All Related Articles

Capital Gains Tax Rates in Europe, 2020

2 min read

Tracking State Legislative Responses to COVID-19

Many states are racing to pass budgets, emergency COVID-19 supplemental appropriations, and other must-pass legislation as quickly as possible. We’re tracking the latest state legislative responses to the coronavirus crisis.

66 min read

Tracking Economic Relief Plans Around the World during the Coronavirus Outbreak

Countries around the world are implementing emergency tax measures to support their economies under the coronavirus (COVID-19) threat.

51 min read

Analysis of Capital Gains Tax Proposals Among Democratic Presidential Candidates

Joe Biden and Bernie Sanders have both released proposals to tax capital gains at ordinary income rates for the wealthiest Americans. As part of a broader platform to address income inequality, Biden and Sanders suggest increasing current capital gains rates on taxpayers with income over $1 million and $250,000, respectively.

21 min read

State Tax Changes as of January 1, 2020

This year was a significant one for state tax policy, and the wide range of changes taking effect January 1, 2020, reflects the scope and intensity of that activity. With states continuing to grapple with issues like the taxation of international income and collections obligations for remote sellers and marketplace facilitators, the coming year is unlikely to be any quieter.

23 min read

Evaluating Mark-to-Market Taxation of Capital Gains

The success of any mark-to-market system lies in its ability to accurately value tangible and non-tangible (or non-tradable) assets such as intellectual property and brand-value recognition. Administrative regulations, guidance, and enforcement are the Achilles’ heel of any plan to annually tax accrued gains.

17 min read

Illustrating Senator Warren’s Taxes on Capital Income

Taken together, these proposed tax changes would significantly raise marginal and effective tax rates and increase the cost of capital, all of which would lead to a reduced level of output and less revenue than anticipated.

5 min read

Measuring Opportunity Zone Success

16 min read

Business in America

Who are the workers, consumers, and shareholders who interact with businesses in the U.S.? What forms do these businesses take? How do business taxes impact people’s lives? It is essential we answer these questions in order to design a business tax system that is simple, efficient, and enables economic progress.

5 min read

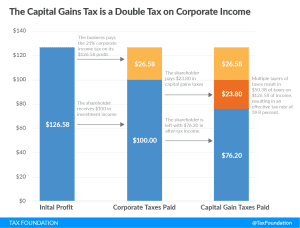

Taxes on Capital Income Are More Than Just the Corporate Income Tax

The United States’ statutory corporate income tax rate is now more aligned with the rates of other nations . However, taxes on capital income, or corporate investment, are more than just the corporate income tax. Shareholder-level taxes, such as those on dividends and capital gains, also affect incentives to save and invest.

3 min read

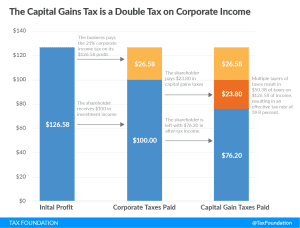

An Overview of Capital Gains Taxes

Capital gains taxes create a burden on saving because they are an additional layer of taxes on a given dollar of income. The capital gains tax rate cannot be directly compared to individual income tax rates, because the additional layers of tax that apply to capital gains income must also be part of the discussion.

14 min read