The Joint Committee on Taxation (JCT) recently released a report entitled “Overview of the Tax Gap.” The tax gapThe tax gap is the difference between taxes legally owed and taxes collected. The gross tax gap in the U.S. accounts for at least 1 billion in lost revenue each year, according to the latest estimate by the IRS (2011 to 2013), suggesting a voluntary taxpayer compliance rate of 83.6 percent. The net tax gap is calculated by subtracting late tax collections from the gross tax gap: from 2011 to 2013, the average net gap was around 1 billion. is the difference between taxes paid and taxes owed, and this gap can exist for a few reasons. Taxpayers may report less than their full taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. liability on their return (underreporting), pay less taxes than owed (underpayment), or simply not file a tax return at all (non-filing).

The IRS estimates that, between tax years 2008 and 2010, the U.S. had an annual gross tax gap of $504 billion, and an annual net tax gap of $447 billion, in 2016 dollars. The annual net tax gap is lower because that number is adjusted for late payments and payments due to enforcement. Overall, the voluntary compliance rate was 81.7 percent, while the net compliance rate was 83.7 percent. These compliance rates are a few percentage points lower than tax gap estimates in 2001 and 2006, but according to the IRS, most of this decline is due to recent methodology changes and the addition of new tax gap components, not to changes in taxpayer behavior.

The tax gap exists for multiple reasons, but the report shows that taxpayer compliance is highest when taxpayers receive information reporting from third parties such as employers and financial firms.

