The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. It reduces households’ taxable incomes and, consequently, their total taxes paid. The Tax Cuts and Jobs Act (TCJA) reduced the amount of principal and limited the types of loans that qualify for the deduction.

How Does It Work?

The deduction for mortgage interest is available to taxpayers who choose to itemize. It allows taxpayers to deduct interest paid up to $750,000 ($375,000 for married filing separately) worth of principal (the original amount borrowed) on either their first or second residence. Home equity loan interest is deductible if the borrowed funds are used to build or improve a qualifying residence and contribute to the $750,000 cap. Notably, no matter when the debt was incurred, taxpayers may not deduct any mortgage interest debt whose proceeds did not go toward the construction, purchase, or improvement of a home (Internal Revenue Service, “Publication 936: Home Mortgage Interest Deduction”). The current $750,000 limitation was introduced as part of the Tax Cuts and Jobs Act (TCJA) and will revert to the old limitation of $1 million after 2025.

Though the deduction is often viewed as a policy that increases the incidence of homeownership, research suggests it does not accomplish this goal. There is, however, evidence that the deduction increases housing costs by increasing demand for housing among itemizing taxpayers.

Who Takes It?

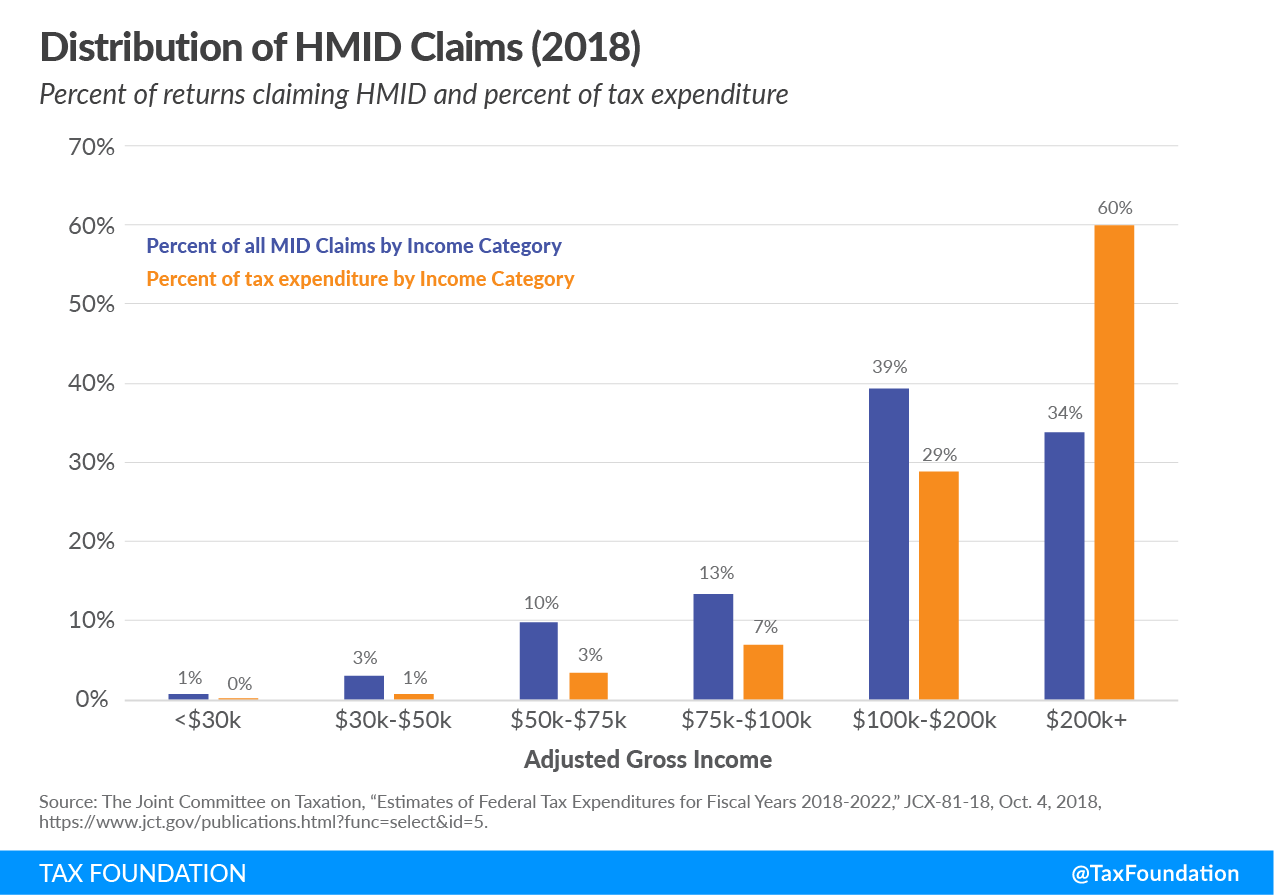

The benefits of the deduction go primarily to high-income taxpayers because high-income taxpayers tend to itemize more often, and the value of the deduction increases with the price of a home. For example, estimates for 2018 showed that less than 4 percent of taxpayers earning under $50,000 would claim the deduction, and these taxpayers would receive less than 1 percent of the tax expenditure’s overall benefits. Taxpayers making over $200,000 would make up 34 percent of claims and take 60 percent of the benefits. While the total value of the deduction went down due to the TCJA, the share of benefits is now more concentrated among high-income taxpayers due to more taxpayers opting for the more generous standard deduction.

Recent Changes to the Mortgage Interest Deduction

The TCJA reduced the amount of principal available for the mortgage interest deduction from $1 million to $750,000. The new law also changed the treatment of home equity loans. Prior to the TCJA, interest on up to $100,000 of home equity loans was deductible in addition to interest paid on up to $1 million in principal and could be used for expenses like credit card debt or tuition. After the TCJA, home equity loans are now included within the mortgage’s principal limit, and interest is only deductible if used to build or improve a qualifying residence.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe