All Related Articles

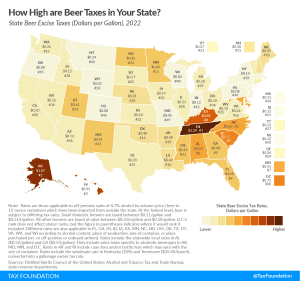

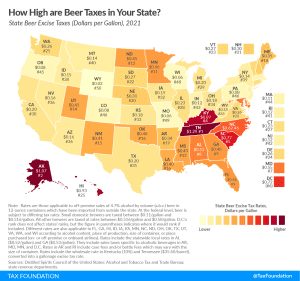

Beer Taxes by State, 2022

Tennessee, Alaska, Hawaii, and Kentucky levy the highest beer excise tax rates in the nation. How does your state compare?

3 min read

Unpacking the State and Local Tax Toolkit: Sources of State and Local Tax Collections (FY 2020)

The mix of tax sources states choose can have important implications for both revenue stability and economic growth, and the many variations across states are indicative of the different ways states weigh competing policy goals.

29 min read

Who Gets Hit by the Inflation Reduction Act Book Minimum Tax?

In dollar terms, the industries that would account for the largest book minimum tax liabilities are manufacturing, at $73.2 billion, followed by finance, insurance, and management at $46.9 billion.

6 min read

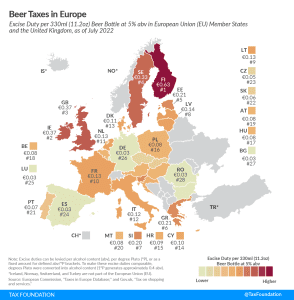

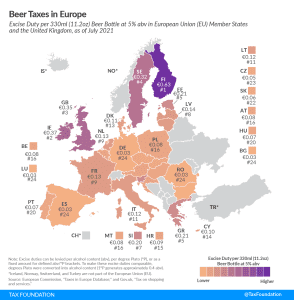

Beer Taxes in Europe, 2022

’Tis the season to crack open a cold one. Ahead of International Beer Day on August 5th, let’s take a minute to discover how much of your cash is actually going toward the cost of a brew with this week’s tax map, which explores excise duties on beer.

3 min read

Facts & Figures 2022: How Does Your State Compare?

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

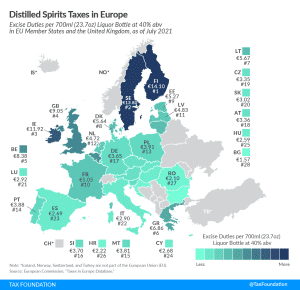

Distilled Spirits Taxes in Europe, 2021

The highest excise duties are applied in Finland, Sweden, and Ireland, where the rates for a standard-size bottle of liquor are €14.10 ($16.08), €13.80 ($15.73), and €11.92 ($13.59), respectively.

3 min read

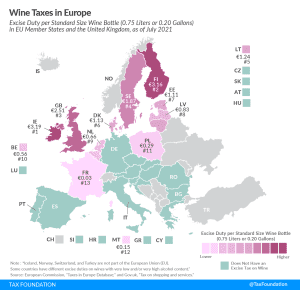

Wine Taxes in Europe, 2021

As one might expect, southern European countries that are well-known for their wines—such as France, Greece, Portugal, and Spain—either don’t tax it or do so at a very low rate. But travel north and you’ll see countries that tend to levy taxes on wine—and often hefty taxes.

3 min read

Beer Taxes in Europe, 2021

Finland has the highest excise tax on beer in Europe, followed by Ireland and the United Kingdom. Compare beer taxes in Europe this International Beer Day

3 min read

Illuminating Independence Day Taxes

5 min read

Beer Taxes by State, 2021

2021 state beer excise tax rates vary widely: as low as $0.02 per gallon in Wyoming and as high as $1.29 per gallon in Tennessee. Missouri and Wisconsin tie for second lowest at $0.06 per gallon, and Alaska is second highest with its $1.07 per gallon tax.

3 min read

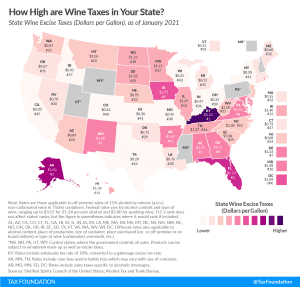

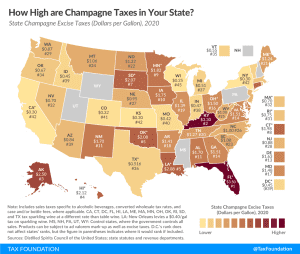

How High Are Wine Taxes in Your State?

States tend to tax wine at a higher rate than beer but at a lower rate than distilled spirits due to wine’s mid-range alcohol content. You’ll find the highest wine excise taxes in Kentucky at $3.23 per gallon, far above Alaska’s second-place $2.50 per gallon. Those states are followed by Florida ($2.25), Iowa ($1.75), and Alabama and New Mexico (tied at $1.70).

2 min read

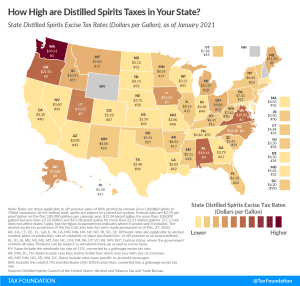

Distilled Spirits Taxes by State, 2021

Of all alcoholic beverages subject to taxation, stiff drinks—and all distilled spirits—face the stiffest tax rates. Like many excise taxes, the treatment of distilled spirits varies widely across the states.

2 min read

The World of Excise Taxation

Marijuana, betting, soda, ride-sharing—over the last decade, the excise tax family has grown significantly and it’s more crucial than ever that lawmakers, businesses, and consumers understand the possibilities and, more importantly, limitations of excise tax application.

Excise Tax Application and Trends

The excise tax family is growing. Over the last decade, several products have become subject to excise taxes or are in the process of becoming so. Given this development, it is more crucial than ever that lawmakers, businesses, and consumers understand the possibilities and, more importantly, limitations of excise tax application.

77 min read

Facts and Figures 2021: How Does Your State Compare?

Our updated 2021 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

Consumption Tax Policies in OECD Countries

Despite the potential of consumption taxes as a neutral and efficient source of tax revenues, many governments have implemented policies that are unduly complex and have poorly designed tax bases that exclude many goods or services from taxation, or tax them at reduced rates.

40 min read

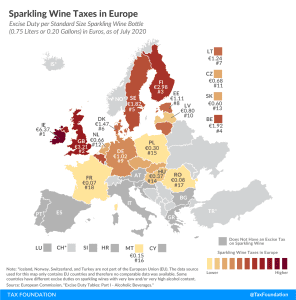

Sparkling Wine Taxes in Europe

This week, people around the world will celebrate New Year’s Eve, with many opening a bottle of sparkling wine to wish farewell to—a rather consequential—2020 and offer a warm welcome to the—by many of us, long-awaited—new year 2021.

1 min read

Tax Extenders Hitch a Ride on Omnibus and COVID-19 Relief Deal

Tax extenders are no stranger to hitching a last-minute ride on year-end legislation. This year they made another last-minute appearance, finding a hold in their own division of the 5,593-page bill to fund the government through the fiscal year and provide additional coronavirus relief through March.

2 min read