Featured Articles

All Related Articles

Brazil Proposes Major Overhaul of Its Alcohol Tax System

The Brazilian government is poised to make the biggest change to its alcohol tax policy in recent history.

6 min read

The French Budget: Moving from Public Debate to Principled Solutions

Focusing on competitiveness, neutrality, and efficient policies to raise revenue would go a long way in increasing economic growth and stabilizing public finances over the long term.

7 min read

Why the Economic Effects of Taxes (Including Tariffs) Matter

Estimating the economic effects of different types of taxes informs policymakers about the trade-offs of raising revenue in a given way.

5 min read

Modernizing State Sales Taxes: A Policymaker’s Guide

The sales tax is the second-largest source of state tax revenue and an important source of local tax revenue, but decades of base erosion threaten the tax’s share of overall revenue and have prompted years of countervailing rate increases.

72 min read

Cigarette Taxes in Europe, 2024

Explore the latest EU tobacco and cigarette tax rates, including EU excise duties on cigarettes. Compare cigarette taxes in Europe.

3 min read

How Are Olympians and Attendees Taxed?

The 2024 Summer Olympics are underway, drawing the attention of billions and continuing a tradition dating back thousands of years. But you know what else originated thousands of years ago and affects even more people? Taxes.

3 min read

Proposed Nebraska Property Tax Relief Plan Would Make Things Worse

Gov. Pillen is searching for tax burden relief. But his plan, which reportedly involves a two-tiered sales tax and the state’s assumption of most school funding responsibility, would have profound implications that even those most convinced of the urgency of property tax relief may find unworkable and unpalatable.

12 min read

Tax Files under New Council of EU Presidency: Hungary

As Hungary takes over the six-month rotating presidency of the Council of the European Union in the aftermath of the European elections, the relationship between tax policy and Europe’s competitiveness will be closely linked.

6 min read

The Impact of High Inflation on Tax Revenues across Europe

The European Union’s experience with high inflation highlights the critical need for adaptive fiscal policies. Best practices drawn from the academic literature recommend implementing automatic adjustment mechanisms with a certain periodicity and based on price increases.

31 min read

Supreme Court Rules against Moores 7-2, Leaves Most Questions Undecided

The government won in Moore. However, given the narrow opinion of the court and the reasoning in the Barrett concurrence and the Thomas dissent, it seems likely that future rulings under other facts and circumstances could favor taxpayers instead.

7 min read

The European Union’s ViDA Proposal: Ignoring Principles Does Not Make Tax Policy Fairer

Adopting tax policy based on sound principles like neutrality rather than political expediency is essential for the European Union’s fiscal future.

5 min read

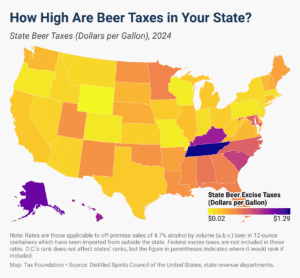

Beer Taxes by State, 2024

Different layers of taxation on production and distribution combine to make up about 40 percent of the retail price of beer.

3 min read

A Comparison of the Tax Burden on Labor in the OECD, 2024

Governments often justify higher tax burdens with more extensive public services. However, the cost of these services can be more than half of an average worker’s salary.

16 min read

Why We’re Closely Watching Moore v. U.S.

The Moore case could have important impacts on tax policy.

5 min read

Digital Taxation around the World

The outcome of the digital tax debate will likely shape domestic and international taxation for decades to come. Designing these policies based on sound principles will be essential in ensuring they can withstand challenges arising in the rapidly changing economic and technological environment of the 21st century.

58 min read

The Impact of BEPS 1.0

The global landscape of international corporate taxation is undergoing significant transformations as jurisdictions grapple with the difficulty of defining and apportioning corporate income for the purposes of tax.

22 min read

Excise Duties on Electricity in Europe, 2024

EU Member States should seek to minimize the rate and broaden the base of electricity duties, consolidating their rates to the required minimum rate.

3 min read

Facts & Figures 2024: How Does Your State Compare?

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

Considering Tax Reform Options for 2025 (and Beyond)

Given that U.S. debt is roughly the size of our annual economic output, policymakers will face many tough fiscal choices in the coming years. The good news is there are policies that both support a larger economy and avoid adding to the debt.

6 min read

Sources of US Tax Revenue by Tax Type, 2024 Update

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

3 min read