The average tax rate is the total tax paid divided by taxable income. While marginal tax rates show the amount of tax paid on the next dollar earned, average tax rates show the overall share of income paid in taxes.

How Are Average Tax Rates Calculated?

For individual income an average tax rate is total taxes paid divided by income. A single taxpayer with $45,000 in gross income pays approximately $3,700 in income taxes. This results in an average rate of 8.2 percent. The tax liability comes from the tax bracket the individual is in and the marginal rates applied to their income. A portion of the taxpayer’s income is taxed at a marginal rate of 10 percent, a portion is taxed at a marginal rate of 12 percent, and another portion is untaxed due to the standard deduction.

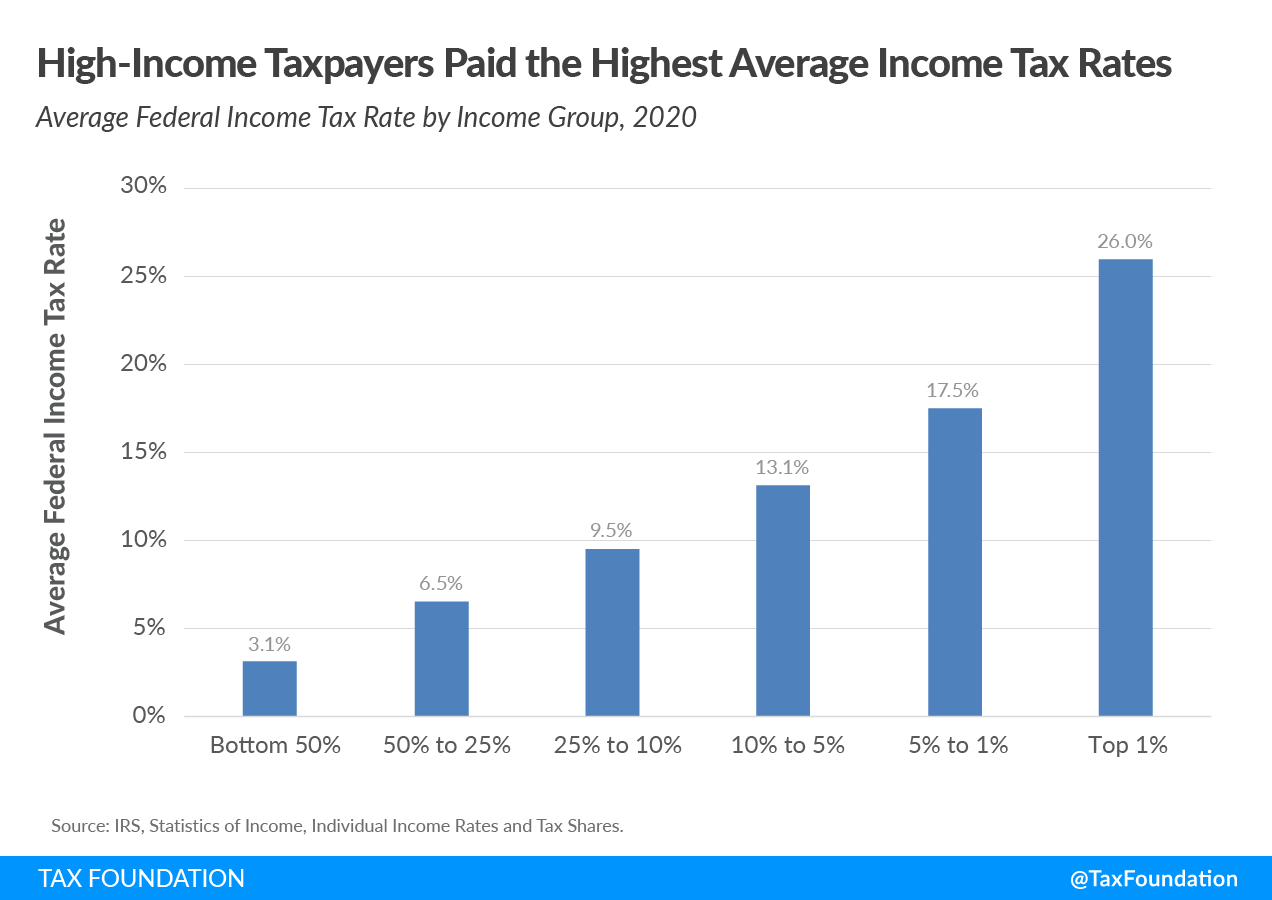

Progressivity and Who Pays

Due to the progressivity of the U.S. federal tax system high-income taxpayers pay the highest average income tax rate. According to 2020 data from the IRS, the average tax rate for the top 1 percent was 26.0 percent while the bottom 50 percent of taxpayers had an average tax rate of just 3.1 percent.

How Have These Rates Changed Over Time?

