs. An Organisation for Co-operation and Development (OECD) study has found that the corporate tax is the least efficient and most harmful way for governments to raise revenue.

Our experts are providing the latest details and analysis of proposed federal tax policy changes.

10 min read

The Polish government is considering converting its traditional corporate income tax into a tax on distributed profits. We estimate that this reform would result in greater investment, a larger productive capital stock, and higher economic output in the long run.

29 min read

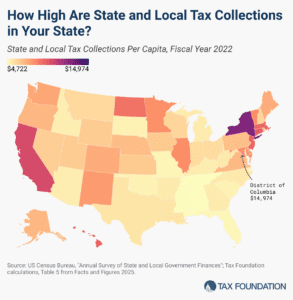

According to the latest economic data from the US Census Bureau, the average per capita state and local tax burden is $7,109. However, collections vary widely by state, reflecting differences in tax rates and bases, natural resource endowments, the scale and scope of taxable economic activity in each state, and residents’ political preferences.

5 min read

Pairing permanent TCJA individual tax cuts with new limits on business SALT deductions would shrink the economy, reduce American incomes, and increase the federal budget deficit, undermining the policy goals of TCJA permanence.

3 min read

A tax preference originally designed to level the playing field now has the opposite effect, creating preferences for one class of financial institutions even though the distinctions between credit unions and banks are increasingly blurred.

6 min read

President Trump has repeatedly floated the idea of entirely replacing the federal income tax with new tariffs. Recently, he has said that when tariff revenues come in, he will use them to replace or substantially cut income taxes for people making under $200,000.

8 min read

By implementing a more sophisticated and nuanced trigger system for its tax reduction goals, North Carolina can sustain its trajectory toward lower tax rates, reinforce its reputation as a business-friendly state, and ensure long-term fiscal stability in an ever-changing economic landscape.

4 min read

Without aligning fiscal discipline with pro-growth tax policies, Germany and the EU risk high deficits, mounting debt, and sustained inflation.

5 min read

Without businesses as their taxpayers and tax collectors, governments would not have the resources to provide even the most basic services.

5 min read

On average, businesses in the OECD are liable for collecting, paying, and remitting more than 85 percent of the total tax collection.

15 min read

If adopted, these reforms would make Kansas’ tax code substantially more competitive while returning revenue growth to taxpayers in a fiscally responsible manner.

5 min read

Do tariffs really level the playing field, or are they just bad economics? In this emergency episode, we fact-check the Trump administration’s claims that retaliatory tariffs make trade fairer.

What are the biggest tax stories shaping policy today—and what do they mean for you? In our 100th episode, we break down the five biggest tax stories, from the global tax deal to the looming expiration of the Tax Cuts and Jobs Act.

Surtaxes such as Germany’s solidarity surtax run counter to the principles of simplicity and transparency of the tax system because they impose an additional layer of tax on taxpayers and create a more complex tax structure that often obscures the actual tax burden.

4 min read

Maryland’s proposed budget has garnered headlines for many reasons, but another momentous change is flying under the radar: backdoor adoption of potentially mandatory worldwide combined reporting.

6 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

Lawmakers should prioritize pro-growth tax policies and use the least economically damaging offsets to make the legislation fiscally responsible. If lawmakers choose to use C-SALT, they should carefully consider the economic trade-off with permanent, pro-growth tax cuts that support investment and innovation in the US.

7 min read

Tax legislation in 2025 may have good reason to address international corporate income taxes, because of scheduled changes slated to go into effect or because of international developments like the Pillar Two agreement.

63 min read

While Governor Moore’s tax plan is still being fiercely debated in Maryland, legislators have introduced several additional proposals—mostly aimed at increasing taxes on businesses—to generate revenue and address the state’s chronic budget deficit.

6 min read

Lawmakers should finish the work they have begun over the past few decades, tackling tax rates and structures to give the state a leg up in an era of enhanced competition.

84 min read