All Related Articles

Opportunity Zones: What We Know and What We Don’t

Research suggests place-based incentive programs redistribute rather than generate new economic activity, subsidize investments that would have occurred anyway, and displace low-income residents.

20 min read

The Economics of Stock Buybacks

Stock buybacks are readily visible, and unfortunately some have misunderstood stock buybacks to be taking place at the expense of long-term investments.

17 min readResponding to the NYT’s Stock Buybacks Analysis

The increase in stock buybacks isn’t surprising nor a sign that the Tax Cuts and Jobs Act won’t increase domestic investment.

2 min read

What the Main Criticisms of Stock Buybacks Get Wrong

Stock buybacks are a clearly visible phenomenon, but most critics point out the initial action, the buyback, and ignore the greater context.

3 min read

Enhancing Tax Competitiveness in Connecticut

Connecticut has failed to live up to the expectations of 1991. Changes intended to make tax collections more stable, combined with constraints intended to promote fiscal prudence, have strayed far wide of the mark. To turn things around, Connecticut needs a more competitive tax code.

32 min read

The Economics of 1986 Tax Reform, and Why It Didn’t Create Growth

In contrast, the Tax Cuts and Jobs Act lowered the corporate tax rate and allows immediate and full expensing for the next five years.

3 min read

Stock Buybacks Don’t Hinder Investment Spending

Stock buybacks transfer capital from old established firms to new and innovative ones that need capital to meet their potential.

2 min read

Not So Much Ado About Stock Buybacks—Q1 2018 Repurchases Comparable to Past Years

A closer look at the data shows that the amount of stock buybacks following the enactment of the Tax Cuts and Jobs Act isn’t out of the norm.

3 min read

Missing Some Context on Stock Buybacks

Stock buybacks made since the enactment of the Tax Cuts and Jobs Act doesn’t mean that workers won’t ultimately benefit through higher wages.

2 min read

States Explore Taxing Carried Interest

3 min read

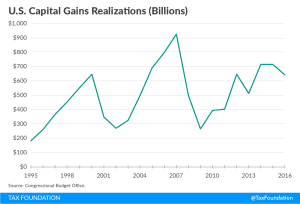

Getting “Real” by Indexing Capital Gains for Inflation

Many elements of the income tax are adjusted for inflation, such as tax brackets, but the purchase price of assets that are later sold for capital gains or losses is not. Here’s the case for changing that.

17 min read

The ‘Grain Glitch’ Needs to Be Fixed

The Tax Cuts and Jobs Act tax preference for farm co-ops would distort agricultural activity and create tax planning opportunities for wealthy taxpayers.

9 min read

Trends in State Tax Policy, 2018

In 2018, trends to watch in state tax policy will include reductions in corporate tax rates, the spread of gross receipts taxes, new and lower taxes on marijuana, estate tax repeal, a wait-and-see approach on federal tax reform, and more.

16 min read

Important Differences Between the House and Senate Tax Reform Bills Heading into Conference

The House and Senate have both passed legislation that would overhaul the federal tax code. Learn about the key differences between the two bills.

7 min read

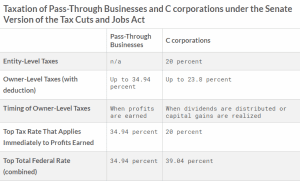

Are Pass-Through Businesses Treated Fairly Under the Senate Version of the Tax Cuts and Jobs Act?

A more careful look shows that the Senate Tax Cuts and Jobs Act doesn’t put pass-through businesses at a disadvantage compared to C corporations.

4 min read