All Related Articles

Global Tax Relief Efforts Vary in Scope and Time Frame in Response to COVID-19

Countries around the world have implemented and continue to implement emergency tax measures to support their economies during the coronavirus (COVID-19) crisis.

5 min read

In Some States, 2020 Estimated Tax Payments Are Due Before 2019 Tax Returns

To prevent confusion and to ensure taxpayers receive the full benefit of the extended federal deadline, states should consider extending first- and second-quarter estimated tax payment due dates to July 15 or later.

9 min read

Trade-offs of Delaying Tax Filing and Instituting a Payroll Tax Holiday on Businesses and Individuals

Some policymakers are proposing a payroll tax holiday for businesses and individuals for 2020 and a complete delay in filing deadlines for tax year 2019 and 2020 to April 2021. What are the pros and cons of doing so?

4 min read

Idaho, Mississippi, and Virginia are the Holdouts on July 15th Tax Deadlines

Every state with an individual income tax has made some adjustment to its filing or payment deadlines, but three—Idaho, Mississippi, and Virginia—have not followed the federal government’s date of July 15th or later.

3 min read

March 27th Afternoon State Tax Update

Massachusetts, Ohio, and West Virginia have newly extended their income tax filing and payment deadlines to match the July 15 federal deadline.

3 min read

Lawmakers Concerned that Delay in Tax Filing Deadline Not Fully Understood

The U.S. Treasury Department has pushed the April 15 tax payment deadline to July 15. However, taxpayers still have to file their tax returns by the usual April 15 deadline.

3 min read

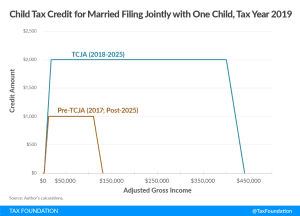

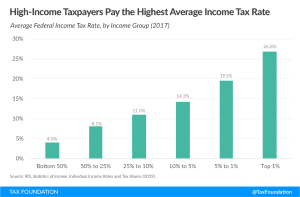

A Preliminary Look at 2018 Tax Data

Initial 2018 IRS tax return data shows that the TCJA expanded the use of several credits and deductions, made the standard deduction more favorable than itemizing, reduced tax refunds, and lowered taxes for most Americans.

4 min read