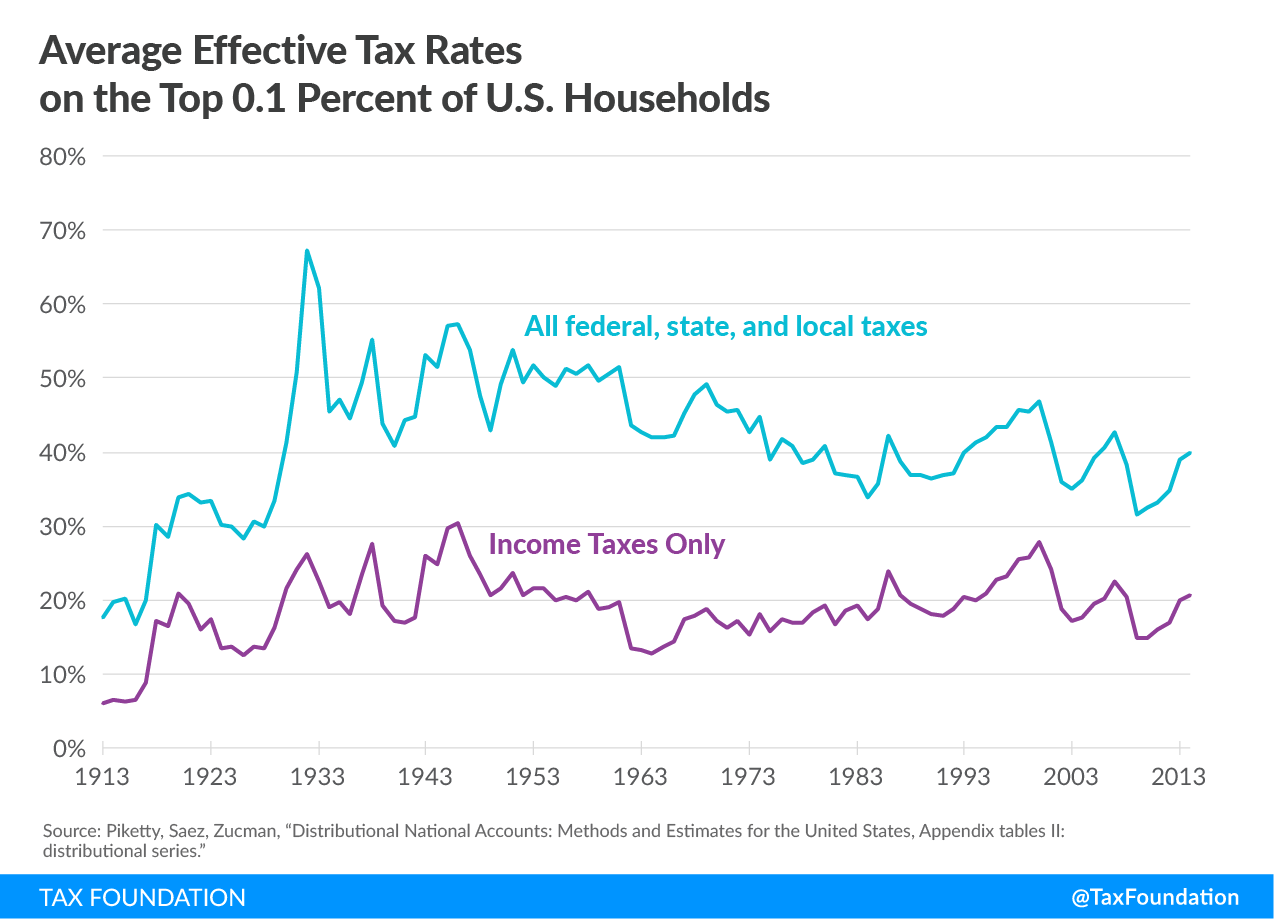

Average tax rates faced by the top 0.1 percent of U.S. households have fluctuated over time. This results from changes to U.S. tax laws at the federal, state, and local levels. While the average rates for total taxes on the top 0.1 percent have fallen 10.8 percentage points from the 1950s (the blue line in the figure below), average income tax rates have remained relatively stable (the purple line in the figure below). In the 1950s, the top 0.1 percent of households faced average effective income tax rates of 21.0 percent, versus 20.7 percent as of 2014.

The 91 percent top marginal income tax rate of 1950 only applied to households with income over $200,000 (or about $2 million in today’s dollars). Only a small number of taxpayers would have had enough income to fall into the top bracket—fewer than 10,000 households, according to an article in The Wall Street Journal.

Even among households that did fall into the 91 percent bracket, the majority of their income was not subject to that top bracket. After all, the 91 percent bracket only applied to income above $200,000, not to every single dollar earned by households. So despite a top bracket with a very high rate, the average tax rate was much lower.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe