A tax deduction allows taxpayers to subtract certain deductible expenses and other items to reduce how much of their income is taxed, which reduces how much tax they owe. For individuals, some deductions are available to all taxpayers, while others are reserved only for taxpayers who itemize. For businesses, most business expenses are fully and immediately deductible in the year they occur, but others, particularly for capital investment and research and development (R&D), must be deducted over time.

What Deductions Are Currently Allowed for Individuals?

All taxpayers (whether they itemize or take the standard deduction) can take deductions for business use of their car or home, money saved in an individual retirement account (IRA) or health savings account (HSA), student loan interest, teacher expenses, and certain other categories of expenses. Taxpayers with net capital losses (for example, from selling a stock for less than they bought it for) can deduct up to $3,000 of net losses to lower their income, and the remaining losses can be carried forward to future years.

Some deductions are reserved for taxpayers who itemize. When filing a tax return, individual taxpayers must choose between claiming the standard deduction (a flat deduction amount that varies by filing status) or itemizing their deductions. In tax year 2021, fewer than 1 in 10 taxpayers itemized their deductions.

If itemizing, taxpayers can deduct expenses for mortgage interest, state and local taxes paid, charitable donations, medical and dental expenses that exceed 7.5 percent of adjusted gross income (AGI), and several other categories of expenses.

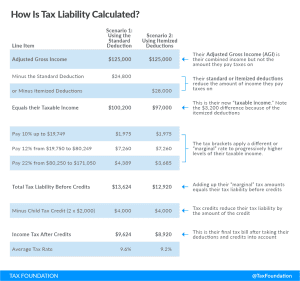

The value of a tax deduction depends on the marginal tax rate faced by a taxpayer. For example, a taxpayer in the 10 percent tax bracket with a $1,000 deduction saves $100 in taxes, while a taxpayer in the 32 percent tax bracket with a $1,000 deduction saves $320 in taxes.

What Deductions Are Currently Allowed for Businesses?

Businesses deduct a wide variety of expenses to calculate their taxable income.

Some business expenses are fully and immediately deducted in the year incurred, like expenses for advertising, taxes paid to state and local governments, compensation paid to employees, and other “ordinary” and “necessary” costs incurred in running a business.

Other expenses, however, are not fully and immediately deductible. Costs for making a capital investment (like purchasing a new machine) or engaging in R&D (like paying a scientist) have to be depreciated and amortized (or deducted over time) according to schedules set forth in the tax code. The tax code also has specific rules for deducting net operating losses (NOLs), where a business with a loss in one year can recognize that loss in a future year to offset future profits, and net interest expenses, which are limited to a certain percentage of income.

The Tax Cuts and Jobs Act of 2017 created a temporary provision for noncorporate businesses, such as sole proprietorships, partnerships, S corporations, and LLCs, permitting qualifying businesses to deduct up to 20 percent of their qualifying business income.

Tax Deduction vs. Tax Credit

Tax deductions reduce tax liability by the amount deducted multiplied by the taxpayer’s marginal tax rate, while tax credits directly reduce tax liability dollar-for-dollar. Consequently, a tax credit of a particular amount is always more valuable than a deduction of the same amount.

Tax credits tend to provide larger benefits to lower-income taxpayers than tax deductions. That’s because lower-income filers face lower marginal tax rates, and because, in some cases, tax credits are refundable, meaning they can more than offset any tax liability owed.

Imagine, for instance, two filers, one with taxable income of $30,000 and another with taxable income of $300,000. A $1,000 deduction will reduce both filers’ taxable income by the same amount, but because that income is subject to a 12 percent marginal rate for the lower-income filer and a 35 percent marginal rate for the higher-income filer, the reduction in tax liability would be $120 for the lower-income filer and $350 for the higher-income filer. By contrast, a $350 credit would reduce tax liability by $350 for both filers.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe