Why Your Tax Refund Is Nothing to Celebrate

Don’t be fooled by tax myths and misconceptions this tax filing season.

3 min read

Don’t be fooled by tax myths and misconceptions this tax filing season.

3 min read

Working from home is great. The tax complications? Not so much.

4 min read

Explore the IRS inflation-adjusted 2024 tax brackets, for which taxpayers will file tax returns in early 2025.

4 min read

It is hard to imagine the IRS Direct e-File Program operating seamlessly with the complexity of the current U.S. tax system. Instead, lawmakers should first address the more fundamental problem that causes taxpayer frustration: our highly complicated tax code.

4 min read

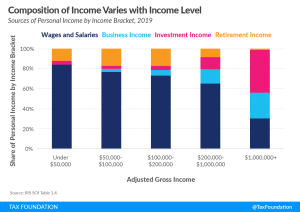

Reviewing reported income helps to understand the composition of the federal government’s revenue base and how Americans earn their taxable income. The individual income tax, the federal government’s largest source of revenue, is largely a tax on labor.

10 min read

If your state issued tax rebates last year, you might have to pay federal income tax on the rebate you received. Maybe. Who knows? Unfortunately, not the IRS—at least not yet.

5 min read

A combination of long-standing IRS operational deficiencies, the agency’s temporary closure due to the pandemic, and the now-expired pandemic relief produced a perfect recipe for a paper backlog.

4 min read

The IRS recently released the new inflation adjusted 2023 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

4 min read

The Inflation Reduction Act focused more on enforcement and hiring more auditors rather than programs that make it easier for taxpayers to comply with the code and the IRS to administer it.

6 min read

In a pattern that has become all too common in recent decades, the newly enacted Inflation Reduction Act (IRA) added yet another layer of complexity to an already complex and burdensome federal tax code.

9 min read

Reviewing reported income helps to understand the composition of the federal government’s revenue base and how Americans earn their taxable income. The individual income tax, the federal government’s largest source of revenue, is largely a tax on labor.

10 min read

Efforts to improve the taxpayer experience should focus on the IRS’s operations and include structural improvements to the tax code.

4 min read

As the deadline for tax filing nears, the IRS faces scrutiny for its backlog of returns, inaccessible taxpayer service, and delays in issuing certain refunds.

5 min read

The National Taxpayer Advocate argued the IRS telephone service “was the worst it has ever been” in 2021, with an answer rate of about 11 percent.

4 min read

Return-free filing could reduce compliance costs for many taxpayers, but would only be as good as the system it is administrating.

4 min read

A rosy revenue outlook has allowed Ohio to join eight other states in providing tax relief this legislative session. The Ohio legislature agreed on a two-year budget, which includes individual income tax cuts.

4 min read

During the pandemic, economic relief administered through the tax code exploded as Congress passed nearly $6 trillion of legislation into law. That left the 2021 tax filing season, which ended May 17, with complications that still linger.

4 min read

The IRS recently announced the extension of tax filing and payment deadlines from April 15th to May 17th to help taxpayers navigating the many tax changes amid the pandemic and give the IRS opportunity to clear its backlog of tax returns and correspondence.

7 min read