Cannabis Taxation: Lessons Learned from U.S. States and a Blueprint for Nationwide Cannabis Tax Policy

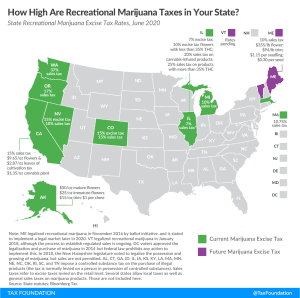

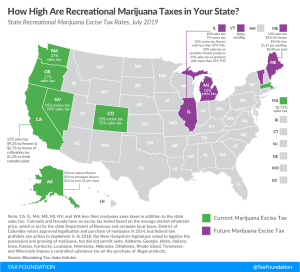

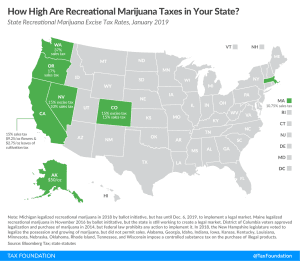

Marijuana taxation is one of the hottest policy issues in the United States. Twenty-one states have implemented legislation to legalize and tax recreational marijuana sales.

16 min read