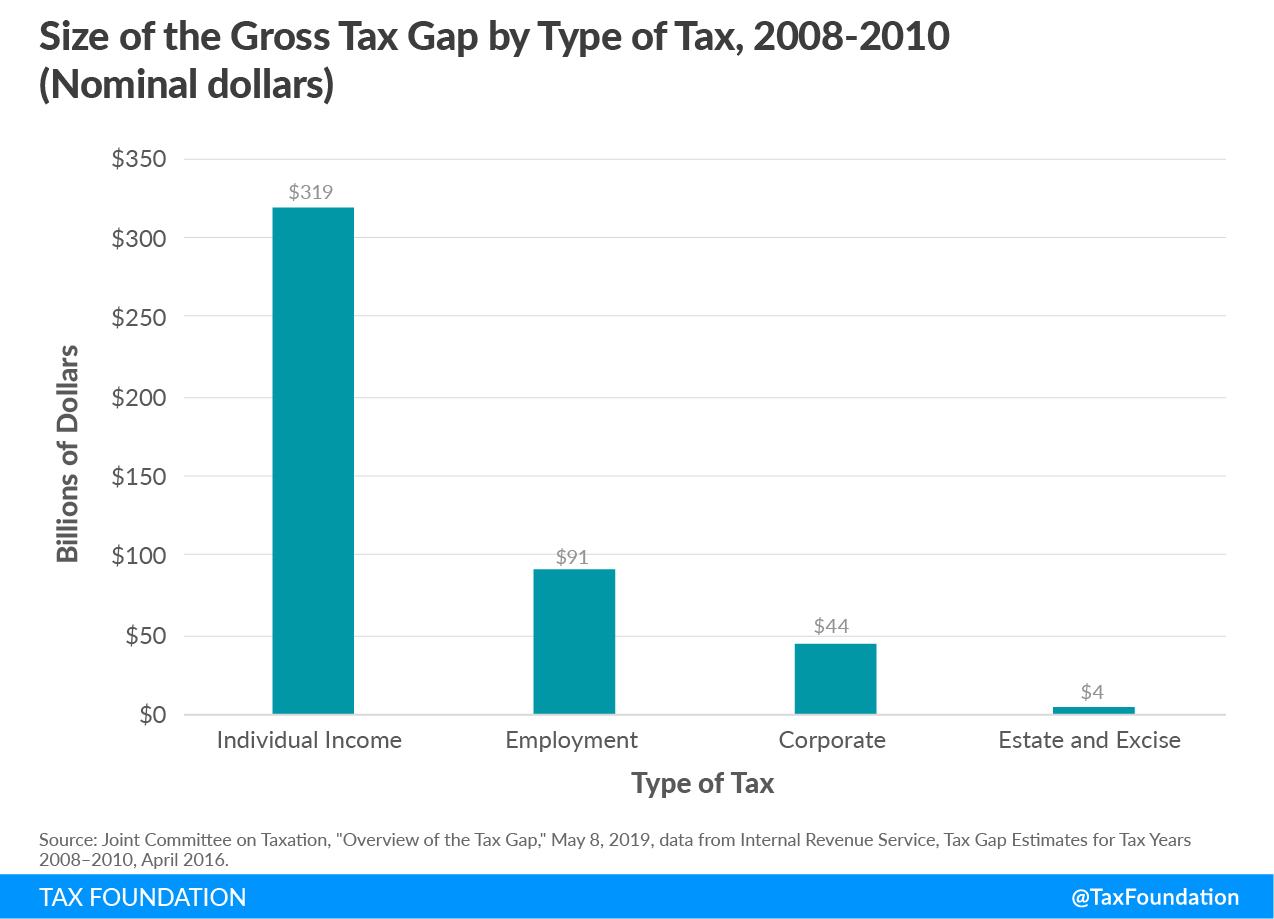

During the 2008 to 2010 time frame, the tax gap varied by tax type. The figure below shows noncompliance was highest under the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. , at about $319 billion in nominal dollars. This compares to just $91 billion for employment taxes (which includes Self-Employment Taxes, FICA taxes to fund Medicare and Social Security, and Unemployment taxes witheld by employers to pay for programs like social security), and $44 billion for the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. . The tax gap for estate and excise taxes was even smaller, at about $4 billion.

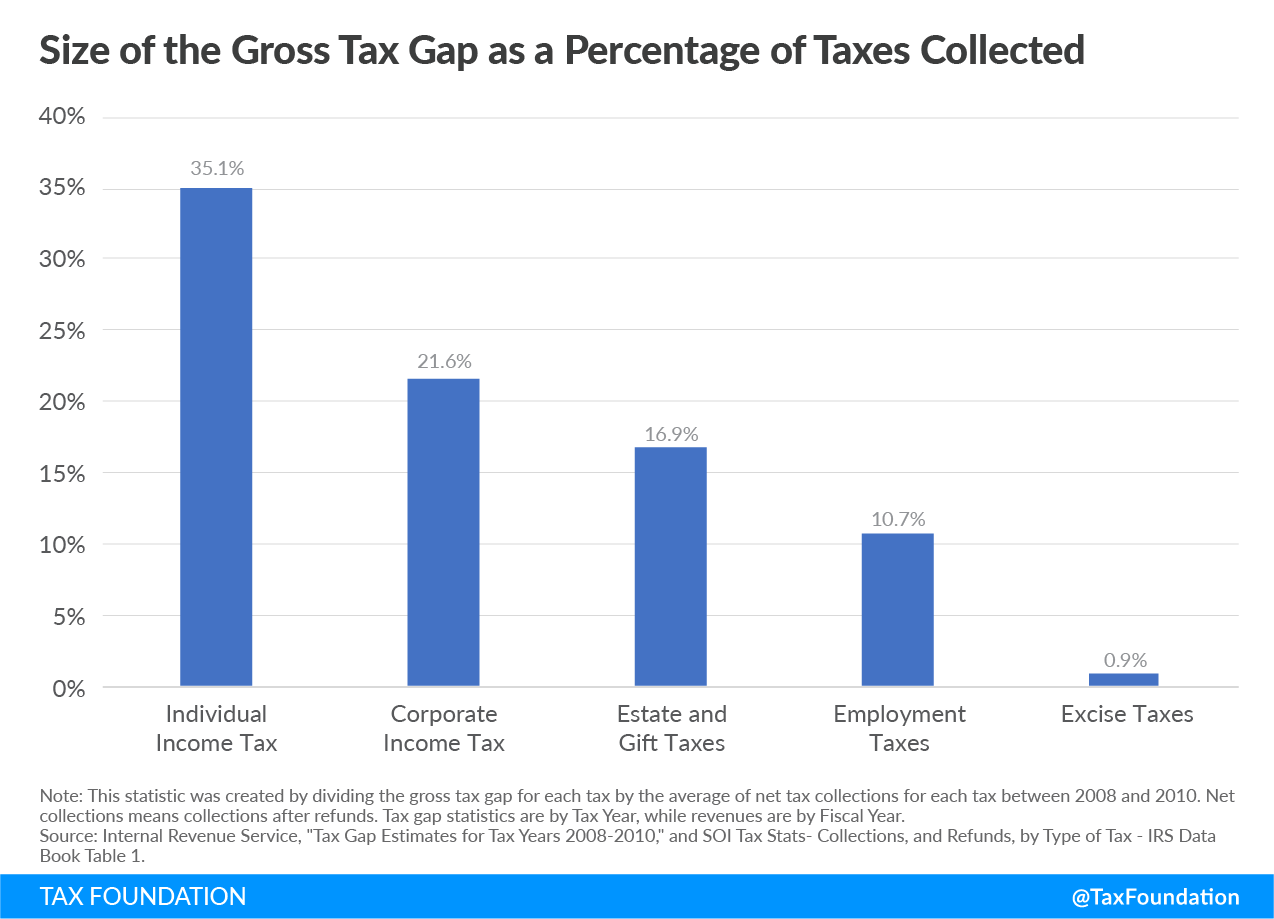

Since the chart above is only in nominal dollars, showing the tax gap as a percentage of each tax collected provides important context for noncompliance within each respective tax. The individual income tax has the largest tax gap as a percentage of taxes collected, while the tax gap for excise taxes is less than 1 percent of taxes collected. For the purposes of this figure, we separated excise taxes from estate and gift taxes to highlight the tax gap difference between the two taxes.

