The Tax Cuts and Jobs Act: Explained

Key Findings

- The TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Cuts and Jobs Act (TCJA) changed the U.S. tax system from one where the worldwide income of U.S. corporations was taxed to one which only taxes income earned within the United States.

- These changes removed a major barrier to repatriationRepatriation is the process by which multinational companies bring overseas earnings back to the home country. Prior to the 2017 Tax Cuts and Jobs Act (TCJA), the US tax code created major disincentives for US companies to repatriate their earnings. Changes from the TCJA eliminate these disincentives. , or the process by which companies bring overseas earnings back to the United States. Going forward companies do not face the old tax barriers which discouraged repatriation.

- To transition to the new system, the TCJA imposed a one-time tax of 15.5 percent on liquid assets and 8 percent on illiquid assets, payable over eight years, regardless of whether companies repatriate old overseas earnings.

- Estimates of the amount of earnings built up overseas under the old system vary, but the headline amount is less important than knowing the composition: how much was reinvested overseas versus how much remained in liquid assets such as cash.

- Recent estimates show companies held about $1 trillion of overseas earnings in liquid assets. Most of this $1 trillion is invested in dollar-denominated bonds, such as U.S. Treasuries.

- Repatriation has significantly increased since enactment of the TCJA. More earnings have been repatriated in the first sixth months of 2018 than in 2015, 2016, and 2017 combined. However, it is unclear how much of this repatriation is comprised of current as well as past earnings.

- Repatriation, or the potential of an inflow of capital into the United States, is not the reason the TCJA is expected to boost investment and grow the economy. The lower corporate tax rate drives the long-run economic growth expected from the TCJA.

Introduction

Prior to the Tax Cuts and Jobs Act (TCJA), the tax code created major disincentives for U.S. companies to repatriate their earnings, or bring earnings made overseas back to the United States. Changes in the TCJA eliminate these disincentives, thus, going forward, companies do not face the old barriers which discouraged repatriation.

Due to the old disincentives, companies had built up large amounts of earnings abroad. Given the change in the incentives, many have speculated that this will lead companies to repatriate large shares of the earnings that they have been holding overseas. While we have seen a significant uptick in repatriation since enactment of the TCJA, it’s important to understand the context and intent of the TCJA’s reforms, as well as the composition of the cash held abroad, to appropriately analyze the effects of deemed repatriation.

This paper briefly reviews how the Tax Cuts and Jobs Act changed the tax treatment of foreign earnings and then examines research on the amount and composition of overseas earnings. This is followed by a discussion of factors relevant to how companies might react to these changed incentives.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeThe Tcja Changed the Tax Treatment of Foreign Earnings

Prior to the TCJA, the United States had a worldwide tax systemA worldwide tax system for corporations, as opposed to a territorial tax system, includes foreign-earned income in the domestic tax base. As part of the 2017 Tax Cuts and Jobs Act (TCJA), the United States shifted from worldwide taxation towards territorial taxation. , under which U.S. corporations were required to pay U.S. corporate income taxes on all their earnings, even those that were made outside the United States.[1] However, income earned from foreign operations was not taxed until that income was distributed to the U.S. parent corporation, or when the earnings were repatriated.[2] This discouraged companies from repatriating their earnings, and instead these earnings remained overseas, where their U.S. tax liability was deferred.

The United States’ worldwide system of taxation was rare; as of 2015, only six nations worldwide used such a system.[3] It placed U.S. corporations at a disadvantage and created an impediment to repatriation because companies could defer U.S. taxation by keeping their overseas earnings overseas. When companies decided to repatriate their earnings, they would have to pay the pre-TCJA 35 percent U.S. corporate income tax rate, the highest in the industrialized world. Firms, however, would receive credit for foreign taxes paid.

For example, imagine a company which paid a 15 percent tax on its foreign earnings. When it repatriated its earnings to the United States, it would owe an additional 20 percent tax, the difference between 35 percent and 15 percent, on those earnings. If instead the company held its earnings overseas, it would not owe this additional tax.

