Tax on Stock Buybacks a Misguided Way to Encourage Investment

Research shows that a tax on stock buybacks would not be the right policy solution to encourage long-term investment or lift wages.

3 min read

Research shows that a tax on stock buybacks would not be the right policy solution to encourage long-term investment or lift wages.

3 min read

Mark-to-market is not simple to implement, as it involves new administrative and compliance challenges for taxpayers. Mark-to-market levies tax on phantom income, requiring some taxpayers to engage in some degree of liquidation, ultimately suppressing incentives to save and invest. The limited tax revenues that could result from these proposals are not worth the risk.

5 min read

The Biden administration has targeted U.S. businesses, including corporations and passthrough entities, to raise revenue to fund new spending. However, individual taxpayers across America will end up footing the bill.

4 min read

New research from Federal Reserve Bank of Boston economists suggests wealth inequality has grown less than previously estimated and that shares of wealth held by top earners drops significantly when accounting for sources of lower- and middle-class wealth that are often overlooked.

2 min read

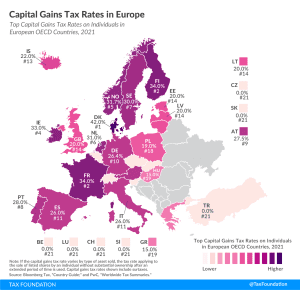

President Biden’s proposal to tax capital gains at higher, ordinary income tax rates would lead the U.S. to have the highest top marginal tax rate on capital gains in the OECD.

2 min read

The redistribution of income from the Biden administration’s tax proposals would involve many winners and losers, not only across different types of taxpayers but also geographically across the country. Launch our new interactive map to see average tax changes by state and congressional district over the budget window from 2022 to 2031.

8 min read

Explore President Biden budget proposals, including tax and spending in American Jobs Plan and American Families Plan. See Biden tax and spending proposals.

12 min read

Policymakers concerned about the current tax treatment of unrealized capital gains would be better off exploring policy solutions like consumption taxes rather than tried-and-failed strategies.

5 min read

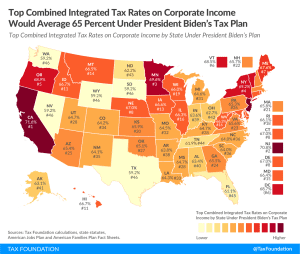

Under President Biden’s tax plan, the United States would tax corporate income at the highest top rate in the industrialized world, averaging 65.1 percent.

3 min read

The Biden administration is proposing to tax long-term capital gains at ordinary income rates for high earners, which will bring the top federal rate to highs not seen since the 1920s.

2 min read

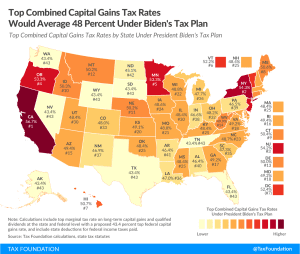

The top federal rate on capital gains would be 43.4 percent under Biden’s tax plan (when including the net investment income tax). Rates would be even higher in many U.S. states due to state and local capital gains taxes, leading to a combined average rate of over 48 percent compared to about 29 percent under current law.

3 min read

Our updated 2021 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

A year ago, it seemed possible that New Hampshire was headed toward a triggered tax increase. Instead, lawmakers may trim business tax rates and begin the phaseout of the state’s tax on interest and dividend income, which would take away the asterisk and make New Hampshire the ninth state to forgo an individual income tax altogether.

4 min read

While other countries in Europe are working towards introducing tax cuts and stimulating economic recovery by supporting business investment and employment, Spain is putting more fiscal pressure on households and businesses.

4 min read

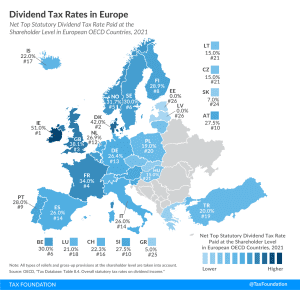

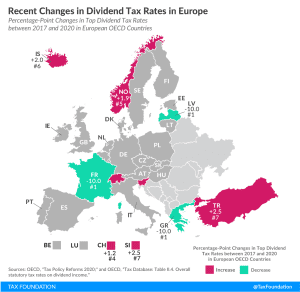

Over the last three years, eight European OECD countries have made changes to their dividend tax rates. Iceland, Norway, Slovenia, Switzerland, and Turkey increased their rates, each between roughly one and three percentage points. France, Greece, and Latvia cut their rates by 10 percentage points.

2 min read

Joe Biden recently released a piece reviewing his tax proposals, contrasting them with President Donald Trump’s tax ideas. A major theme within this piece can be summarized in the title: “A Tale of Two Tax Policies: Trump Rewards Wealth, Biden Rewards Work.”

4 min read