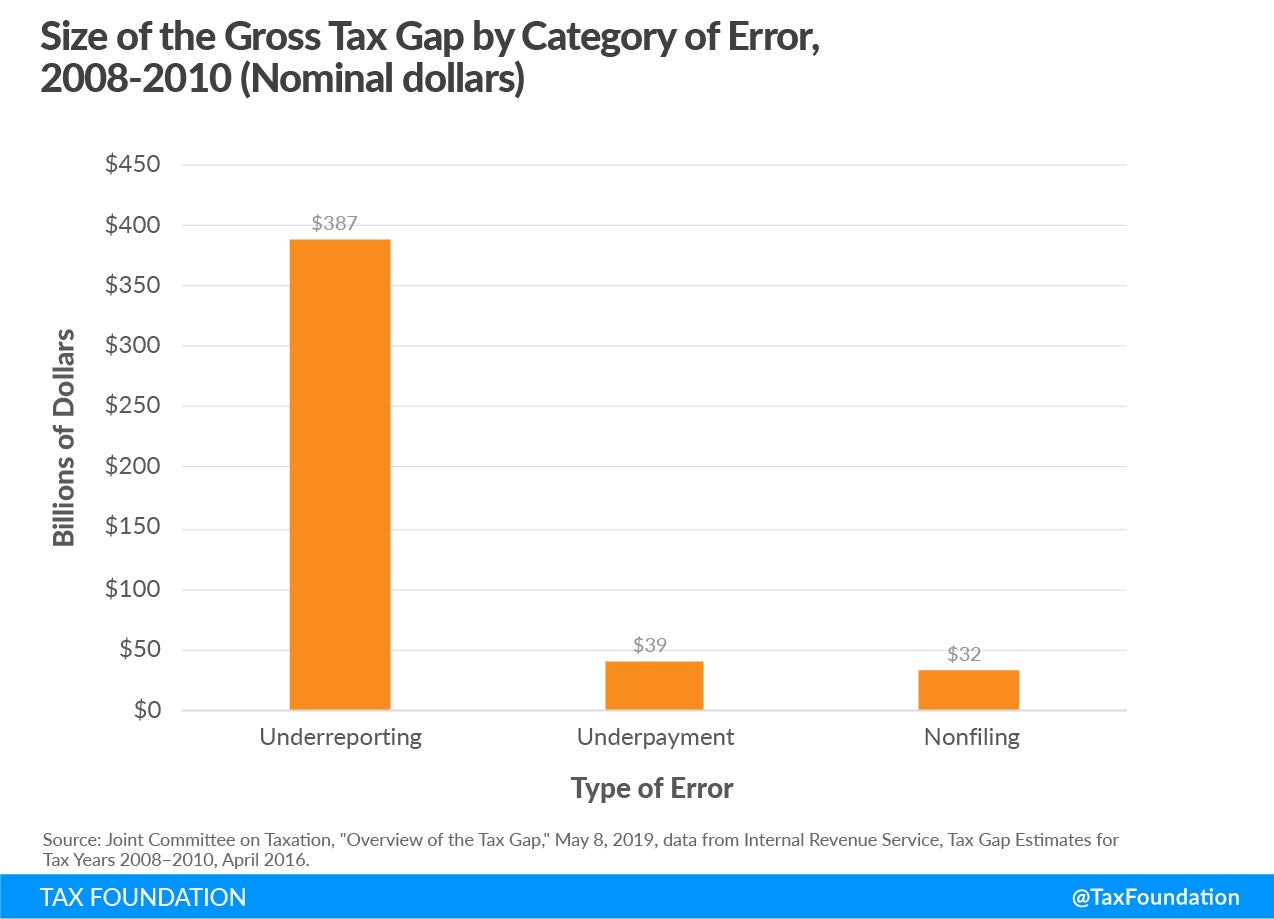

The main driver of noncompliance was underreporting, or the failure of a taxpayer to accurately report their full tax liability to the IRS, at $387 billion. The figure below shows that noncompliance due to underpayment and non-filing was much lower, at $39 billion and $32 billion, respectively.

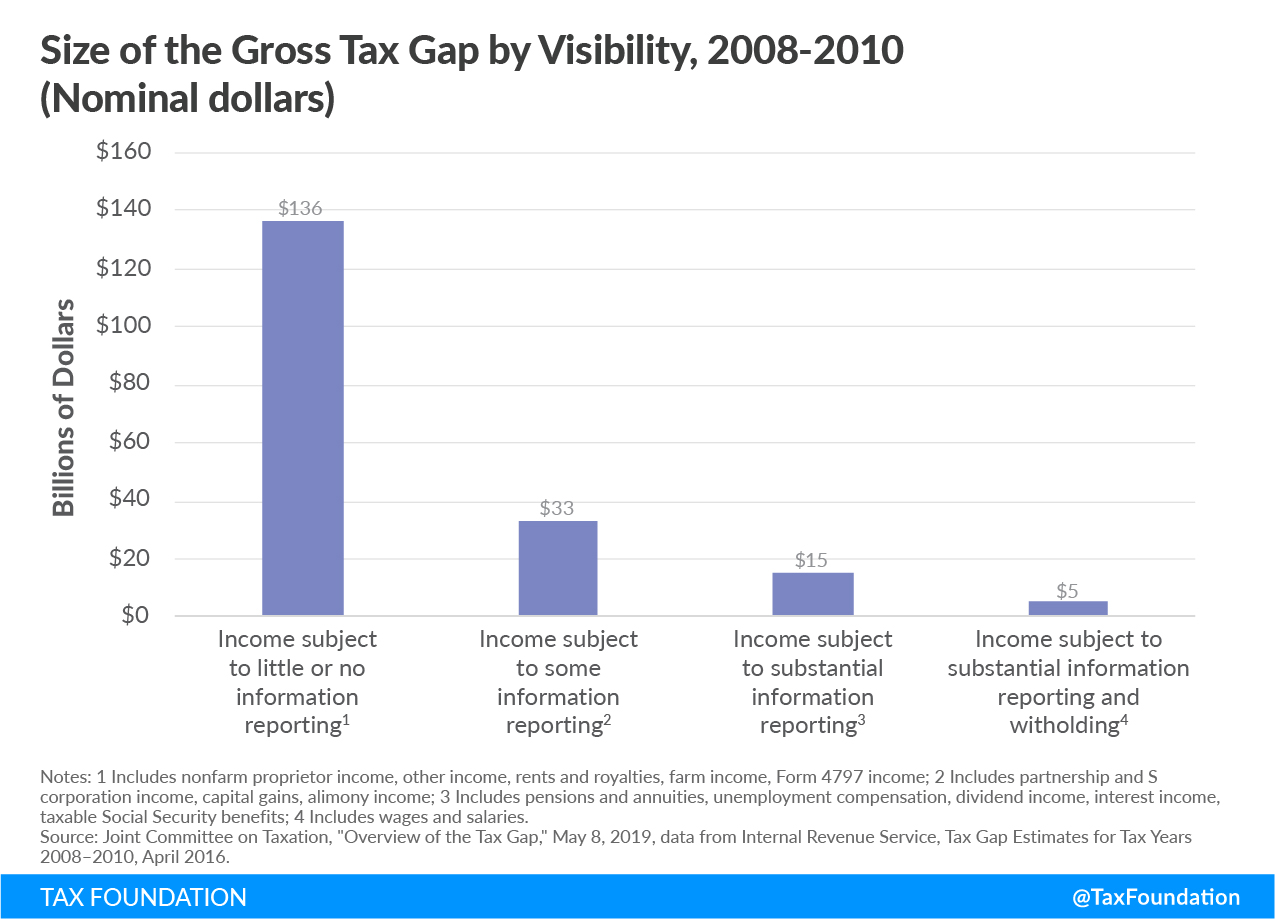

The IRS also breaks down the tax gap based on “visibility.” The main variable is income information reporting requirements. In some cases, third parties, such as employers and financial firms, are required to report income information to taxpayers on wages, salaries, and other income, such as dividends and real estate sales. According to JCT, this third-party reporting helps taxpayers comply with the tax code:

Evidence shows that compliance is greatest for sources of income, such as wages and salaries, which are reported to the IRS by employers and other payers and for which taxes are withheld by third parties. Noncompliance is greatest for income and tax preferences, including self-employment income, for which third-party information is not separately reported to the IRS and is very difficult to obtain.

The figure below supports this idea. During the period studied, the tax gap was highest in cases when income was subject to “little or no information reporting,” at about $136 billion. The tax gap declines as more income information reporting is required. The tax gap was lowest, at about $5 billion, when income was witheld and subject to substantial information reporting, or when third paries remit payments for taxpayers.

A relevant example is income tax collections for gig economy workers. Recently, the Department of Treasury’s Inspector General for Tax Administration found 13 percent of gig economy workers with gig economy income above $400 failed to report the income for self-employment and income tax purposes in 2016. Making gig economy income more visible, such as by increasing the proportion of gig economy participants who receive Form 1099-K, would be one way to help gig economy employees more accurately report their income and increase tax compliance.

When looking at ways to increase tax compliance and reduce the tax gap, policymakers should consider the role income information reporting from third parties plays in helping taxpayers accurately report their income.

Share this article