Companies that had little need for additional cash flow, access to credit in the domestic market,[4] or investment opportunities overseas, were unlikely to repatriate their cash due to the large tax liability. Thus, a large amount of earnings built up overseas under the old system.

The Tax Cuts and Jobs Act enacted reforms that moved away from the worldwide system and toward a territorial system, in which only income earned within the United States is subject to the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. .[5] To transition to this new system and address the buildup of cash that occurred under the old system, the TCJA requires companies to pay a one-time tax. Called “deemed repatriation,” this tax would be assessed at a 15.5 percent rate on liquid assets like cash and an 8 percent rate on noncash assets as if companies repatriated their cash, regardless of whether they really do so. Companies can pay the tax in installments over eight years.[6] The Joint Committee on Taxation estimates this will result in $338.8 billion in tax revenue over 10 years.[7]

One of the keys to understanding this policy change is that it improves incentives going forward. Companies owe tax on their overseas earnings that built up under the old system regardless of whether they are brought back, but companies will not owe corporate income taxes on future earnings they repatriate, subject to some minimum taxes on global income.[8]

A Picture of Overseas Earnings

Under the old law, companies’ ability to defer taxes on foreign earnings resulted in large amounts of earnings piling up abroad. Estimates of total earnings held abroad vary, but the headline amount of earnings is less important than the composition of those earnings. Overseas holdings may include more than just cash, as companies may have reinvested their earnings into foreign operations by building or expanding factories, purchasing machinery and equipment, or engaging in research and development activities—cash tied up in these uses is referred to as indefinitely reinvested earnings.[9]

A 2015 report by Credit Suisse helped shed light on why estimates of overseas earnings vary:[10] “Companies are required to disclose the amount of indefinitely reinvested foreign earnings, once a year… Keep in mind that companies could have additional earnings parked overseas.” The report goes on to explain that companies report deferred tax liability, or corporate income taxes that they owe on earnings not reinvested, without disclosing the actual amount of those earnings.[11]

If companies used their earnings to improve a factory or undergo a research project, those earnings cannot be easily converted into cash. Thus, earnings that companies reinvested are not likely to be repatriated, at least in the short term. Research shows that a significant portion of overseas earnings have been reinvested.

The Credit Suisse report estimated that at the end of 2014, S&P 500 companies had $2.1 trillion of overseas earnings held abroad.[12] Excluding financial companies, it further estimated that 37 percent was held in cash ($690 billion), while the remaining $1.2 trillion was reinvested in assets.[13] AuditA tax audit is when the Internal Revenue Service (IRS) or a state or local revenue agency conducts a formal investigation of financial information to verify an individual or corporation has accurately reported and paid their taxes. Selection can be at random, or due to unusual deductions or income reported on a tax return. Analytics reported that the total amount of indefinitely reinvested earnings held overseas by Russell 1000 companies reached $2.6 trillion in 2016.[14]

Thus, the measure of overseas earnings that could be repatriated should not include earnings that have been reinvested in overseas operations, and instead focus on earnings that are liquid. More recently, an analysis by Federal Reserve economists reports that as of the end of 2017, U.S. multinational corporations had accumulated approximately $1 trillion in liquid assets held abroad, most of which was invested in U.S. fixed-income securities.[15] Most overseas earnings thus are not held in cash, but in dollar-denominated bonds, which can be more easily converted to cash should companies want to repatriate past earnings.

The composition of past earnings shows that not all earnings held abroad can easily be repatriated because large shares have been reinvested into overseas operations.

Responses to Deemed Repatriation

Deemed repatriation, as enacted by the Tax Cuts and Jobs Act, is a mandatory tax on past earnings held abroad; companies will owe taxes of 15.5 percent on liquid assets like cash and 8 percent on noncash assets earnings made under the old tax law, regardless of whether the cash is repatriated. Companies face improved incentives for future earnings, because earnings made under the new law will not face U.S. corporate income tax. When evaluating how companies will respond there are several other factors to consider.

