Featured Articles

All Related Articles

Where Should the Money Come From?

The fiscal response to the COVID-19 pandemic will require policymakers to consider what revenue resources should be used to fill budget gaps. Tax policy experts have proposed wealth taxes, (global) corporate minimum taxes, excess profits taxes, and digital taxes as opportunities for governments to raise new revenues.

20 min read

Brazil has the Opportunity to Implement a Simple Consumption Tax and Foster Tax Progressivity at the Same Time

Brazil has one of the world’s most complex tax systems. Brazil has the opportunity to implement a simple consumption tax and foster tax progressivity at the same time.

5 min read

Revenue Gains in Asian and Pacific Countries Likely Offset by COVID-19

Because of the COVID-19 pandemic and the associated economic crisis, countries in the Asia-Pacific region will see a differentiated impact on their capacity of mobilizing domestic revenue depending on the structure of their economy. According to the OECD report, those economies that rely mostly on natural resources, tourism, and trade taxes are especially vulnerable.

5 min read

Global Tax Relief Efforts Vary in Scope and Time Frame in Response to COVID-19

Countries around the world have implemented and continue to implement emergency tax measures to support their economies during the coronavirus (COVID-19) crisis.

5 min read

Germany Adopts a Temporary VAT Cut

Tax policy responses to the pandemic should be designed to provide immediate support while paving the way to recovery. A temporary VAT rate cut in the context of an inefficient VAT system is likely to deliver mixed results at best.

4 min read

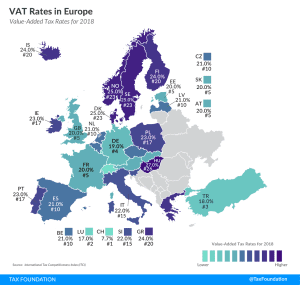

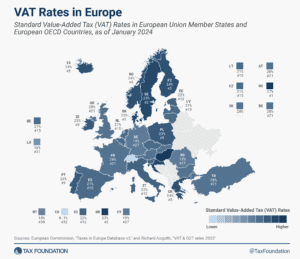

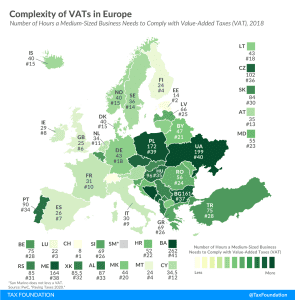

Complexity of VATs in Europe

2 min read

California Considers Business Head Tax Plan that Seattle Repealed

With California’s unemployment rate approaching 25 percent, it is somewhat surprising to find policymakers contemplating a literal tax on jobs.

3 min read

Lessons from Alberto Alesina for U.S. Lawmakers

Alesina’s work suggests that raising taxes to reduce the federal deficit and national debt would be an economic mistake. The less economically damaging path is to cut spending, what some have called austerity policies.

3 min read

A Comparison of the Tax Burden on Labor in the OECD, 2020

A higher tax burden on labor often leads to lower employment rates and wages. That’s important for policymakers to remember as they look for ways to help their economies recover from coronavirus-induced shutdowns. If their goal is to encourage employment, policies that lower the tax burden on labor could prove a powerful tool.

20 min read

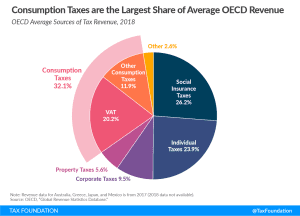

New OECD Study: Consumption Tax Revenues during Economic Downturns

Compared to other tax revenue sources, consumption tax revenue as a share of GDP tends to be relatively stable over time, even during economic downturns.

2 min read

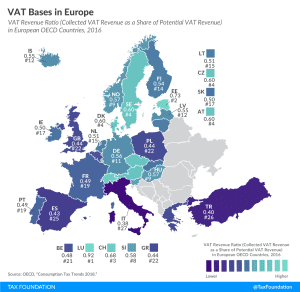

VAT Bases in Europe

The extent to which businesses and consumers will benefit from coronavirus relief measures like temporary VAT changes will depend on the VAT base.

2 min read

Denmark Unplugs the Economy

Denmark, a high-tax country with 5.5 million citizens, has implemented policies designed to avoid layoffs and bankruptcies and basically unplug the economy during the pandemic.

4 min read

Norway Opens the Fiscal Toolbox

Norway passed a large coronavirus tax relief package to address layoffs and bankruptcies, which includes a reduced VAT rate, the introduction of a loss carryback provision, and targeted postponements for wealth tax payments, among other provisions.

5 min read

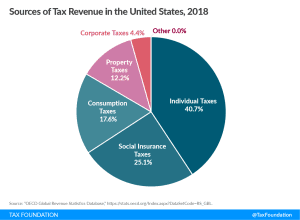

Tax Policy and Economic Downturns

The Great Recession provides some insight into how tax revenues declined during a deep recession. Across OECD countries, revenues fell by 11 percent from 2008 to 2009 with corporate income taxes seeing the steepest decline at 28 percent. Revenues from individual income taxes fell by 16 percent.

4 min read

Reliance on Consumption Taxes in Europe

2 min read

FAQ on Digital Services Taxes and the OECD’s BEPS Project

What is a digital services tax (DST)? What countries have announced, proposed, or implemented a DST? What are some of the criticisms of a DST? What are alternatives to a DST? What is the OECD BEPS project and what is its main objective? What is the main objective of OECD Pillar 1? What is the main objective of OECD Pillar 2?

8 min read