First, it takes time for the effects of fiscal policy changes, such as deemed repatriation, to work their way through the economy and it takes time for companies to respond. Further to this point, at this time, the technical rules regarding deemed repatriation have not been finalized.[16] It makes sense that companies would wait for final guidance before making final decisions.

Another factor is that earnings invested in factories, machinery, and equipment, and other illiquid uses such as research and development, will likely stay in place. According to many estimates, as mentioned above, indefinitely reinvested earnings represent the largest share of earnings held abroad.

Other factors might influence repatriation decisions, such as foreign regulations for minimum balances that financial companies must maintain, foreign tax liability on dividends paid to parent corporations triggered by repatriation, and taxation of repatriated earnings by some U.S. states.[17] Additionally, corporations might not have an immediate need for cash, and thus have little need to repatriate earnings held overseas.

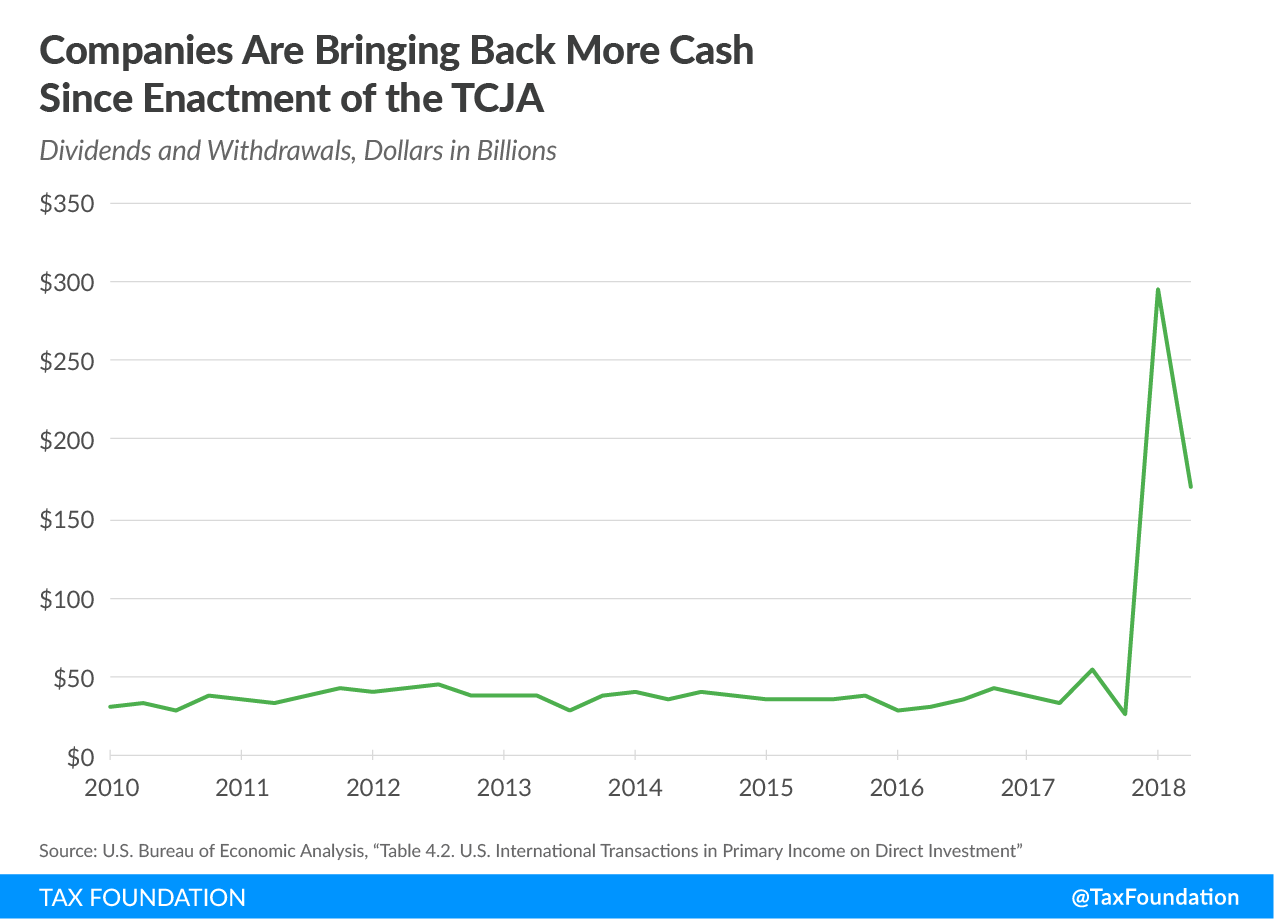

Currently, the U.S. Bureau of Economic Analysis has published six months of repatriation data under the new tax law. Though this is a short time frame, the data shows that in the first two quarters of 2018, repatriation has significantly increased.[18] In the first quarter of 2018, companies brought back $294.9 billion of overseas earnings, followed by $169.5 billion in the second quarter.[19] It is important to note that we cannot tell from this data which portion of that repatriation is past earnings and which is current earnings.

While that is important to note, the data nevertheless shows an increase of 535 percent from the same period in 2017.[20] Put another way, the volume of repatriated earnings within the first six months of 2018 is more than all repatriated earnings of 2015, 2016, and 2017 combined.[21] The levels of repatriation since the Tax Cuts and Jobs Act are significantly above historical norms.

Source: U.S. Bureau of Economic Analysis, “Table 4.2. U.S. International Transactions in Primary Income on Direct Investment”

Whether companies now choose to repatriate their past earnings, one-time influxes of cash do not create jobs or boost investment. This is because repatriation doesn’t boost incentives to invest.[22] Rather, other changes made by the Tax Cuts and Jobs Act, such as the lower corporate income tax rate, drive the expectation that the new tax law will boost investment and economic growth.[23]

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeConclusion

The Tax Cuts and Jobs Act changed the tax treatment of foreign earnings, moving the U.S. system from one which taxes worldwide income to one which generally only taxes income earned within the United States. Prior to this change, the tax code distorted companies’ decisions by discouraging them from bringing their overseas earnings back to the U.S. The TCJA removed the incentive to keep earnings abroad going forward and features a one-time transition tax to address the overseas earnings that built up under the old system.

Companies may decide to bring these past earnings back to the United States. When evaluating how much companies might bring back, it is important to understand the composition of overseas earnings; earnings that have been reinvested in illiquid assets are not likely to be repatriated. It will take time for companies to determine how much of their cash to repatriate, and numerous factors influence these decisions.

Early data indicates a significant uptick in repatriation since enactment of the Tax Cuts and Jobs Act, though these figures include repatriation of current earnings as well as past earnings. Regardless of how much cash companies bring back to the United States, repatriation is not why we expect the new law to boost investment and economic growth. Rather, the TCJA’s lower corporate income tax rate incentivizes increased investment and drives the expected economic growth.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeNotes

[1] Kyle Pomerleau, “Worldwide Taxation is Very Rare,” Tax Foundation, Feb. 5, 2015, https://taxfoundation.org/worldwide-taxation-very-rare/.

[2] However, under U.S. Subpart F, passive income (interest, dividends, rents, and royalties) was taxed on a current basis, meaning it did not get the benefit of deferral. This was to prevent companies from putting highly mobile financial assets abroad to indefinitely avoid U.S. tax liability on the income. See Kyle Pomerleau, “A Hybrid Approach: The Treatment of Foreign Profits under the Tax Cuts and Jobs Act,” Tax Foundation, May 3, 2018, https://taxfoundation.org/treatment-foreign-profits-tax-cuts-jobs-act/.

[3] Ibid.

[4] Amir El-Sibaie, “A Repatriation Tax Holiday Sounds Fun, but Comes with a Hangover,” Tax Foundation, Aug. 14, 2017, https://taxfoundation.org/repatriation-tax-holiday-hangover/.

[5] Some quibble with the extent to which our new international tax system is a territorial tax system. See Kyle Pomerleau, “A Hybrid Approach: The Treatment of Foreign Profits under the Tax Cuts and Jobs Act.”

[6] Congress.gov, “Summary: H.R.1 – 115th Congress (2017-2018),” https://www.congress.gov/bill/115th-congress/house-bill/1.

[7] The Joint Committee on Taxation, “Estimated Budget Effects of the Conference Agreement For H.R.1, The ‘Tax Cuts And Jobs Act,’” Dec. 18, 2017, https://www.jct.gov/publications.html?func=startdown&id=5053.

[8] See Kyle Pomerleau, “A Hybrid Approach: The Treatment of Foreign Profits under the Tax Cuts and Jobs Act.”

[9] Thomas A. Barthold, Letter to the House Committee on Ways and Means, Aug. 31, 2016, https://waysandmeans.house.gov/wp-content/uploads/2016/09/20160831-Barthold-Letter-to-BradyNeal.pdf.

[10] David Zion, Ravi Gomatam, and Ron Graziano, “Parking A-Lot Overseas,” Credit Suisse, March 17, 2015, 6-7, https://research-doc.credit-suisse.com/docView?language=ENG&format=PDF&source_id=em&document_id=1045617491&serialid=jHde13PmaivwZHRANjglDIKxoEiA4WVARdLQREk1A7g%3d.

[11] Ibid.

[12] Ibid, 7.

[13] Ibid, 12.

[14] Jessica McKeon, “Indefinitely Reinvested Foreign Earnings Still Climbing,” Audit Analytics, Aug. 14, 2017, https://www.auditanalytics.com/blog/indefinitely-reinvested-foreign-earnings-still-climbing/.

[15] Michael Smolyansky, Gustavo Suarez, and Alexandra Tabova, “U.S. Corporations’ Repatriation of Offshore Profits,” Board of Governors of the Federal Reserve System, Sept. 4, 2018, https://www.federalreserve.gov/econres/notes/feds-notes/us-corporations-repatriation-of-offshore-profits-20180904.htm.

[16] Richard Rubin and Theo Francis, “Trump Promised a Rush of Repatriated Cash, But Company Responses Are Modest,” The Wall Street Journal, Sept. 16, 2018, https://www.wsj.com/articles/companies-arent-all-rushing-to-repatriate-cash-1537106555.

[17] Ibid.

[18] This data is preliminary and open to revision by the U.S. Bureau of Economic Analysis.

[19] U.S. Bureau of Economic Analysis, “Table 4.2. U.S. International Transactions in Primary Income on Direct Investment,” https://apps.bea.gov/iTable/iTable.cfm?ReqID=62&step=1.

[20] Companies repatriated $73 billion over the first two quarters of 2017, compared to $464 billion over the first two quarters of 2018.

[21] Douglas Holtz-Eakin, “Show Me The Money,” American Action Forum, Sept. 21, 2018, https://www.americanactionforum.org/daily-dish/show-me-the-money-corporate-income-repatriation/.

[22] Scott A. Hodge, “Time for a Permanent Holiday on Foreign Earnings,” March 24, 2018, Tax Foundation, https://taxfoundation.org/time-permanent-holiday-foreign-earnings/.

[23] Erica York, “The Benefits of Cutting the Corporate Income Tax Rate,” Aug. 14, 2018, Tax Foundation, https://taxfoundation.org/benefits-cutting-corporate-income-tax-rate/.

Share this article